The Nigerian stock market last week closed higher, driven by growth in the prices of MTN Nigeria, NESTLE and 39 other stocks

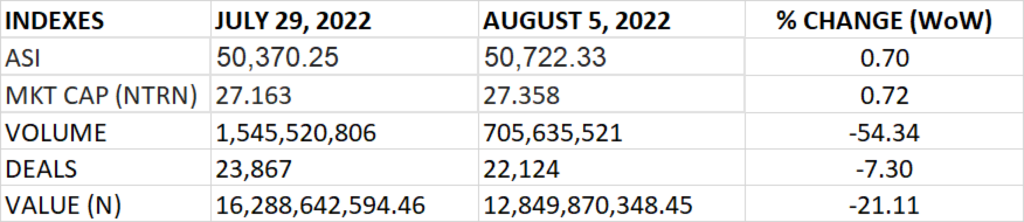

The All Share Index and Market capitalization rose by 0.70% and 0.72% to settle at 50,722.33 points and N27.358 trillion respectively.

An aggregate of 705.6 million units of shares were traded in 22,124 deals, valued at N12.8 billion.

The market breadth closed positive as 41 stocks gained against 22 stocks that declined in their share prices.

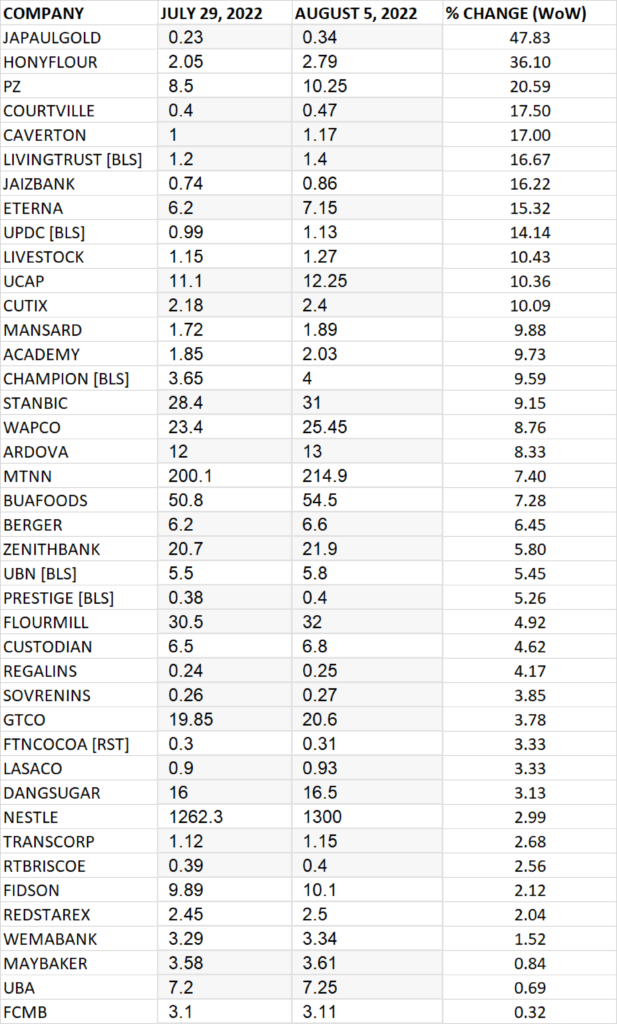

TOP 10 GAINERS

JAPAULGOLD led the gainers last week with 47.83% growth, closing at N0.34 from the previous close of N0.23.

Honeywell Flour, PZ, COURTVILLE and CAVERTON grew their share prices by 36.10%, 20.59%, 17.50% and 17.00% respectively.

Other top 10 gainers include: Living Trust Mortgage Bank 16.67%, Jaiz Bank 16.22%, Eterna Oil 15.32%, UPDC 14.14% and Livestock Feeds 10.43% respectively.

