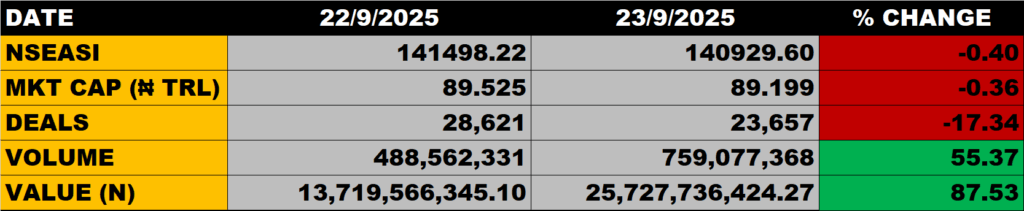

The equity market on Tuesday closed on a bearish note as the All Share Index dropped by 0.40% to settle at 140,929.60 points from the previous close of 141,498.22 points.

The Market Capitalisation declined by 0.36% to close at N89.199 trillion from the previous close of N89.525 trillion, thereby shedding N326 billion.

An aggregate of 759 million units of shares were traded in 23,657 deals, valued at N25.7 billion.

The Market Breadth closed negative as 16 equities appreciated in their share prices against 35 equities that declined in their share prices.

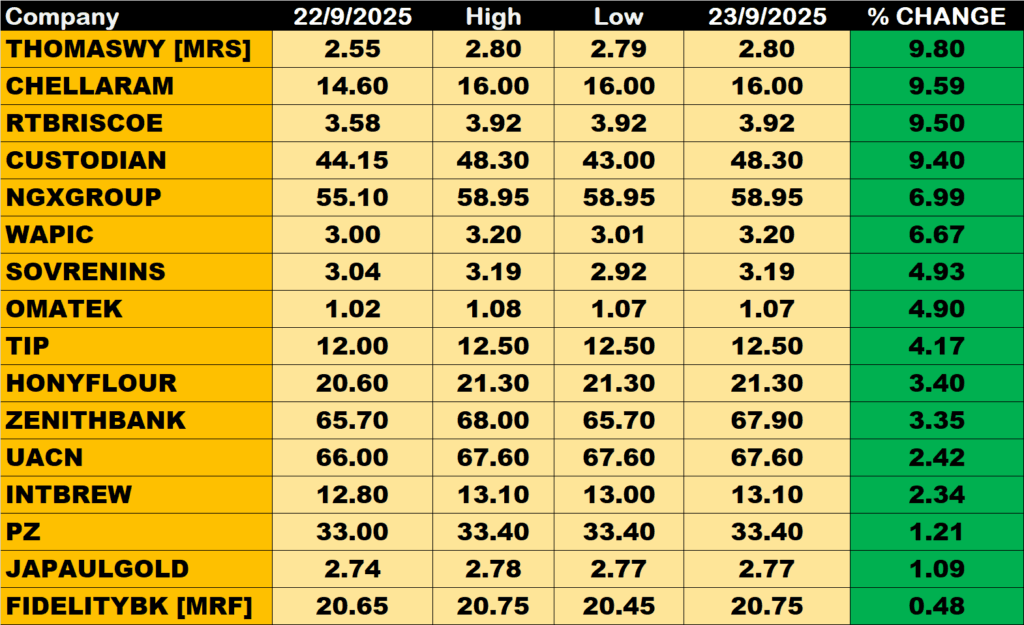

Percentage Gainers

THOMASWYAT led other gainers with 9.80% growth to close at N2.80 from the previous close of N2.55.

CHELLARAM and RTBRISCOE among other gainers also grew their share prices by 9.59% and 9.50% respectively.

