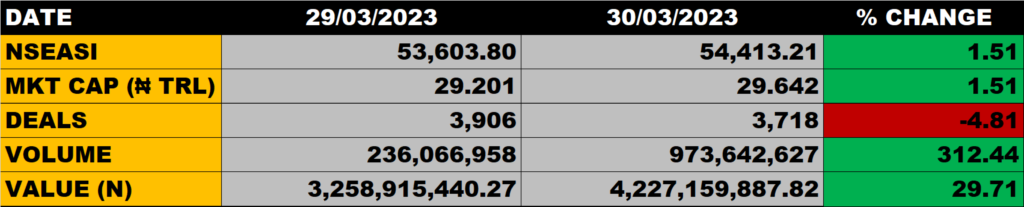

The Nigerian stock market on Thursday extends the bullish trend as the All Share Index grew by 1.51% to close at 54,413.21 points from the previous close of 53,603.80 points.

The Market Capitalisation appreciated by 1.51% to close at N29.642 trillion from the previous close of N29.201 trillion, thereby adding N441 billion.

An aggregate of 973.6 million units of shares were traded in 3,718 deals, valued at N4 billion.

The Market Breadth closed positive as 23 equities emerged as gainers against 10 equities that declined in their share prices.

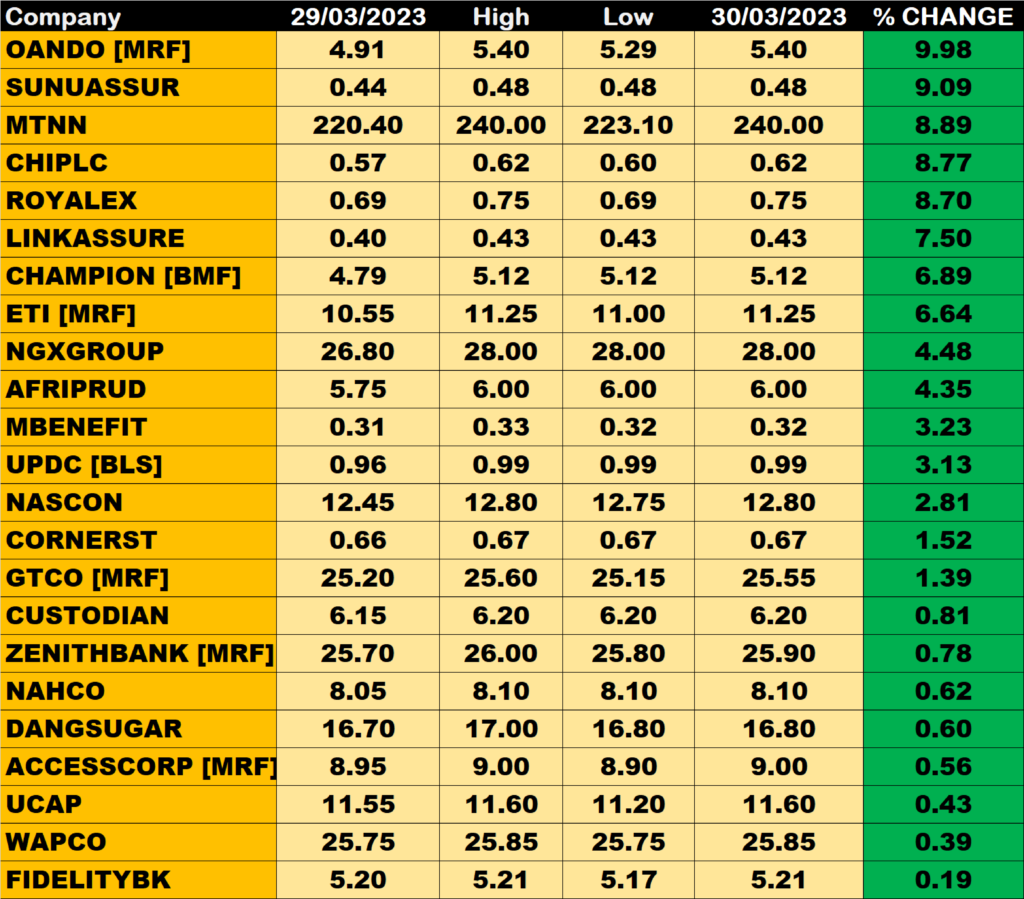

Percentage Gainers

OANDO led other gainers with 9.98% growth to close at N5.40 from the previous close of 4.91.

Sunu Assurance, MTN Nigeria and Consolidated Hallmark Insurance among other gainers also grew their share prices by 9.09%, 8.89% and 8.77% respectively.

Percentage Losers

PZ led other price decliners as it shed 5.88% of its share price to close at N11.20 from the previous close of N11.90.

CHAMS and UNILEVER among other price decliners also shed their share prices by 4.17% and 3.57% respectively.

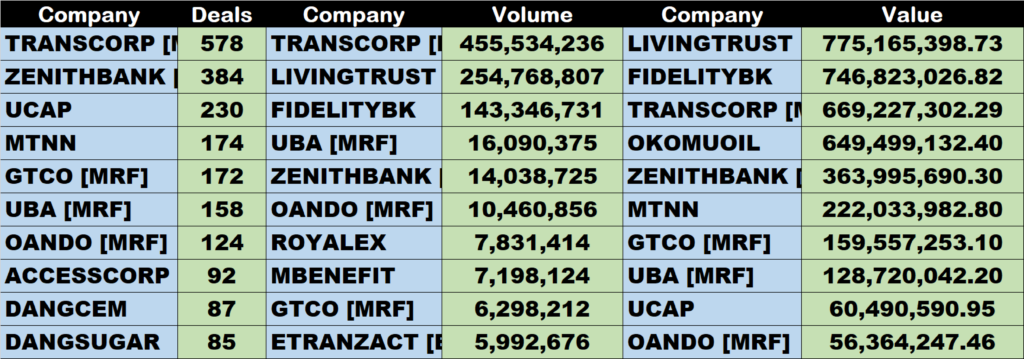

Volume Drivers

TRANSCORP traded about 455.5 million units of its shares in 578 deals, valued at N669 million.

Living Trust Insurance traded about 254.8 million units of its shares in 18 deals, valued at N775 million.

Fidelity Bank traded about 143 million units of its shares in 54 deals, valued at N746.8 million.

Source: Stock market extends Gains, Closes by 1.51% higher – StocksWatch (stocksng.com)