The Nigerian equities market continued to navigate a challenging path on Wednesday as new selling pressure dragged the market lower for the third straight session.

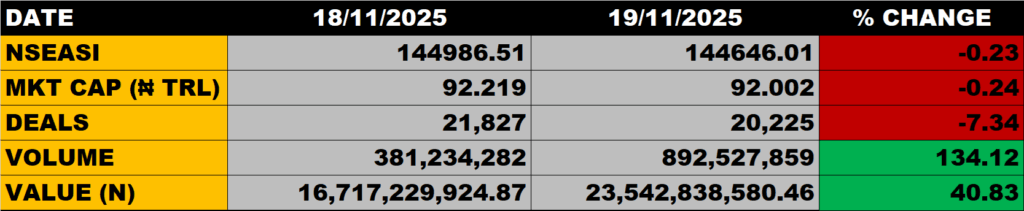

The All Share Index declined by 0.23% to close at 144,646.01 points from the previous close of 144,986.51 points.

The Market Capitalisation declined by 0.24% to close at N92.002 trillion from the previous close of N92.219 trillion, thereby shedding N 217 billion.

An aggregate of 893 million units of shares were traded in 22,225 deals, valued at about N23.5 billion.

The Market Breadth closed negative as 16 equities emerged as gainers against 39 equities that declined in their share prices.

Percentage Gainers

NCR led other gainers with 9.85% growth to close at N40.00 from the previous close of N30.95.

CAVERTON, UACN and Mutual Benefits among other gainers also grew their share prices by 9.71%, 8.33% and 7.69% respectively.

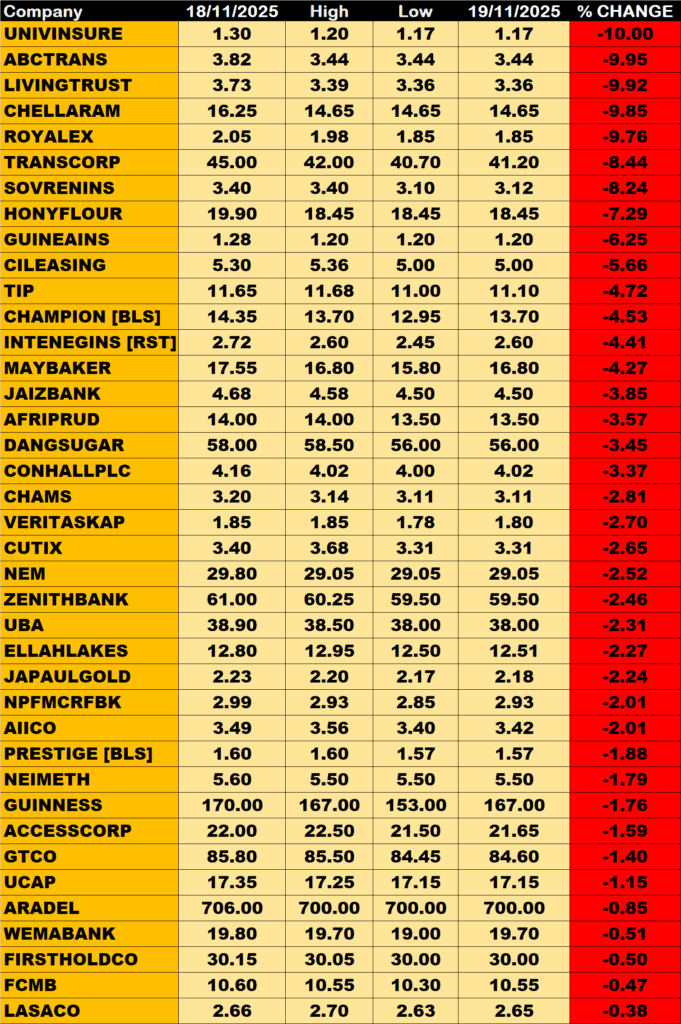

Percentage Losers

Universal Insurance, ABC Transport and Living Trust Insurance led other price decliners as they shed 10.00%, 9.95% and 9.92% respectively.

Volume Drivers

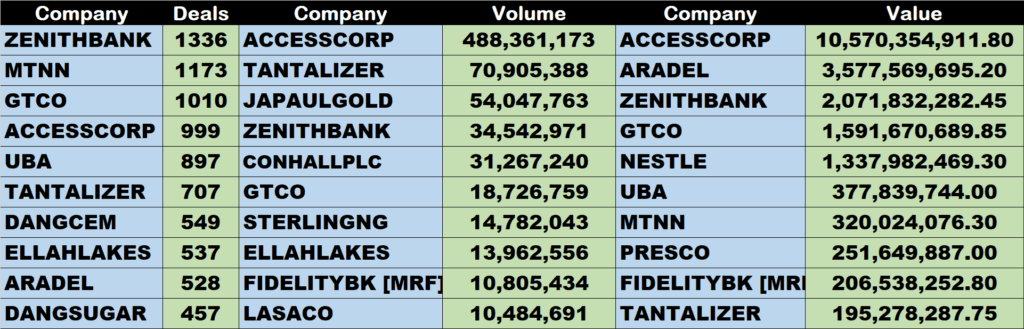

ACCESSCORP traded about 488 million units of its shares in 999 deals, valued at N10.6 billion.

TANTALIZER traded about 71 million units of its shares in 707 deals, valued at N195 million.

JAPAULGOLD traded about 54 million units of its shares in 166 deals, valued at N117 million.

Source: Profit-Taking persists as NGX extends decline by 0.23% | StocksWatch