The Nigerian market stayed afloat on price appreciation in Dangote Cement and other 36 stocks that made the green table on Wednesday, making it four straight gains out of last four sessions.

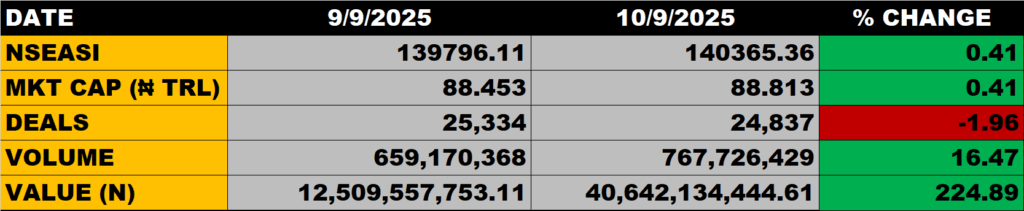

The All Share Index grew 0.41%, closing at 140,365.36 points from the previous close of 139,796.11

Market capitalisation closed at N88.813 trillion up by 0.41% from the previous close of N88.453 trillion, adding N360 billion.

An aggregate of 768 million units of shares were traded in 24,837 deals, valued at N40.6 billion.

Market Breadth

The market breadth closed positive as 37 stocks gained against 26 stocks that declined in their share prices.

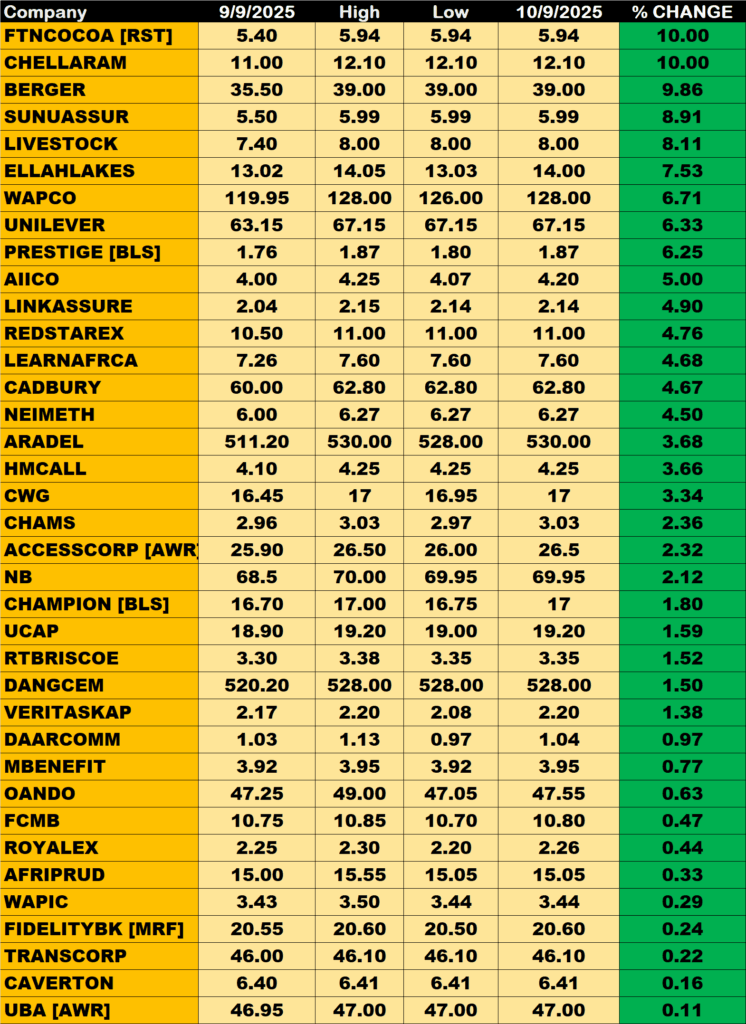

Percentage Gainers

FTN Cocoa and CHELLARAM led other gainers, closing at 10.00% each above their previous close of N5.40 and N11.00 respectively.

Berger Paints, Sunu Assurance and Livestock Feeds also closed the day above 8.00% from their previous close respectively.

