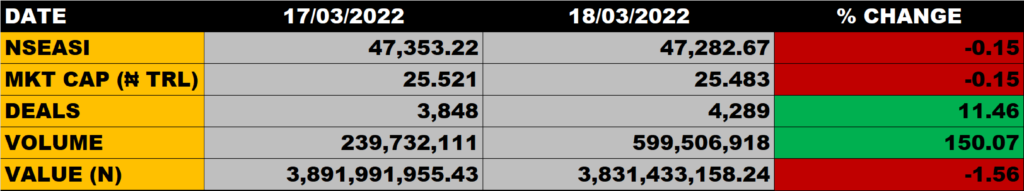

The Nigerian Stock Market on Friday extended loses to two straight sessions as the All Share Index declined further by 0.15% to close at 27,282.67 points from the previous close of 47.353.22 points on Thursday.

Market Capitalisation was down by 0.15% to close at N25.483 trillion against Thursday’s close of N25.521 trillion, shedding N38 billion.

The aggregate volume and value of traded stocks closed at 599,507 million units and N3.831 billion in 4,289 deals.

Market Breadth

Market Breadth closed negative as 13 stocks gained while 21 stocks lost.

Percentage Gainers

PZ led gainers’ chart with 9.55% growth to close at N8.60 from the previous close of N7.85

CWG grew by 8.08% while Royal Exchange and Niger Insurance gained 7.14% and 5.00% respectively.

Percentage Losers

MRS tops the losers’ list, shedding 9.96% of its share price to settle at N12.20 from N13.55 it closed on Thursday.

Still on the red chart are Ikeja Hotel, WAPIC and Mutual Benefits shedding 9.87%, 9.43% and 7.41% of their share prices ahead of other stocks that declined in their share prices.

Volume Drivers

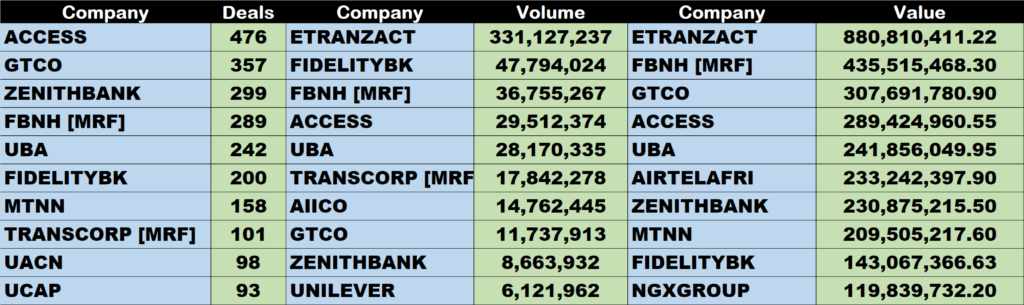

ENTRANZACT traded about 331 million units of its shares in 8 deals, valued at about N880.8 million.

Fidelity Bank traded about 47.8 million units of its shares in 200 deals, valued at about N143 million.

Source: Market extends decline, closes lower by 0.15% – StocksWatch (stocksng.com)