Tuesday’s trading activities on the floor of the Nigerian stock market closed bearish on profit taking.

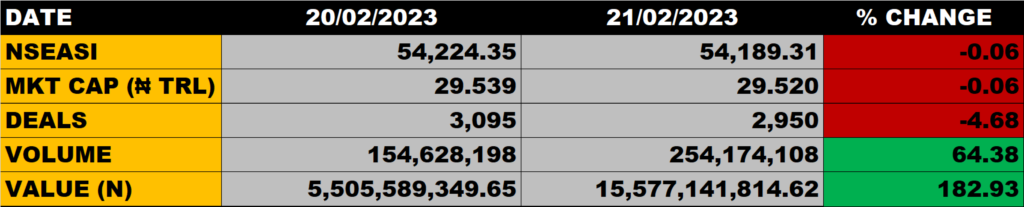

The All Share Index declined by 0.06% to close at 54,189.31 points from the previous close of 54,224.35 points.

The Market Capitalisation declined by 0.06% to close at N29.520 trillion from the previous close of N29.539 trillion, thereby shedding N 19 billion.

An aggregate of 254 million units of shares were traded in 2,950 deals, valued at about 15.58 billion.

The Market Breadth closed negative as 10 equities emerged as gainers against 14 equities that declined in their share prices.

Percentage Gainers

MRS led other gainers with 10.00% growth to close at N25.30 from the previous close of 23.00.

TRIPPLEG, Living Trust Insurance and AIICO among other gainers also grew their share prices by 9.63%, 5.16% and 1.69% respectively.

Percentage Losers

VERITAS KAPITAL, Linkage Assurance, International Breweries and TRANSCORP among other price decliners shed their share prices by over 4.00%.

Volume Drivers

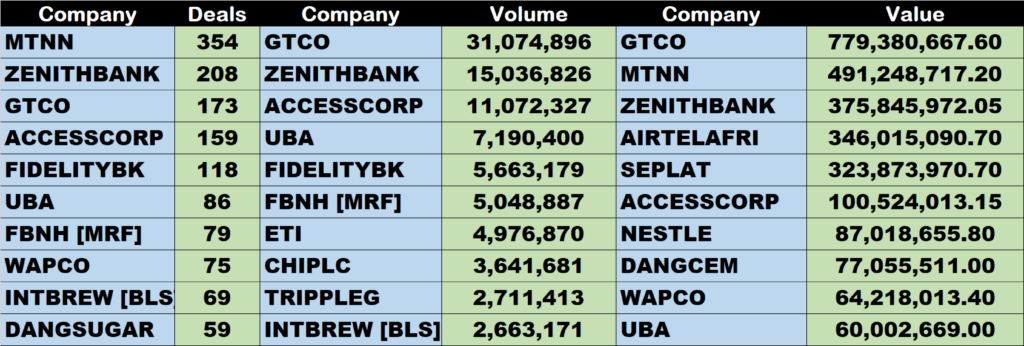

GTCO traded about 31 million units of its shares in 173 deals, valued at N779 million.

Zenith Bank traded about 15 million units of its shares in 208 deals, valued at N375.8 million.

ACCESSCORP traded about 11 million units of its shares in 159 deals, valued at N100.5 million.

Source: Stock market declines by 0.06% on profit taking – StocksWatch (stocksng.com)