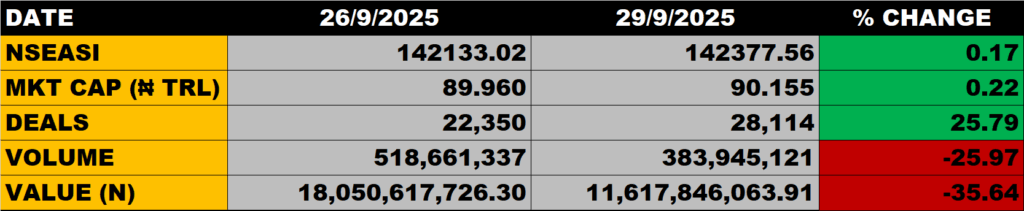

The Nigerian stocks market on Monday closed higher as the All-Share Index appreciated by 0.17% to settle at 142,377.56 points from the previous close of 142,133.02 points.

The Market Capitalisation was up by 0.22% to close at N90.155 trillion from the previous close of N89.960 trillion, thereby gaining N195 billion.

An aggregate of 384 million units of shares were traded in 28,144 deals, valued at N11.6 billion.

The Market Breadth closed negative as 25 equities appreciated in their share prices against 36 equities that declined in their share prices.

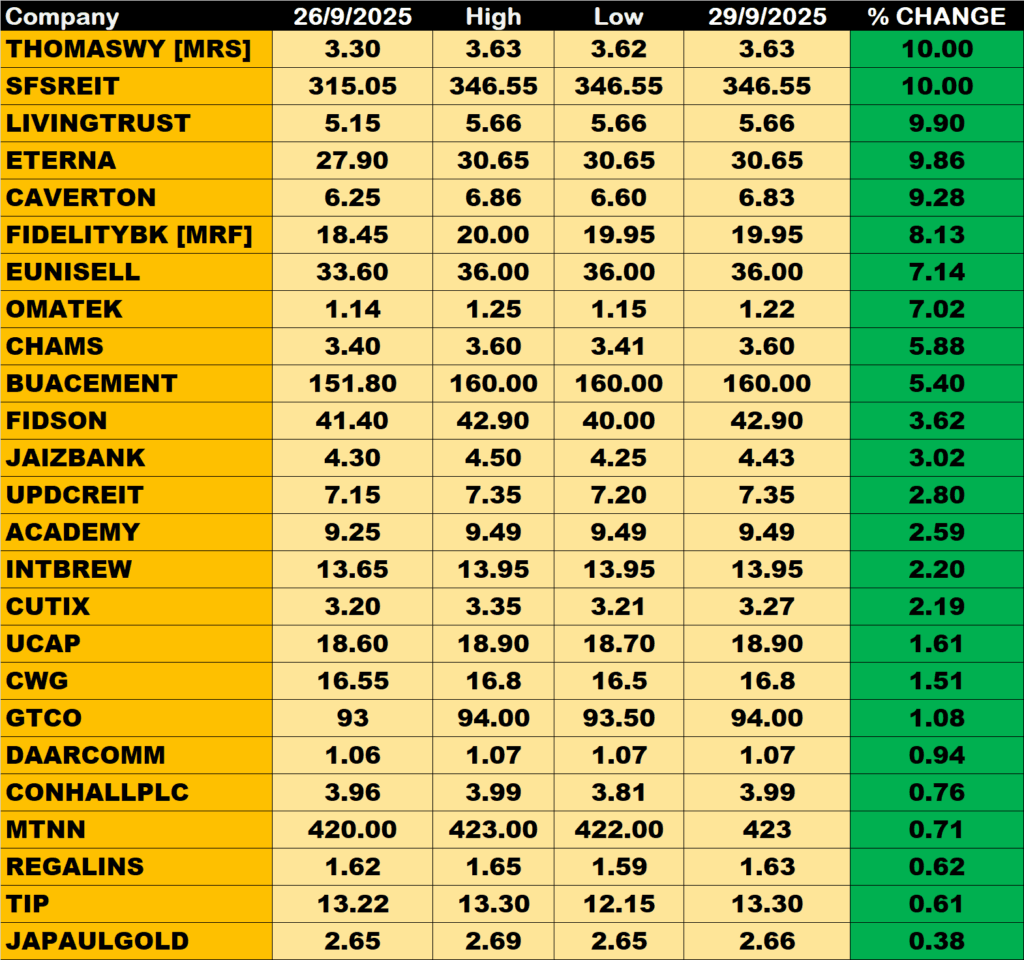

Percentage Gainers

THOMASWYAT and SFSREIT led other gainers with 10.00% growth each to close at N3.63 and N346.55 from the previous close of N3.30 and N315.05 respectively.