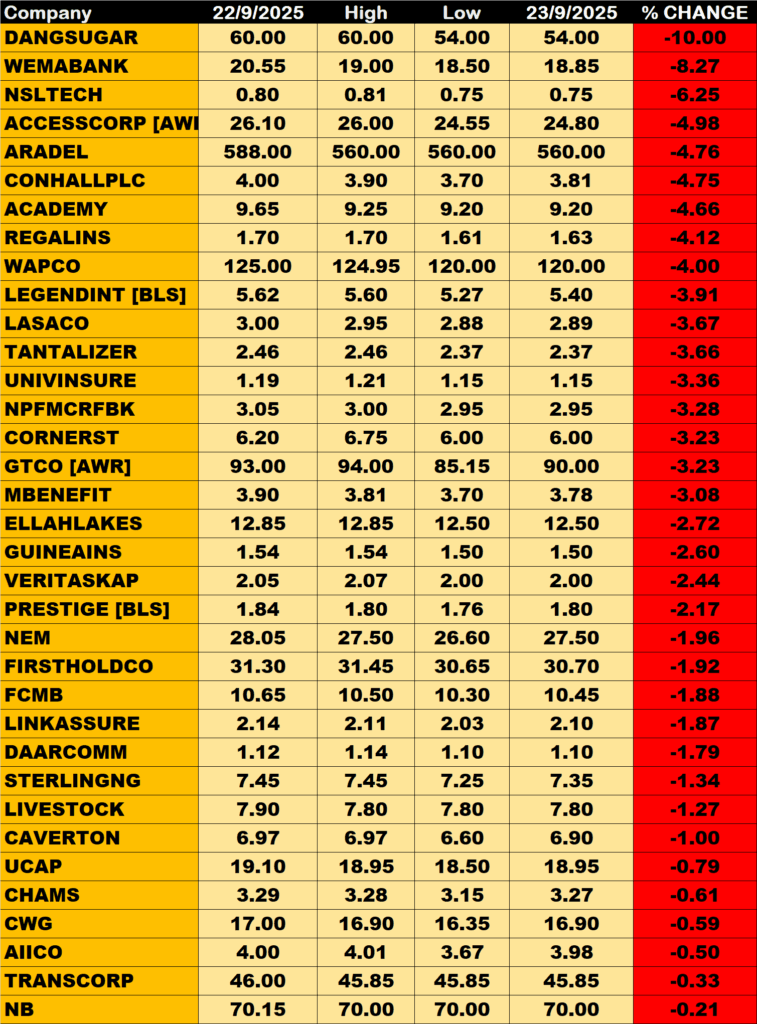

Percentage Losers

Dangote Sugar led other price decliners as it shed 10.00% of its share price to close at N54.00 from the previous close of N60.00.

Wema Bank, Secure Electronic Technology and ACCESSCORP among other price decliners also shed their share prices by 8.27% and 6.25% and 4.98% respectively.

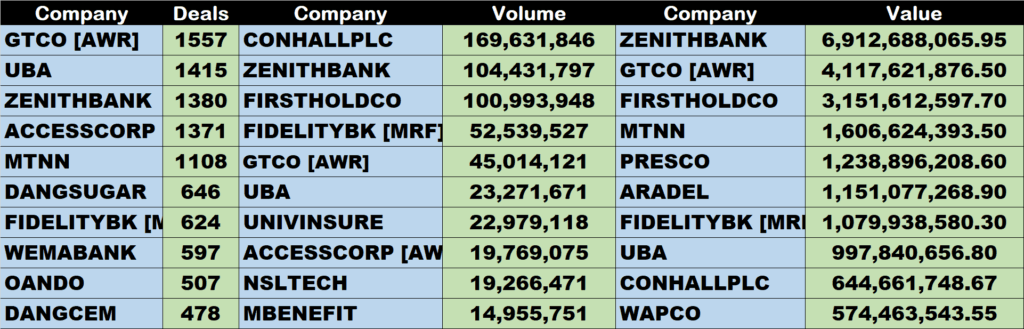

Volume Drivers

Consolidated Hallmark Holdings traded about 170 million units of its shares in 138 deals, valued at about N644 million.

Zenith Bank traded about 104 million units of its shares in just 1,380 deal valued at N8.9 million.

FIRSTHOLDINGCO traded about 101 million units of its shares in 458 deals, valued at N3 billion.

Source: Market sheds N326bn as NGXASI dropped further by 0.40% – StocksWatch