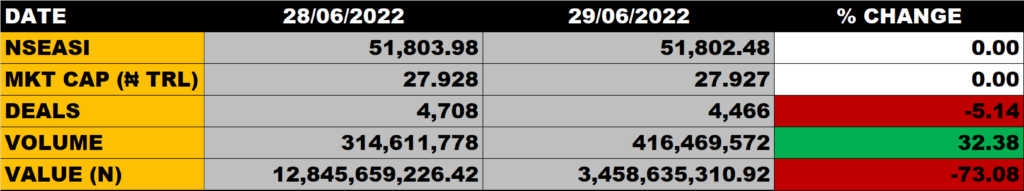

The Nigerian stock market on Wednesday closed on a flat note as the All Share Index closed at 51,802.48 points from the previous close of 51,803.98 points. There is no significant difference between the close of trades on Tuesday and Wednesday.

The Market Capitalisation also closed flat at N27.927 trillion from the previous close of N27.928 trillion on Tuesday.

An aggregate of 416.5 million units of shares were traded in 4,466 deals, valued at N3.46 billion.

The Market Breadth closed positive as 17 equities emerged as gainers against 14 equities that declined in their share prices.

Percentage Gainers

Ikeja Hotel led other gainers with 10% growth to close at N1.21 from the previous close of N1.10.

Royal Exchange and NPF Microfinance Bank among other gainers also grew their share prices by 7.29% and 7.27% respectively.

Percentage Losers

University Press led other price decliners as it shed 9.62% of its share price to close at N2.35 from the previous close of N2.60.

Chams and Linkage Assurance among other price decliners also shed their share prices by 8% and 6.90% respectively.

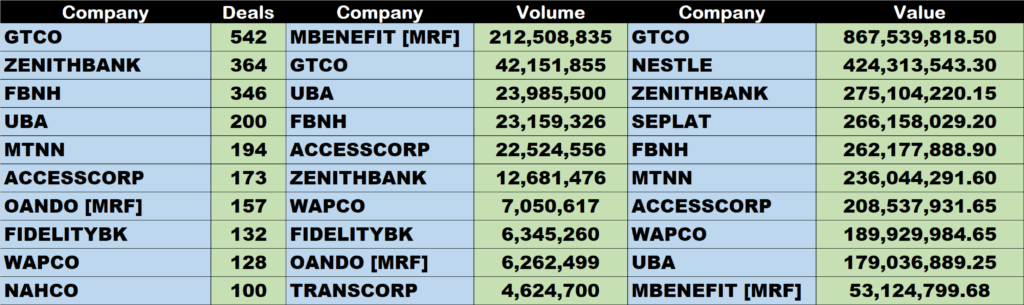

Volume Drivers

Mutual Benefit Assurance traded 212.5 million units of its shares in 17 deal, valued at N53.12 million.

GTCO traded about 42.15 million units of its shares in 542 deals, valued at N867.54 million.

UBA traded about 23.99 million units of its shares in 200 deals, valued at N179 million.

Source: Stock market closes flat amidst renewed investors’ optimism – StocksWatch (stocksng.com)