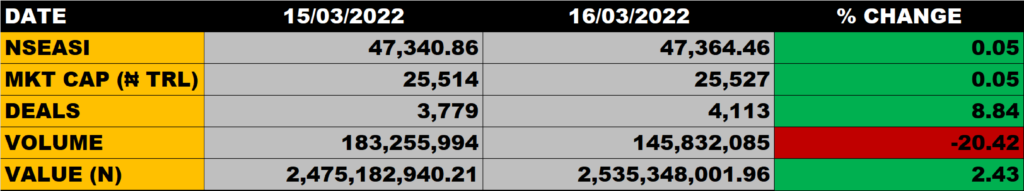

The Nigerian Exchange on Wednesday closed on a positive note as the All Share Index appreciated by 0.05%, closing at 47,364.46 points from the previous close of 47,340.86 points.

Investors gained N13 billion as the Market Capitalisation grew by 0.05% to close at N25.527 trillion from the previous close of N25.514 trillion.

An aggregate of 145.83 million units of shares were traded in 4,113 deals, valued at N2.54 billion.

The Market Breadth closed positive as 18 equities emerged as gainers against 17 equities that declined in their share prices.

Percentage Gainers

NPF Microfinance Bank led other gainers with 10% growth, closing at N2.31 from the previous close of N2.10

PZ and AIICO Insurance among other gainers also grew their share prices by 9.79% and 6.15% respectively.

Percentage Losers

Royal Exchange led other price decliners, shedding 9.73% of its share price to close at N1.02 from the previous close of N1.13.

Livestock Feeds and Industrial & Medical Gases among other price decliners also shed their share prices by 9.71% and 9.47% respectively.

Volume Drivers

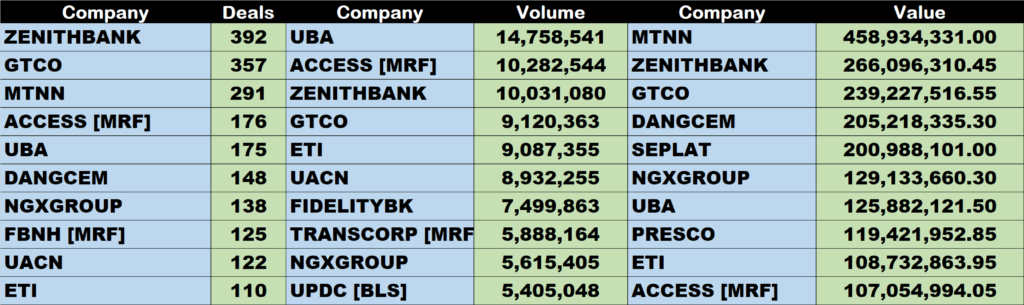

UBA traded about 14.76 million units of its shares in 175 deals, valued at N125.88 million.

Access Bank traded about 10.28 million units of its shares in 176 deals, valued at N107.05 million.

Zenith Bank traded about 10.03 million units of its shares in 392 deals, valued at N266 million.

Source: Market advances by 0.05%, investors gain N13bn – StocksWatch (stocksng.com)