Living Trust Insurance, ETERNA OIL and CAVERTON among other gainers also grew their share prices by 9.90%, 9.86% and 9.28% respectively.

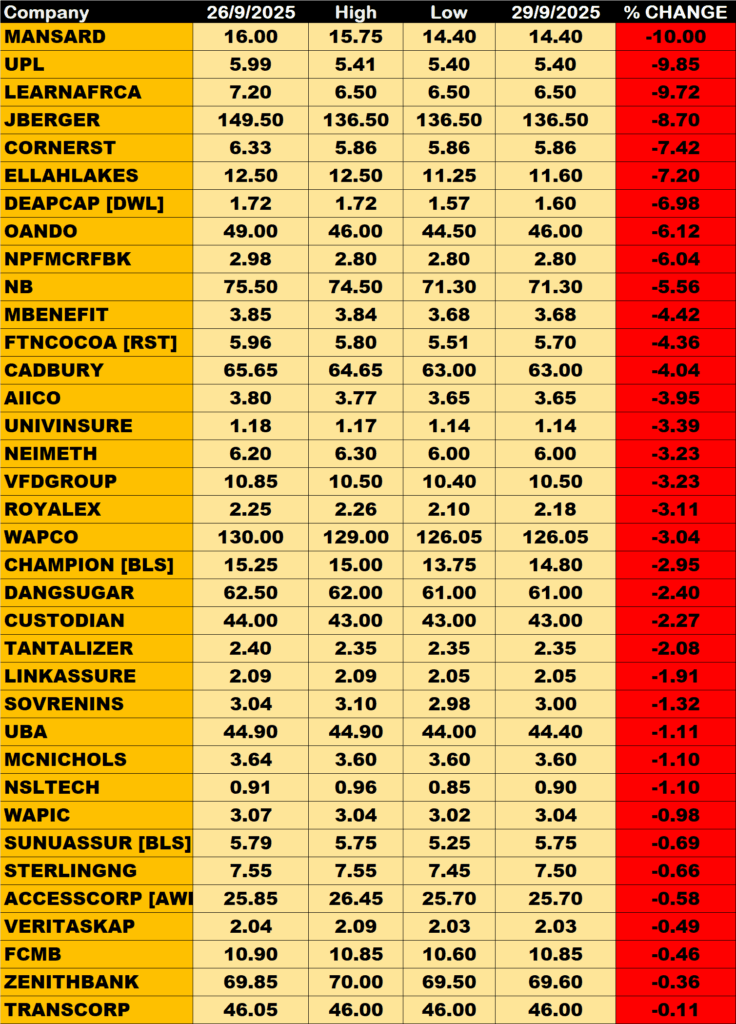

Percentage Losers

MANSARD led price decliners’ table as it shed 10.00% of its share price to close at N14.40 from the previous close of N16.00.

UPL, LEARNAFRICA and Julius Berger among other price decliners also shed their share prices by 9.85%, 9.72% and 8.70% respectively.

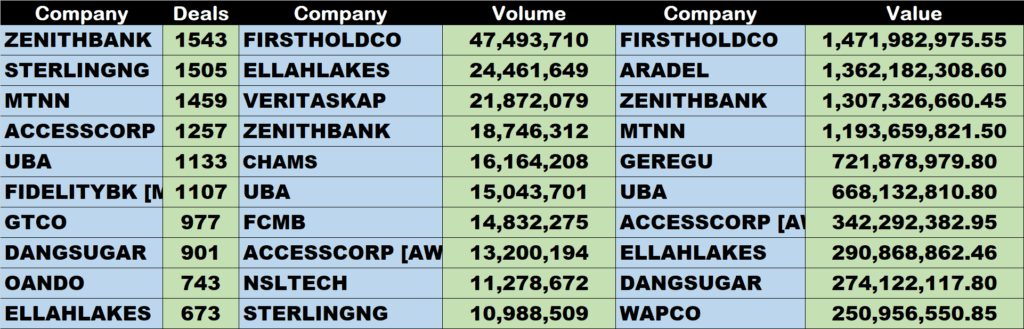

Volume Drivers

First Holding co traded about 47 million units of its shares in 426 deals, valued at about N1.47 billion.

ELLAHLAKES traded about 24 million units of its shares in 673 deals, valued at N291 million.

VERITAS KAPITAL traded about 22 million units of its shares in 122 deals, valued at N44.7 million.