The Nigerian equity market on Thursday closed on a positive note as The All Share Index moved up by 0.21% to close at 140,665.84 points from the previous close of 140,365.36 points.

Investors gained N191 billion as the Market Capitalisation grew by 0.22% to close at N89.004 trillion from the previous close of N88.813 trillion.

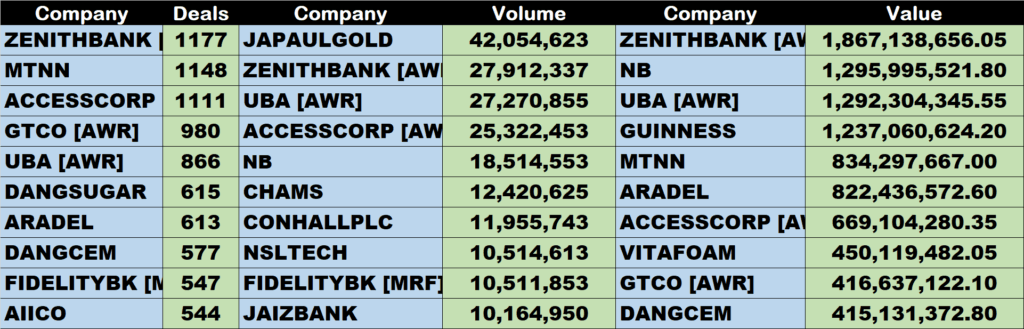

An aggregate of 378 million units of shares were traded in 22,935 deals, valued at N12.4 billion.

The Market Breadth closed positive as 41 equities appreciated in their share prices against 12 equities that declined in their share prices.

Percentage Gainers

GUINNESS, Living Trust Insurance and C & I Leasing led other gainers with 10.00% growth each, closing at N1.43, N4.62 and N6.60 respectively.

ETRANZACT, Regency Alliance and CAP among other gainers also grew their share prices by over 9.00% each.

Percentage Losers

Nem Insurance led other price decliners as it shed 9.94% of its share price to close at N28.10 from the previous close of N31.20.

MANSARD and CWG among other price decliners also shed their share prices by 4.76% and 4.71% respectively.

Volume Drivers

JAPAULGOLD traded about 42 million units of its shares in 204 deals, valued at N111.9 million.

Zenith Bank traded about 28 million units of its shares in 1177 deals valued at N1.87 billion.

UBA traded about 27 million units of its shares in 866 deals, valued at N1.3 billion.

Source: Investors gain N191bn as NGXASI inches up by 0.21 – StocksWatch