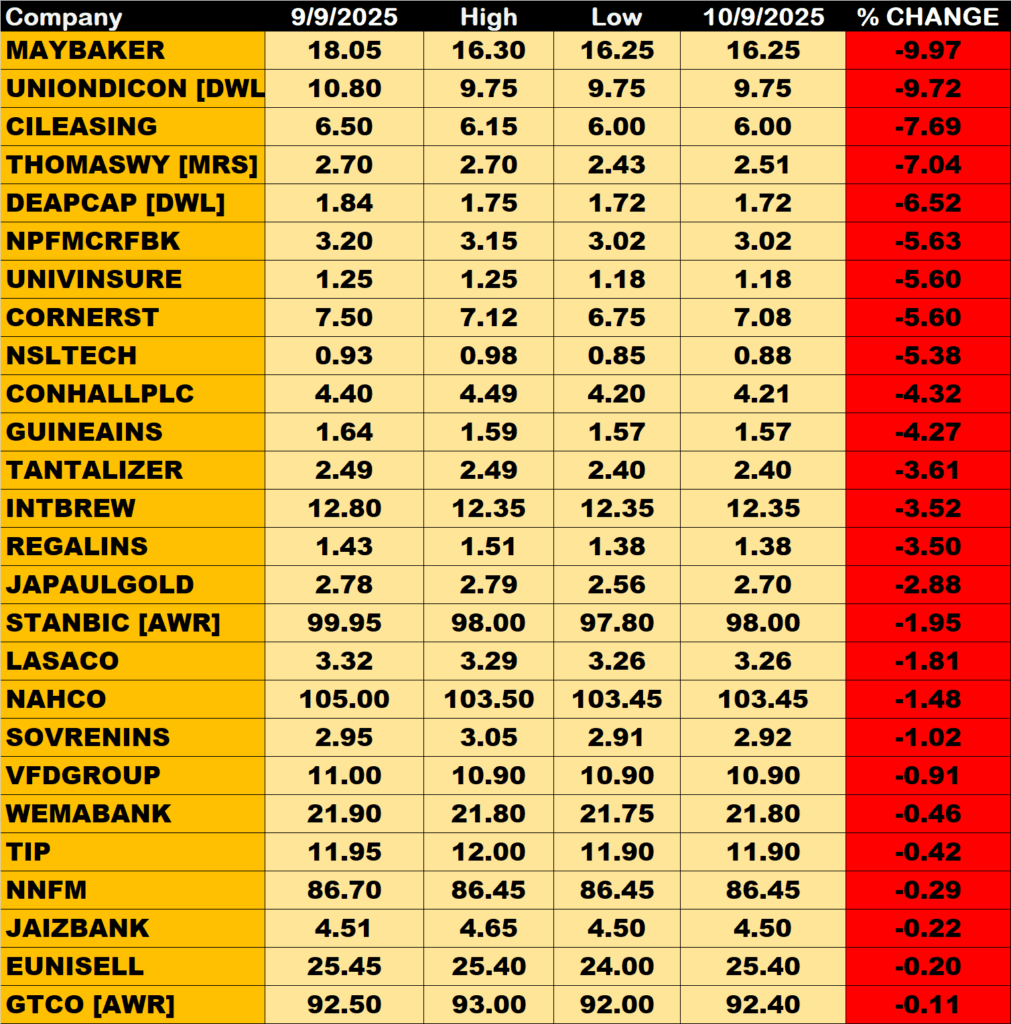

Percentage Losers

May and Baker led decliners’ table shedding 9.97% of its share price to close at N 16.25 from the previous close of N18.05.

UNIONDICON, C & I Leasing and THOMASWYAT shed 9.72%, 7.69% and 7.04% respectively

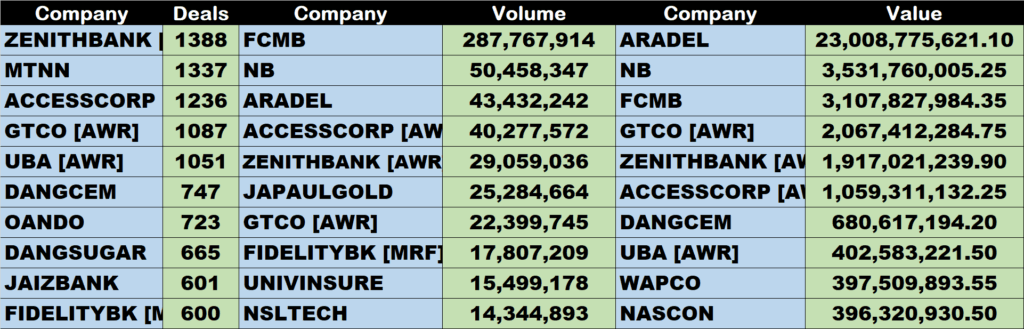

Volume Drivers

FCMB traded about 288 million units of its shares in 559 deals, valued at about N3 billion.

Nigerian breweries traded about 50 million units of its shares in 283 deals, worth about N3.5 billion.

ARADEL traded about 43 million units of its shares in 545 deals, valued at about N23 million.

Source: Stock market stays 0.41% afloat on gains in Dangote cement, other stocks – StocksWatch