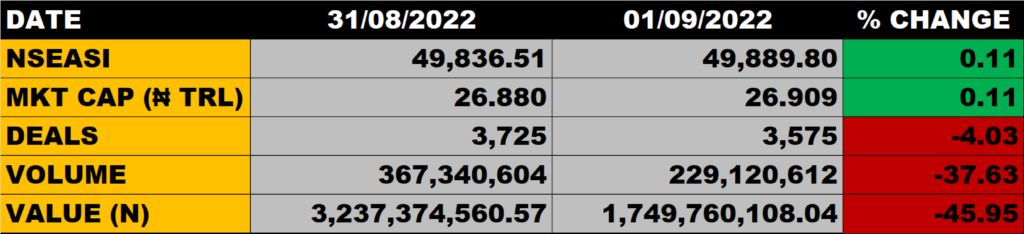

Transactions on the floor of the Nigerian Stock Market on Thursday closed on a positive note as the All Share Index advanced by 0.11% to close at 49,889.80 points from the previous close of 49,836.51 points on Wednesday.

Investors gained N29 billion as the Market Capitalisation grew by 0.11% to close at N26.909 trillion from the previous close of N26.880 trillion.

An aggregate of 229 million units of shares were traded in 3,575 deals, valued at N1.75 billion.

Market Breadth

The market breadth closed positive as 14 equities appreciated in their share prices against 12 equities that declined in their share prices.

Percentage Gainers

PHARMADEKO led other gainers with 7.43% growth, closing at N1.88 from the previous close of N1.75.

Consolidated Hall Mark Insurance and UPDC also grew their share prices by 5.00% each ahead of other gainers

Percentage Losers

Mutual Benefits led other price decliners as it shed 9.39% of its share price to close at N0.29 from the previous close of N0.32.

CWG and TRANSCORP among other price decliners also shed their share prices by 9.09% and 7.08% respectively.

Volume Drivers

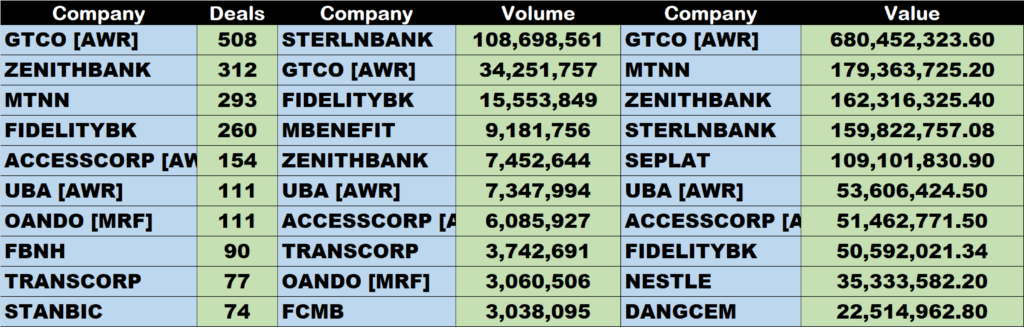

Sterling Bank traded 108.7 million units of its shares in 33 deals, valued at about N159.8 million.

Fidelity Bank traded 15.6 million units of its shares in 260 deals, valued at N50.6 million.

GTCO traded about 34 million units of its shares in 508 deals, valued at 680 million.

Source: Stock market advances by 0.11%, as investors gain N29bn – StocksWatch (stocksng.com)