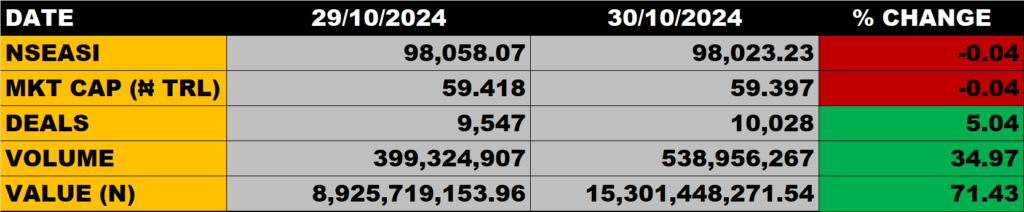

The Nigerian Stock Market on Wednesday declined further as the All Share Index dropped by 0.04% to close at 98,023.23 points from the previous close of 98.058.07 points on Tuesday.

Market Capitalisation was down by 0.04% to close at N59.397 trillion against Monday’s close of N59.418 trillion, shedding N21billion.

The aggregate volume and value of traded stocks closed at 539 million units and N15 billion in 10,028 deals.

Market Breadth

Market Breadth closed positive as 33 stocks gained while 23 stocks lost.

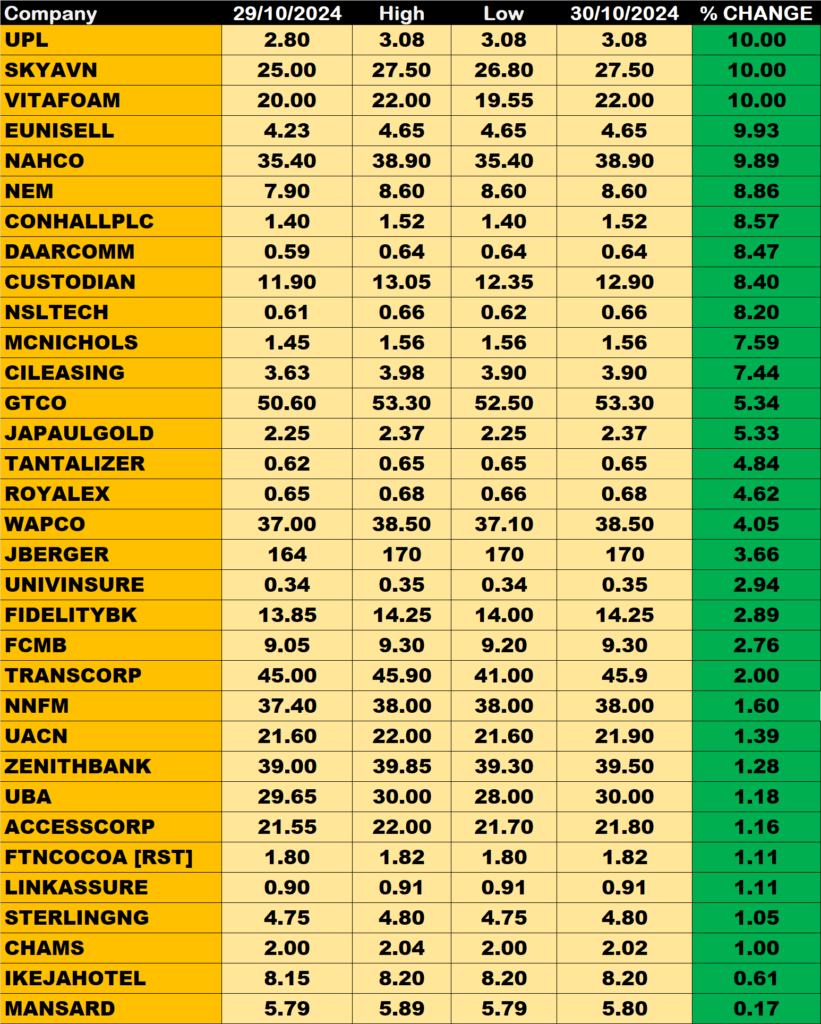

Percentage Gainers

University Press, Sky aviation and VITAFOAM led gainers’ chart with 10.00% growth each to close at N0d.33, N27.50 and N22.00 respectively.

EUNIELL grew by 9.93% while NAHCO and Nem Insurance gained 9.89% and 8.86% respectively.

Percentage Losers

PZ and Jaiz Bank tops the losers’ list, shedding 10.10% each of their share prices to settle at 18.90 and N225 respectively.

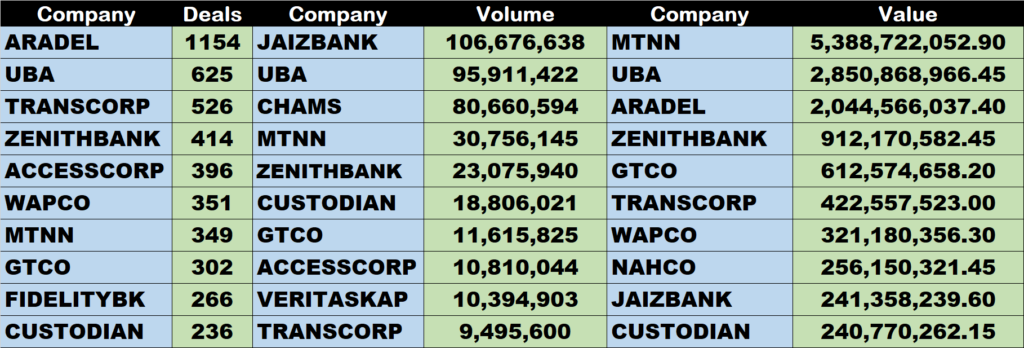

Volume Drivers

Jaiz Bank traded about 107 million units of its shares in 211 deals, valued at about N241 million.

UBA traded about 96 million units of its shares in 625 deals, valued at about N2.85 billion.