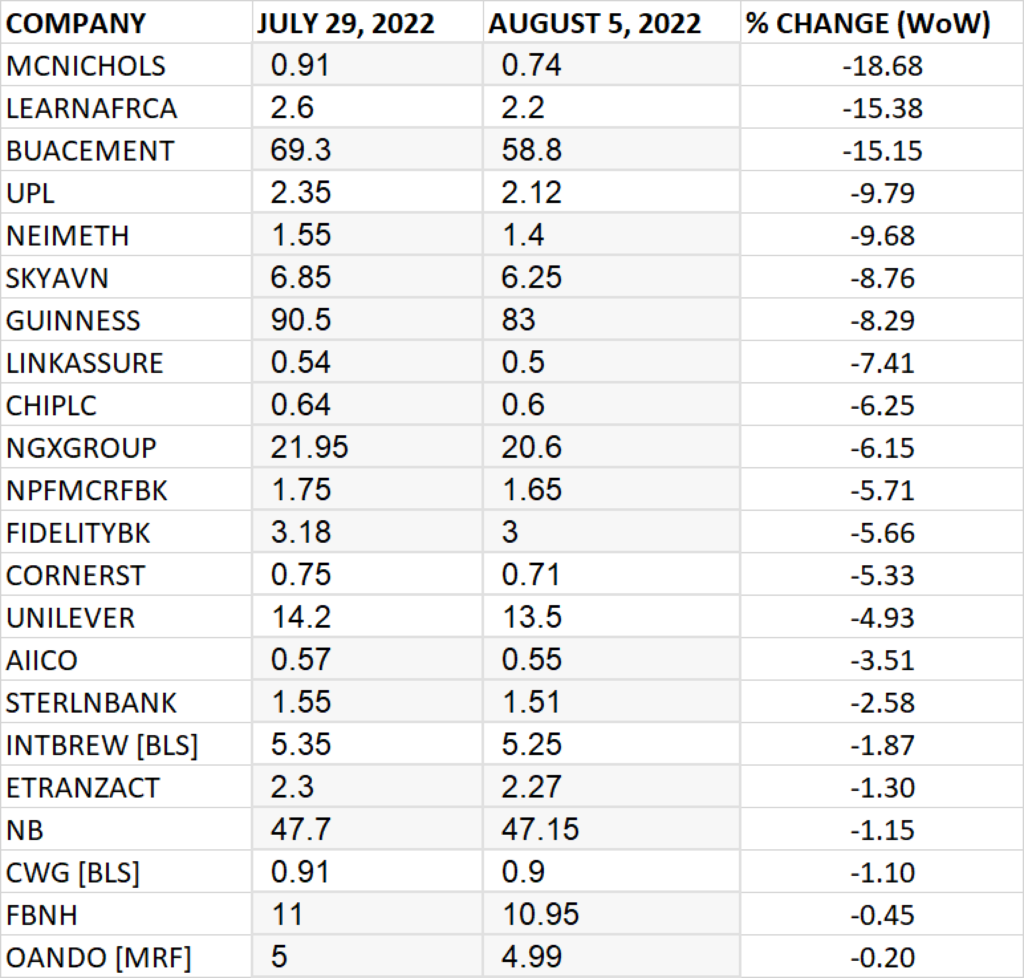

TOP 10 LOSERS

MCNICHOLS led other price decliners, shedding 18.68% of its share price to close at N0.74 from the previous close of N0.91.

Learn Africa, BUACEMENT, University Press and NEIMETH shed 15.38%, 15.915%, 9.79% and 9.68% respectively.

Other price decliners include: Skyway Aviation (-8.76%), GUINNESS (-8.29%), Linkage Assurance (-7.41%), Consolidated Hall mark Insurance (-6.25%) and NGXGROUP (-6.15%) respectively.

GAINERS

LOSERS

Source: Nigerian Bourse rebounds amidst renewed optimism, returns 0.70% WtD – StocksWatch (stocksng.com)