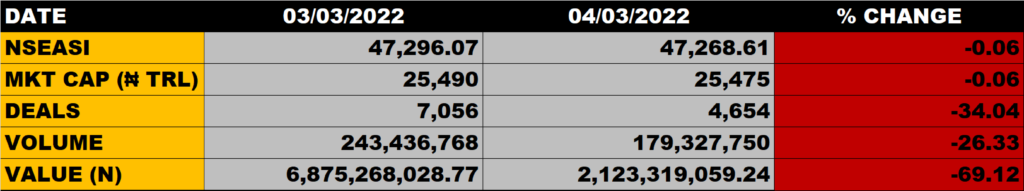

The Nigerian Stock Market on Friday extended its loses to three straight sessions as the All Share Index dipped by 0.06% to close at 47,268.61 points from the previous close of 47.296.07 points on Thursday.

Market Capitalisation declined by 0.06% to close at N25.475 trillion against Thursday’s close of N25.490 trillion, shedding N15 billion.

The aggregate volume and value of traded stocks closed at 179.328 million units and N2.123 billion in 4,654 deals.

Market Breadth

Market Breadth closed positive as 20 stocks gained while 19 stocks lost.

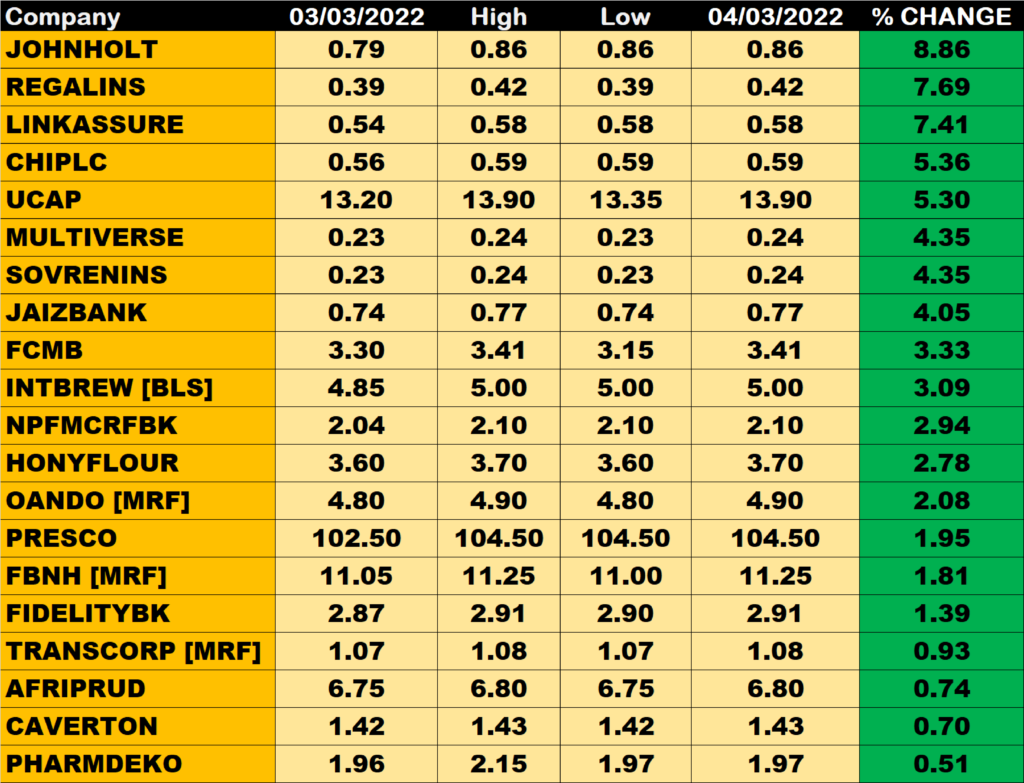

Percentage Gainers

JOHNHOLT led gainers’ chart with 8.86% growth to close at N0.86 from the previous close of N0.79

Regency Alliance grew by 7.69% while Linkage Assurance and Consolidated Hallmark Insurance gained 7.41% and 5.36% respectively.

Percentage Losers

Royal Exchange tops the losers’ list, shedding 9.40% of its share price to settle at N1.35 from N1.49 it closed on Thursday.

Still on the red chart are MCNICHOLS, LASACO and Niger Insurance shedding 9.09%, 8.85% and 8.00% of their share prices ahead of other stocks that declined.

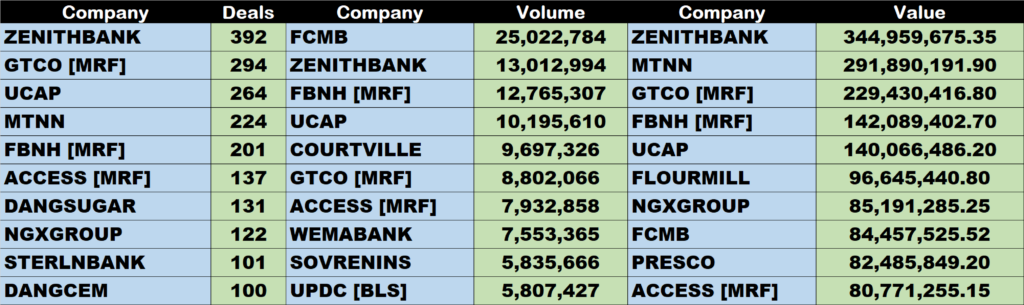

Volume Drivers

Zenith Bank traded about 25 million units of its shares in 392 deals, valued at about N345 million.

FBNH traded about 12.8 million units of its shares in 201 deals, valued at about N142 million.

Source: Nigerian Market dips Further, Closes lower by 0.06% – StocksWatch (stocksng.com)