- Ecobank, First Holdco most attractive banking stocks

- GTCO leads in profit margin

- Comparative Analysis of Banking Sector in Q3 2025

Wole Olajide, ACS

Performance of banking stocks on the Nigerian Exchange in Q3 2025 is mixed. Most of the Tier 1 Banks (FUGAZ) declined in their bottom-line figures, year on year. Except for UBA that made a marginal growth of 2.33% in profit after tax (PAT), others in the Tier 1 category (First Holdco, GTCO, Access and Zenith) declined in their bottom-line figures for the period under review. Interestingly, banks in the Tier 2, category reported impressive figures with double digit growth in turnover and post-tax profit. Wema Bank, Sterling Financial Holdings, Stanbic IBTC and Ecobank Transnational Incorporated achieved significant growth in their topline and bottom-line figures.

Let’s keep an eye on how the earnings reports for these stocks play out this week and what effect they’ll have on their prices.

Even though Fidelity Bank and FCMB are yet to file their Q3 2025 reports, we shall however proceed with the ranking of the available financial institutions that have filed theirs on the floor of the Nigerian Exchange.

The ranking of the performance of the banking sector for Q3 2025 is done using the following metrics: Turnover, Profit after tax (PAT), Turnover growth, PAT growth, Earnings per share (EPS), Price-to-earnings ratio (P/E ratio), Earnings yield and profit margin.

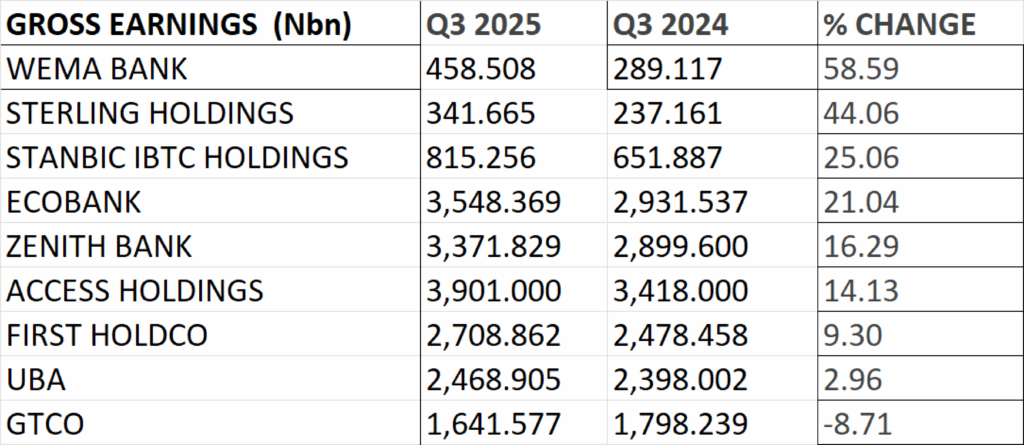

PERFOMANCE IN TURNOVER GROWTH

Turnover, Revenue or Gross Earnings represents the total amount of money a company earns before any deductions or other expenses are taken out.

- Wema Bank Plc emerged first in terms of turnover growth in Third Quarter of 2025 as it reported Gross Earnings of N458.508 billion, up by 58.59% from N289.117 billion reported the previous year.

- Sterling Financial Holdings Plc ranks second in turnover growth. The Financial Institution reported Gross Earnings of N341.665 billion for the 9 months period. This is a growth of 44.06% from N237.161 billion achieved the previous year.

- Stanbic IBTC Holdings emerged third in terms of turnover growth. The Bank reported Gross earnings of N815.256 billion for the 9 months period, up by 25.06% from N651.887 billion reported the previous year.

- Ecobank Transnational Incorporated is fourth in the ranking for turnover growth. Gross Earnings of N3.548 trillion was recorded for the 9 months period, up by 21.04% from N2.932 trillion reported the previous year.

- Zenith Bank emerged fifth in turnover growth with Gross Earnings of N3.372 trillion, up by 16.29% from N2.899 trillion reported the previous year.

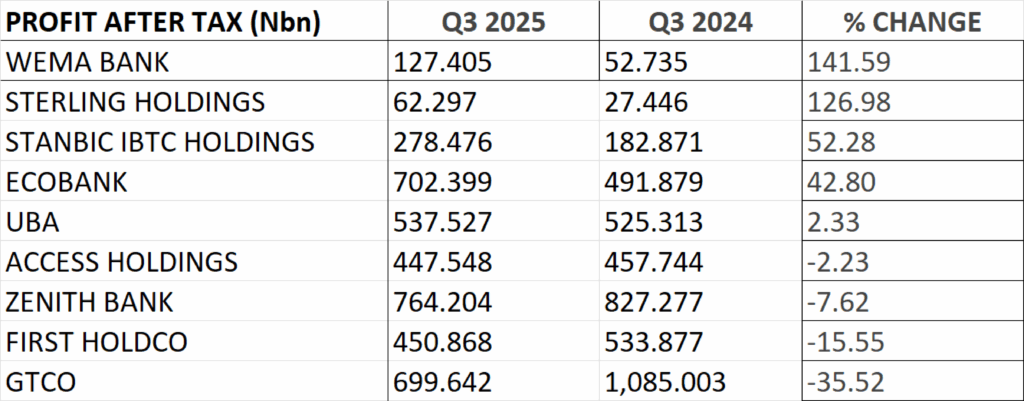

PERFORMANCE IN PAT GROWTH

- Wema Bank reported profit after tax of N127.405 billion for the 9 months period, up by 141.59% from N52.735 billion reported the previous year, emerging as first in PAT growth.

