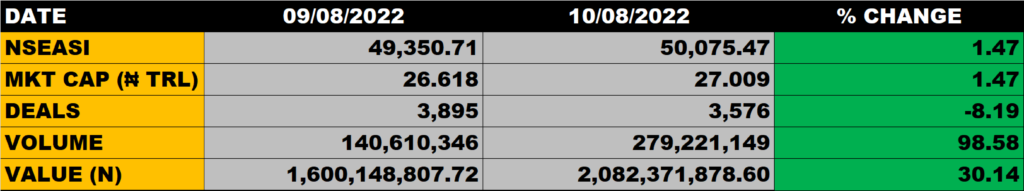

The Nigerian equity market on Wednesday bounced back from two previous bearish sessions driven mainly by 9.96% price appreciation in Dangote Cement as the All Share Index rose by 1.47% to settle at 50,075.49 points from the previous close of 49,350.71 points.

The Market Capitalisation grew by 1.47% to close at N27.009 trillion from the previous close of N26.618 trillion, thereby gaining N391 billion.

An aggregate of 279 million units of shares were traded in 3,576 deals, valued at N2.082 billion.

The Market Breadth closed positive as 20 equities appreciated in their share prices against 10 that declined in their share prices.

Percentage Gainers

Dangote Cement led other gainers with 9.96% growth to close at N265.00 from the previous close of N241.00

Nem Insurance, ELLAHLAKES, JAPAULGOLD, May & Baker and Consolidated Hallmark among other gainers also grew their share prices above 8.00%.

Percentage Losers

WAPCO led other price decliners as it shed 8.84% of its share price to close at N23.20 from the previous close of N25.45.

NAHCO, Honeywell Flour and UACN among other price decliners also shed their share prices by 8.62%, 6.41% and 5.36% respectively.

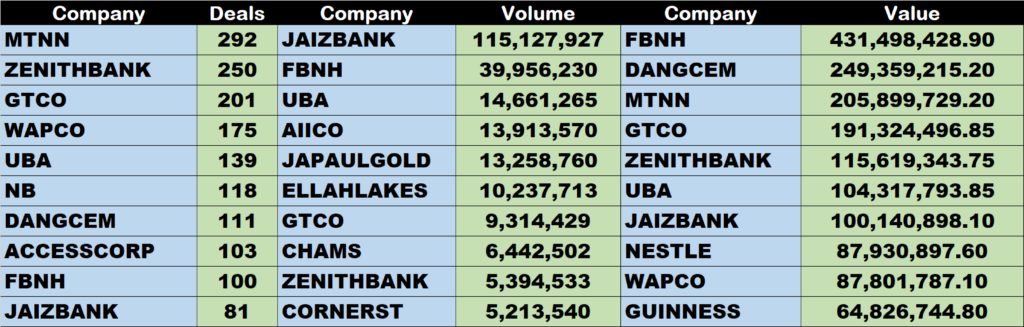

Volume Drivers

Jaiz Bank traded about 115 million units of its shares in 81 deals, valued at about N100 million.

FBNH traded about 40 million units of its shares in just 100 deals, valued at N431 million.

UBA traded about 14.7 million units of its shares in 139 deals, valued at N104 million.

Source: Nigerian Bourse rebounds with 1.47% growth, gains N391bn – StocksWatch (stocksng.com)