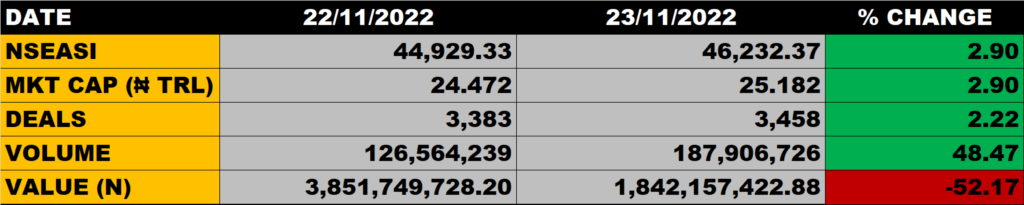

Gains in the prices of Dangote Cement, BUA Cement and other 26 stocks lifted the activities on the floor the Nigerian equity market on Wednesday to a higher close as the All Share Index appreciated by 2.90% to settle at 46,232.37 points from the previous close of 44,929.33 points.

The Market Capitalisation grew by 2.90% to close at N25.182 trillion from the previous close of N24.472 trillion, thereby gaining N710 billion.

An aggregate of 187.9 million units of shares were traded in 3,458 deals, valued at N1.8 billion.

The Market Breadth closed positive as 28 equities appreciated in their share prices against 11 that declined in their share prices.

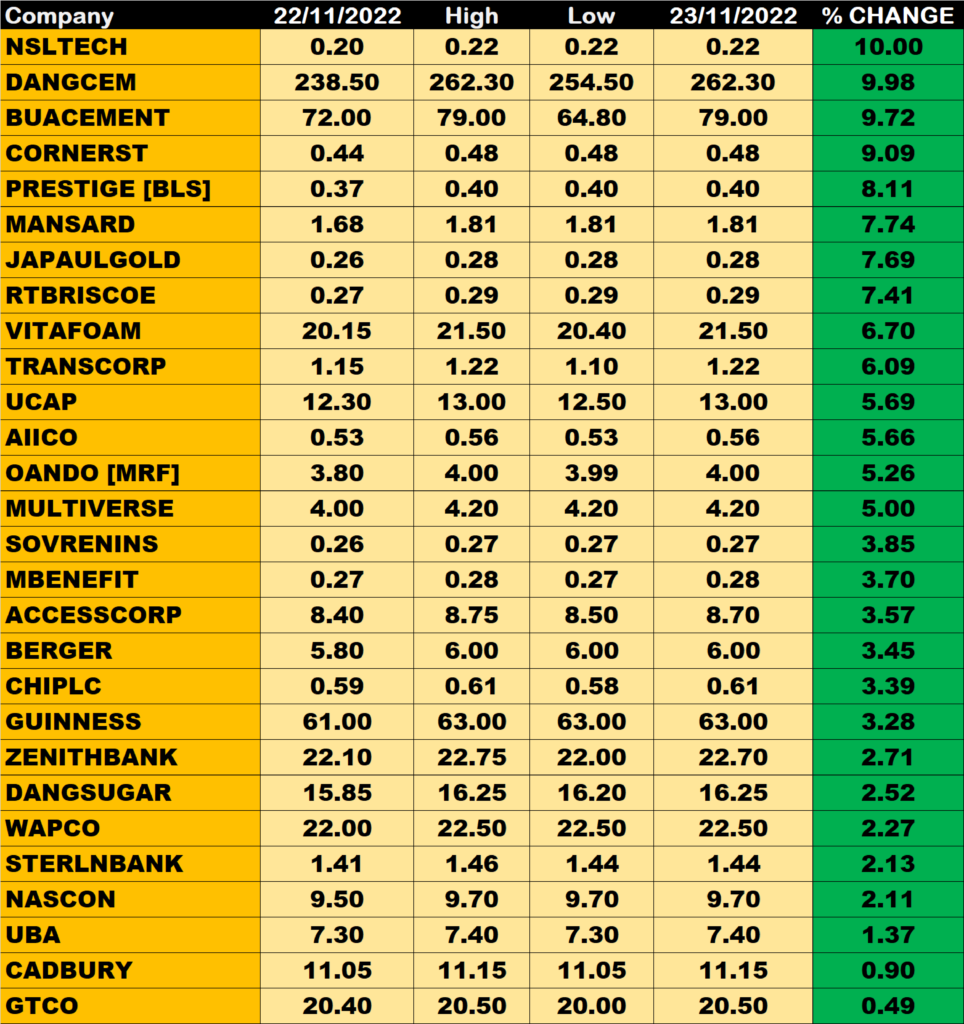

Percentage Gainers

Secure Electronic Technology led other gainers with 10.00% growth to close at N0.22 from the previous close of N0.20.

Dangote Cement, BUA Cement, Cornerstone Insurance, Prestige Assurance and AXA MANSARD among other gainers also grew their share prices above 7.00%.

Percentage Losers

SCOA led other price decliners as it shed 9.30% of its share price to close at N1.17 from the previous close of N1.29.

Royal Exchange, Eterna Oil and CUTIX among other price decliners also shed their share prices by 8.97%, 4.76% and 4.72% respectively.

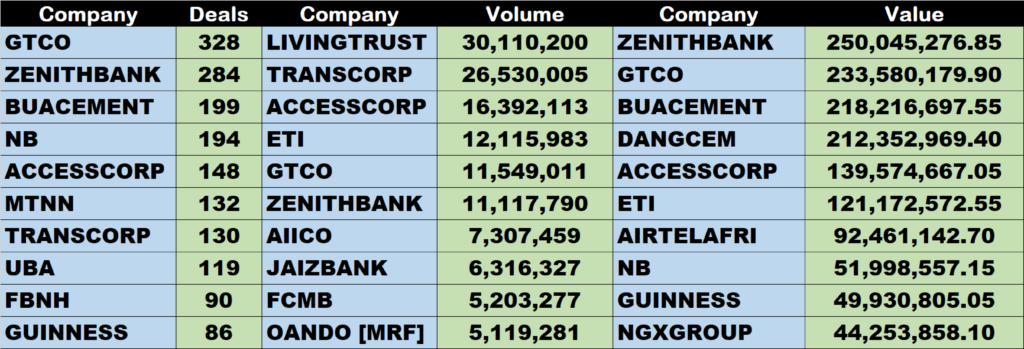

Volume Driver

TRANSCORP traded about 26.5 million units of its shares in 130 deals, valued at about N31 million.

ACCESSCORP traded about 16 million units of its shares in just 148 deals, valued at N139.6 million.

Ecobank traded about 12 million units of its shares in 55 deals, valued at N121 million.

Source: Gains in Dangote Cement, others lift market further by 2.90% higher – StocksWatch (stocksng.com)