The Nigerian stock market closed higher last week, driven by growth in the prices of Dangote Cement, MTN Nigeria and other 71 stocks.

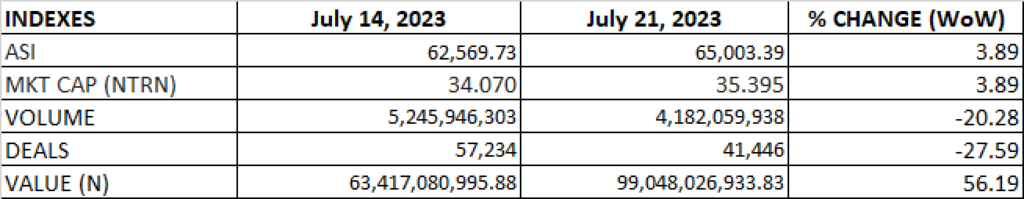

The All Share Index and Market capitalization rose by 3.89% to settle at 65,003.39 points and N35.395 trillion respectively.

An aggregate of 4 billion units of shares were traded in 41,446 deals, valued at N99 billion.

The market breadth closed positive as 73 stocks gained against 19 stocks that declined in their share prices.

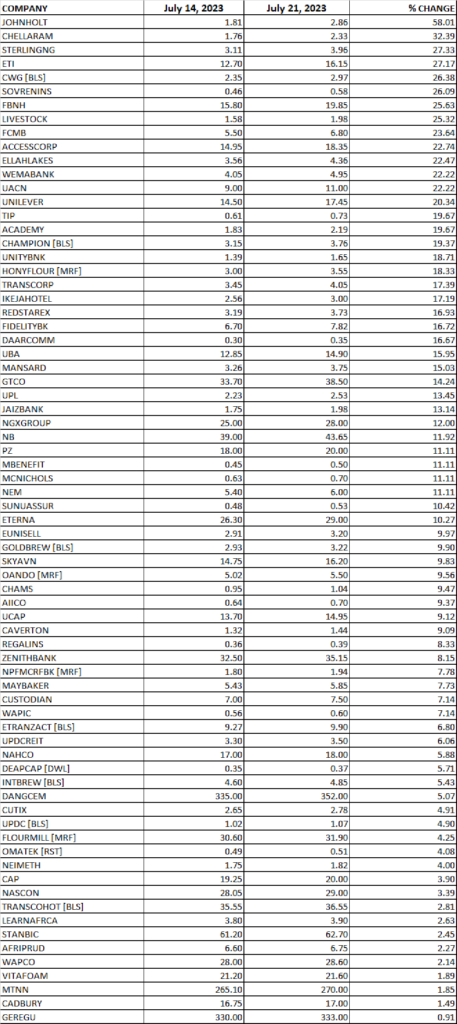

TOP 10 GAINERS

JOHNHOLT led other gainers in the course of last week with 58.01% growth, closing at N2.86 from the previous close of N1.81.

CHELLARAM, Sterling Bank, Ecobank and CWG grew their share prices by 32.39%, 27.33%, 27.17% and 26.38% respectively.

Other top 10 gainers include: Sovereign Trust Insurance 26.09%, FBNH 25.63%, Livestock Feeds 25.32%, FCMB 23.64% and ACCESSCORP 22.74% respectively.

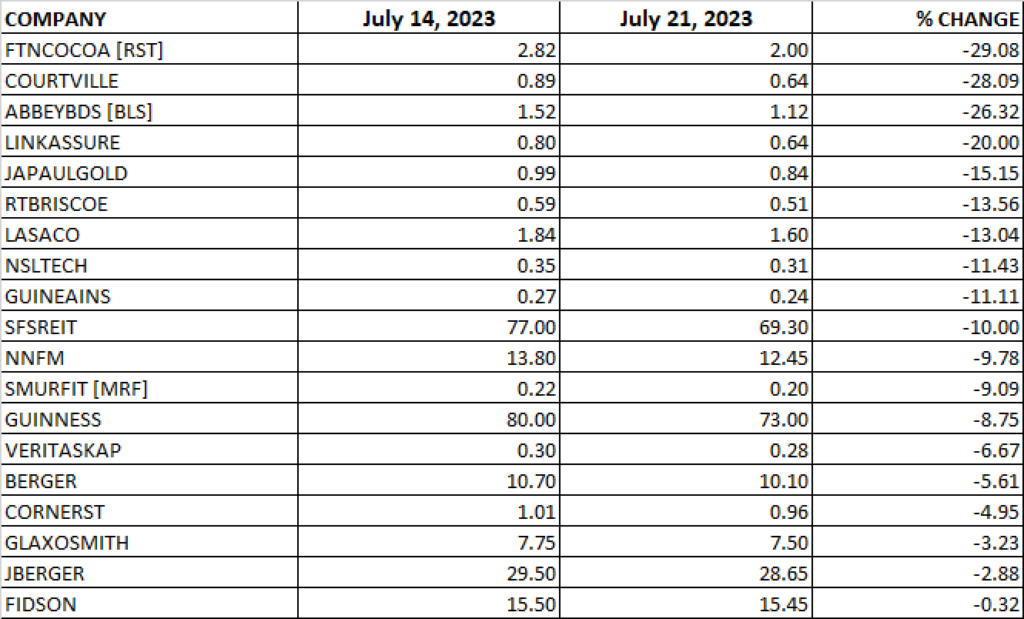

TOP 10 LOSERS

FTN Cocoa led other price decliners, shedding 29.08% of its share price to close at N2.00 from the previous close of 2.82.

COURTVILLE, Abbey Building, Linkage Assurance and JAPAULGOLD shed 28.09%, 26.30%, 20.00% and 15.15% respectively.

Other price decliners include: RTBRISCOE (13.56%), LASACO (13.04%), NSLTECH (11.43%), Guinea Insurance (11.11%) and SFSREIT (10.00%) respectively.

Source: Nigerian Bourse gains N1.3tn, returns 3.89 WtD% – StocksWatch (stocksng.com)