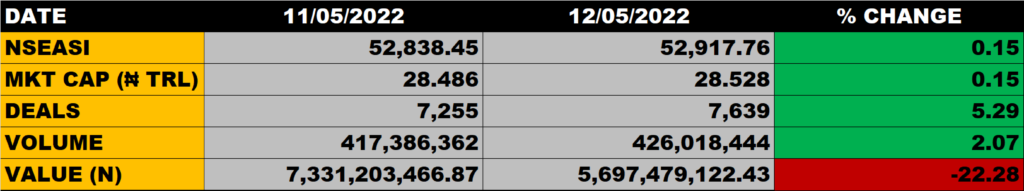

Transactions on the floor of the Nigerian Exchange on Thursday closed on a bullish note as the All Share Index appreciated by 0.15% to close at 52,917.76 points from the previous close of 52,838.45 points.

Investors gained N42 billion as the Market Capitalisation grew by 0.15% to close at N28.528 trillion from the previous close of N28.486 trillion.

An aggregate of 426 million units of shares were traded in 7,639 deals, valued at N5.7 billion.

Market Breadth

The market breadth closed positive as 32 stocks gained against 23 stocks that declined in their share prices.

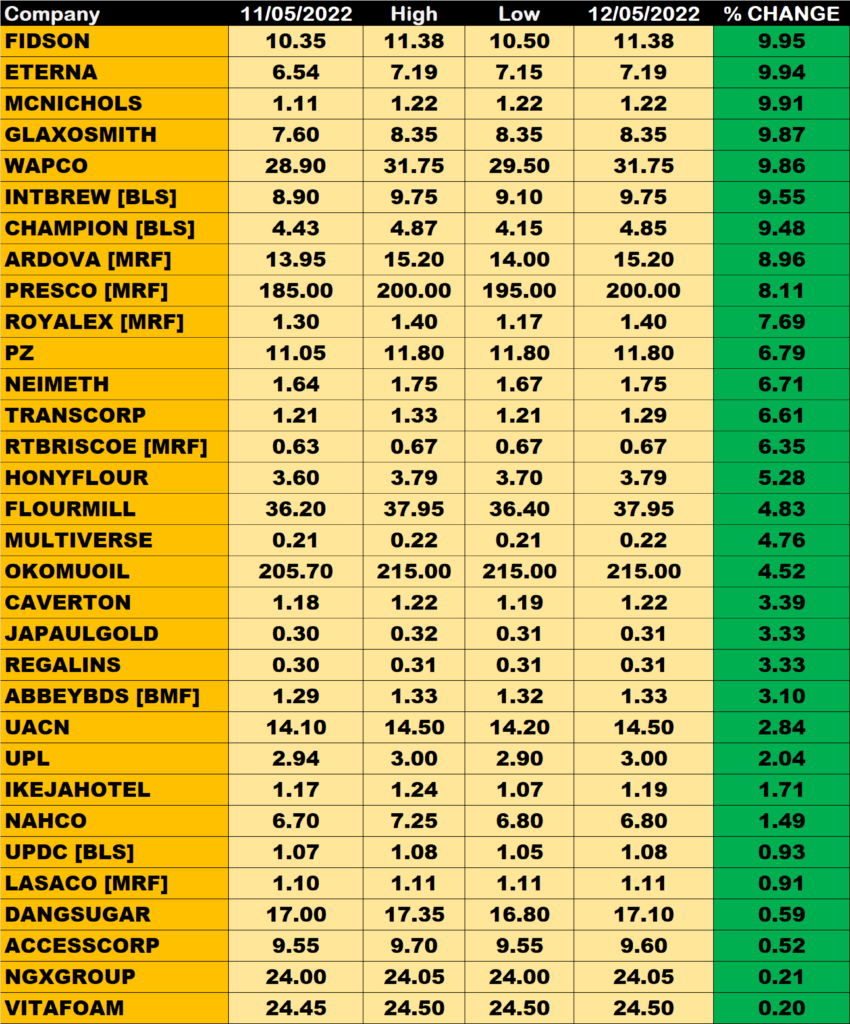

Percentage Gainers

Fidson Healthcare led other gainers with 9.95% growth, closing at N11.38 from the previous close of N10.35.

Eterna Plc, MCNICHOLS, Glaxosmith and Lafarge Africa among others also grew their share prices by 9.94%, 9.91%, 9.87% and 9.86% respectively.

