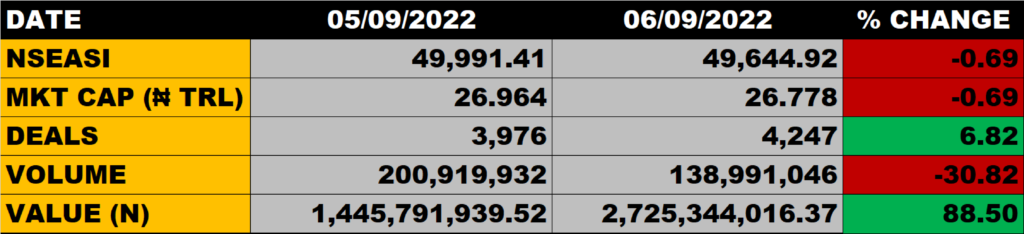

It was yet another bearish session onthe floor of the Nigerian stock market as the All Share Index declined by 0.69% to close at 49,644.92 points against the previous close of 49,991.41 points on Monday.

The market capitalisation closed at N26.778 trillion, down by 0.69% from N26.964 trillion recorded in the last session, thereby shedding N186 billion.

Aggregate volume at end of Tuesday’s session dropped by 30.82% to 138.99 million units while the value of traded stocks stood at N2.725 billion in 4,247 deals.

Market Breadth

The market breadth closed negative as 11 stocks gained against 18 that declined in their share prices.

Percentage Gainers

UNILEVER with 9.43% growth led the gainers to close at N13.35 from the previous close of N12.20.

CAP PLC and CHAMS among other gainers also grew their share prices by 7.58% and 7.14% respectively.

Percentage Losers

NPF Microfinance Bank, Regency Alliance and Livestock Feeds above others 15 stocks shed their share prices by 7.83%, 7.69% and 5.60% respectively.

Volume Drivers

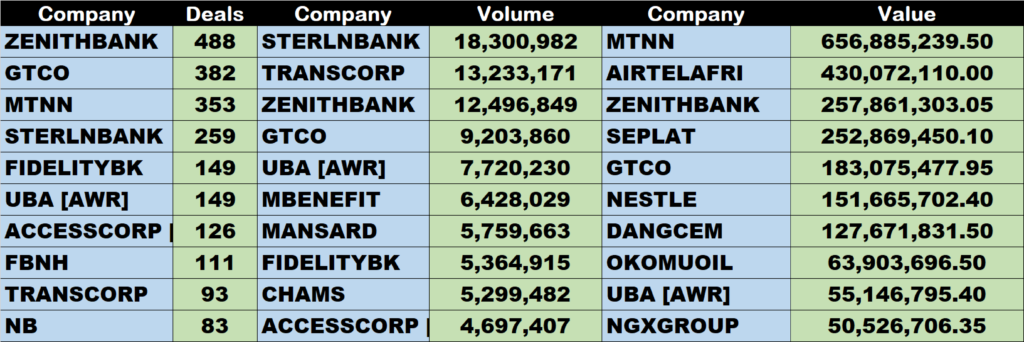

Sterling Bank traded about 18 million units of its shares in 259 deals, valued at about N27.4 million.

Transcorp traded about 13 million units of its shares in 93 deals, valued at about N14 million.

Zenith Bank traded about 12 million units of its shares in 488 deals, valued at N257.9 million.

Source: Nigerian Bourse sheds N186bn as ASI declines further by 0.69% – StocksWatch (stocksng.com)