- Sterling Financial Holdings Plc ranks second in terms of growth in profit after tax. The financial institution reported profit after tax of N62.297 billion for the 9 months period, up by 126.98% from N27.446 billion reported the previous year.

- Stanbic IBTC Holdings grew profit after tax by 58.28% year on year to N278.476 billion from N182.871 billion reported in Q3 2024.

- Ecobank Transnational Incorporated grew profit after tax by 42.80% to N702.399 billion from N491.879 billion achieved the previous year.

- Fifth on the rank is United Bank for Africa (UBA) with a PAT growth of 2.33% year on year. The financial institution recorded profit after tax of N537.527 billion in Q3 2025 from N525.313 billion reported the previous year.

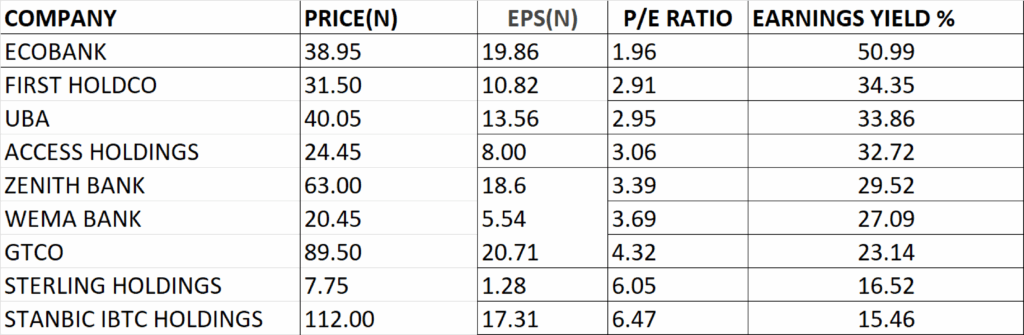

PERFORMANCE IN EARNINGS PER SHARE (EPS), P/E RATIO AND EARNINGS YIELD

- Ecobank Transnational Incorporated is currently trading at N38.95. With the Q3 2025 earnings per share (EPS) of N19.86, a low P/E ratio of 1.96x and earnings yield of 50.99% makes Ecobank the most attractive banking stocks among others.

- First Holdco Plc is currently trading at N31.50. With EPS of N10.82, the P/E ratio of the First Holdco stands at 2.91x with earnings yield of 34.35%.

- UBA is currently trading at N40.05. With the EPS of N13.56, the P/E ratio of the financial institution stands at 2.95x with earnings yield of 33.86%.

- Access Holdings is currently trading at N24.45. With the EPS of N8, the P/E ratio of Access Holdings stands at 3.06x with earnings yield of 32.72%.

- Zenith Bank is currently trading at N63. With the EPS of N18.60, the P/E ratio of Zenith Bank stands at 3.39x with earnings yield of 29.52%.

- Wema Bank is trading at N20.45. With the EPS of N5.54, the P/E ratio of Wema Bank stands at 3.69x with earnings yield of 27.09%.

- GTCO is trading at N89.50. With the EPS of N20.71, the P/E ratio of GTCO stands at 4.32x with earnings yield of 23.14%.

- Sterling Holdings is trading at N7.75. With the EPS of N1.28, the P/E ratio of Sterling stands at 6.05x with earnings yield of 16.52%.

- Stanbic IBTC Holdings is trading at N112. With the EPS of N17.31, the P/E ratio is 6.47x with earnings yield of 15.46%.

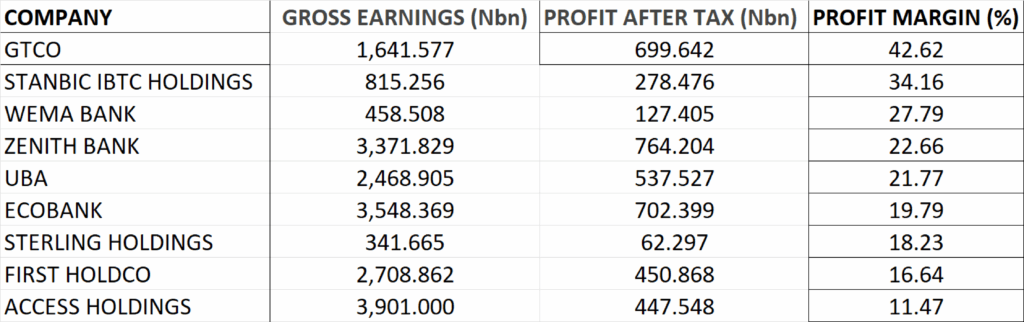

PROFIT MARGIN

Profit margin is a financial ratio that measures the percentage of profit earned by a company in relation to its revenue. Expressed as a percentage, it indicates how much profit the company makes for every revenue generated.

Profit margin is important because this percentage provides a comprehensive picture of the operating efficiency of a business or an industry.

It is calculated as Profit after Tax, divided by Revenue or Turnover, multiplied by 100.

GTCO achieved profit margin of 42.62%, emerging top in the industry for the period under review.

This is followed by Stanbic IBTC Holdings, Wema Bank, Zenith Bank and UBA with profit margin of 34.16%, 27.79%, 22.66% and 21.77% respectively.

Source: Banking Sector in Q3 2025: Wema Bank Leads Industry in Turnover and PAT Growth | StocksWatch