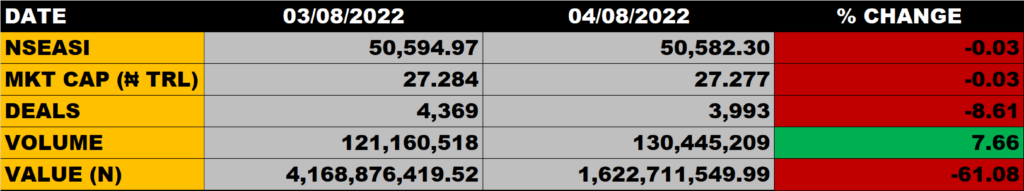

Transactions on the floor of the Nigerian Exchange on Thursday closed lower as the All Share Index declined by 0.03% to close at 50,582.30 points from the previous close of 50,594.97 points.

The Market Capitalisation declined by 0.03% to close at N27.277 trillion from the previous close of N27.284 trillion, thereby shedding N7 billion.

An aggregate of 130 million units of shares were traded in 3,993 deals, valued at N1.6 billion.

The Market Breadth closed positive as 24 equities emerged as gainers against 16 equities that declined in their share prices.

Percentage Gainers

PZ led other gainers chart with 10.00% growth, closing at N9.35 from the previous close N8.50.

Honeywell Flour and STAMBIC IBTC among other gainers also grew their share prices by 9.64% and 9.16% respectively.

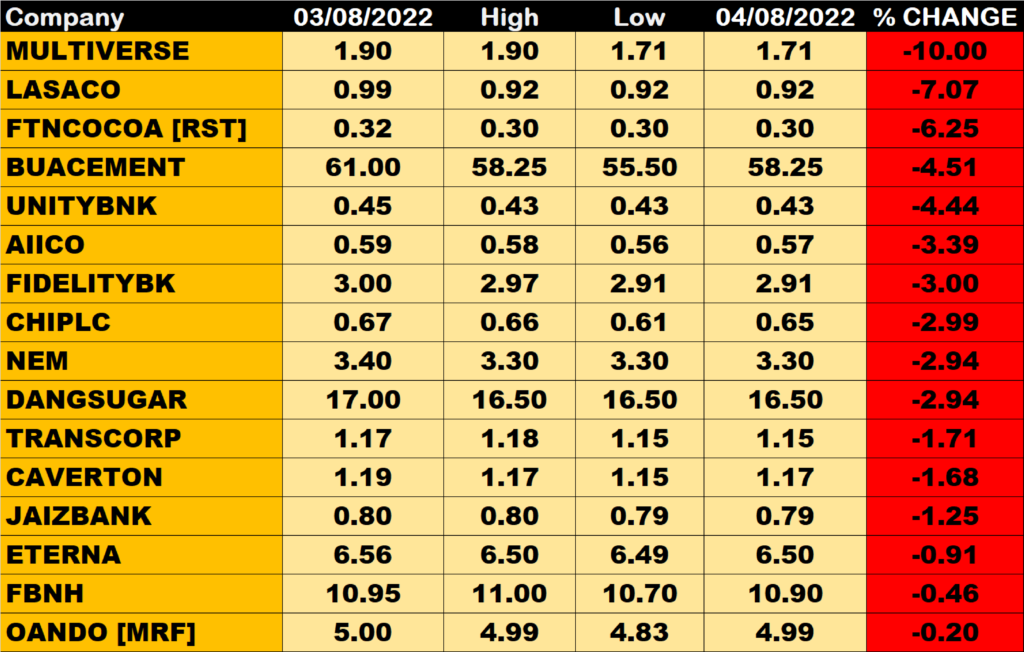

Percentage Losers

MULTIVERSE led other price decliners as it sheds 10.00% of its share price to close at N1.71 from the previous close of N1.90.

LASACO Assurance and FTN Cocoa among other price decliners also shed their share prices by 7.07% and 6.25% respectively.

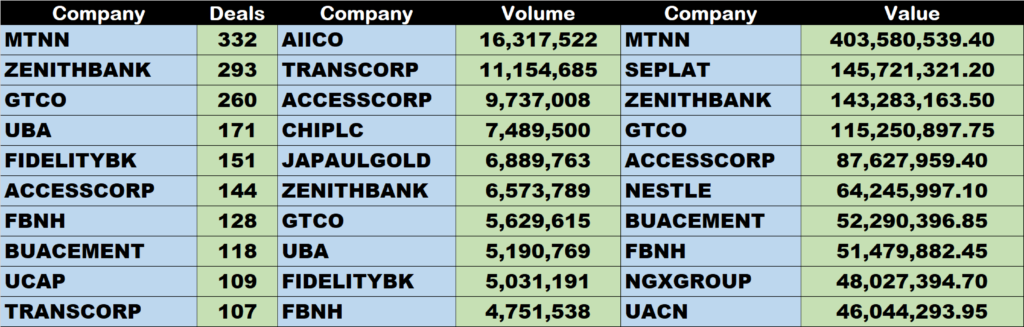

Volume Drivers

TRANSCORP traded about 11 million units of its shares in 107 deals, valued at N12.9 million.

ACCESSCORP traded about 9.7 million units of its shares in 144 deals, valued at N87.6 million.

Zenith Bank traded about 6.5 million units of its shares in 293 deals, valued at N143 million.

Source: Market closes lower by 0.03%, sheds N7bn – StocksWatch (stocksng.com)