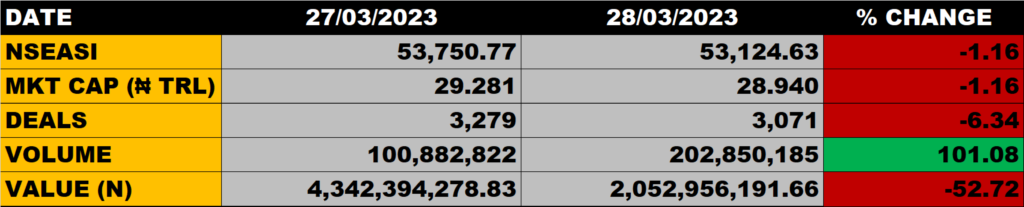

The Nigerian stock market on Tuesday declined further as 8 stocks and notably Dangote Cement shed 4.17% to close the day at N276 from N288, thereby driving the All Share Index down by 1.16% to close at 53,124.63 points from 53,750.77 points recorded last on Monday.

The market capitalisation closed at N28.940 trillion, shedding 341 billion from N29.281 trillion recorded in the last session.

An aggregate of 202.9 million units of stocks were traded in 3,071 deals, valued at N2 billion.

Market Breadth

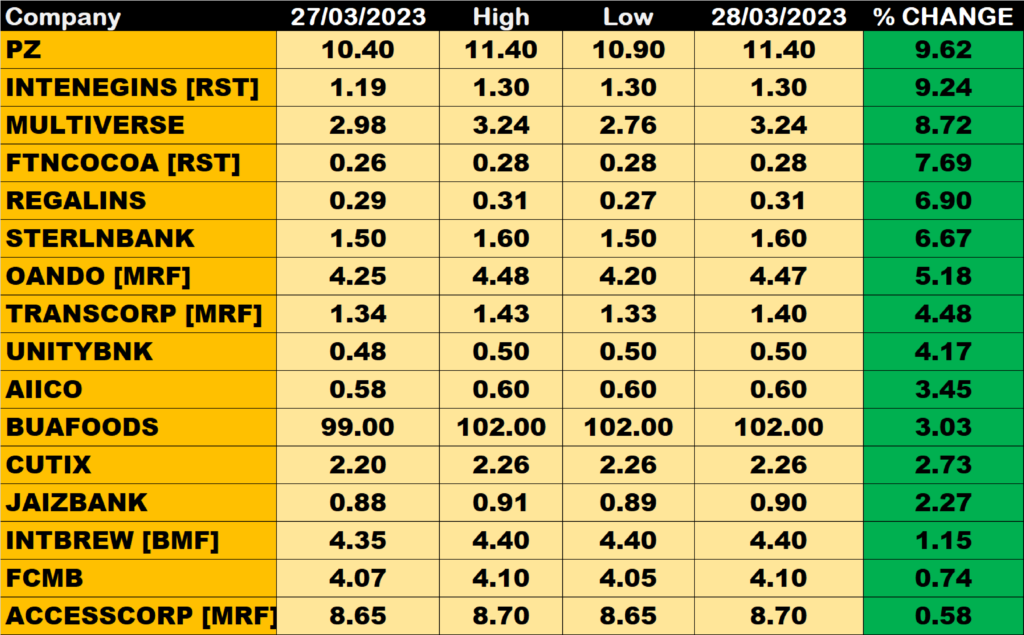

The market breadth closed positive as 16 stocks gained against 9 that declined in their share prices.

Percentage Gainers

PZ with 9.62% growth, led the gainers table to close at N11.40 from the previous close of N10.40.

International Energy Insurance and MULTIVERSE among other gainers also grew their share prices by 9.24% and 8.72% respectively.

Percentage Losers

CHAMS led other losers as it shed 8.00% of its share price to close at N0.23 from N0.25.

UACN, Dangote Cement and Fidson among other stocks shed their share prices by 5.76%, 4.17%, and 2.95% respectively.

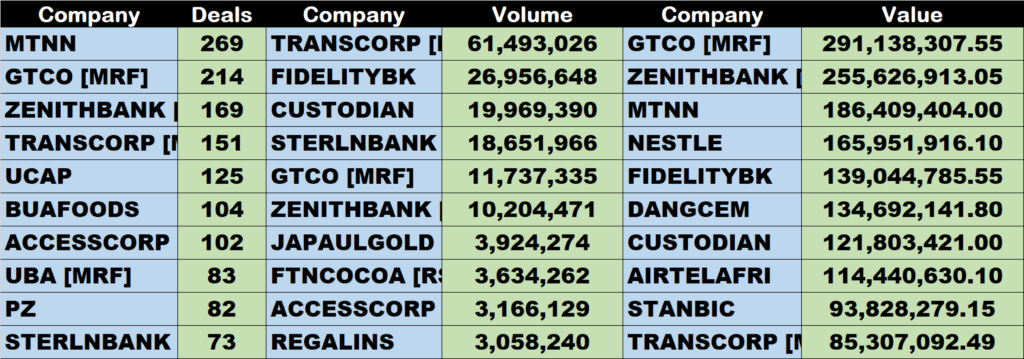

Volume Drivers

TRANSCORP traded about 61 million units of its shares in 151 deals, valued at about N85 million.

Fidelity Bank traded about 27 million units of its shares in 64 deals, valued at about N139 million.

CUSTODIAN traded about 20 million units of its shares in 47 deals, valued at about N121.8 million.

Source: Dangote Cement sheds weight, drives NGXASI down by 1.16% – StocksWatch (stocksng.com)