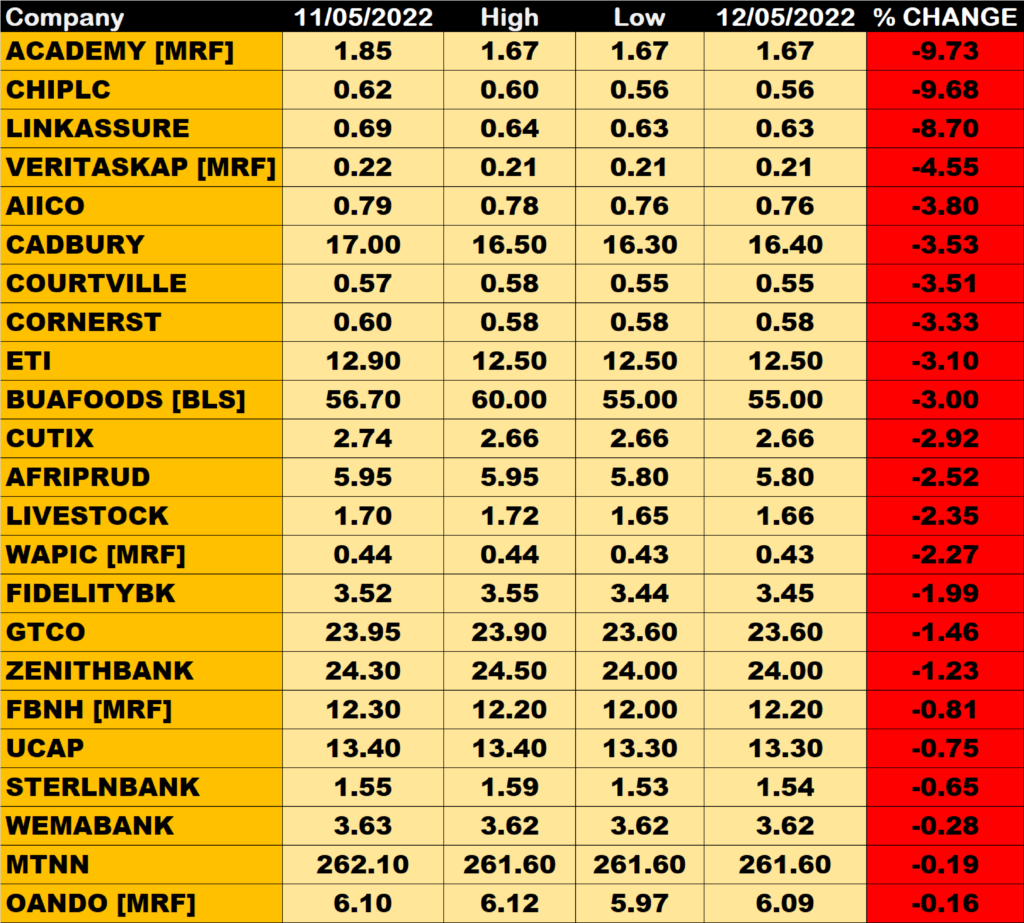

Percentage Losers

Academy Press led other price decliners as it shed 9.73% of its share price to close at N1.67 from the previous close of N1.85.

Consolidated Hallmark Insurance and Linkage Assurance among others shed their share prices by 9.68% and 8.70% respectively.

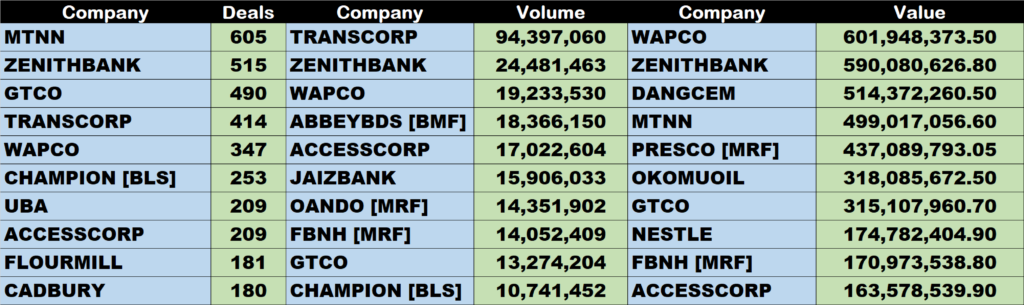

Volume Drivers

Transcorp traded about 94.4 million units of its shares in 414 deals, valued at N122.72 million.

Zenith Bank traded about 24.48 million units of its shares in 515 deals, valued at N590 million.

Lafarge Africa traded about 19.23 million units of its shares in 347 deals, valued at N601.95 million.

Source: Market sustains uptrend as NGXASI inches up by 0.15% – StocksWatch (stocksng.com)