Tuesday’s trading activities on the floor of the Nigerian stock market closed bearish on profit taking in MTN Nigeria and other 15 stocks

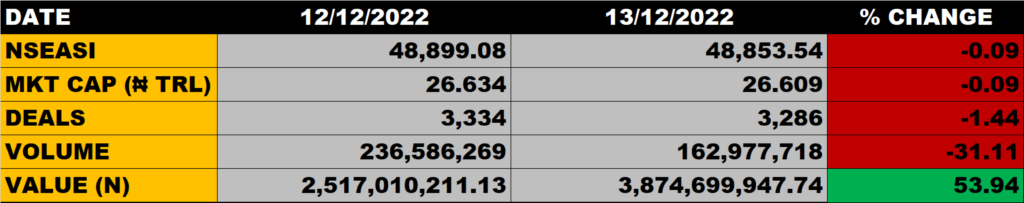

The All Share Index declined by 0.09% to close at 48,853.54 points from the previous close of 48,899.08 points.

The Market Capitalisation declined by 0.09% to close at N26.609 trillion from the previous close of N26.634 trillion, thereby shedding N 25 billion.

An aggregate of 162.98 million units of shares were traded in 3,286 deals, valued at about N3.87 billion.

The Market Breadth closed negative as 13 equities emerged as gainers against 16 equities that declined in their share prices.

Percentage Gainers

Smart Products Nigeria Plc led other gainers with 10.00% growth to close at N0.22 from the previous close of 0.20.

Cornerstone Insurance, BUA Cement and FTN Cocoa among other gainers also grew their share prices by 8.70%, 3.60% and 3.23% respectively.

Percentage Losers

SCOA led other price decliners as it shed 9.30% of its share price to close at N0.78 from the previous close of N0.86.

CHAMS and Jaiz Bank among other price decliners also shed their share prices by 8.70% and 8.42% respectively.

Volume Drivers

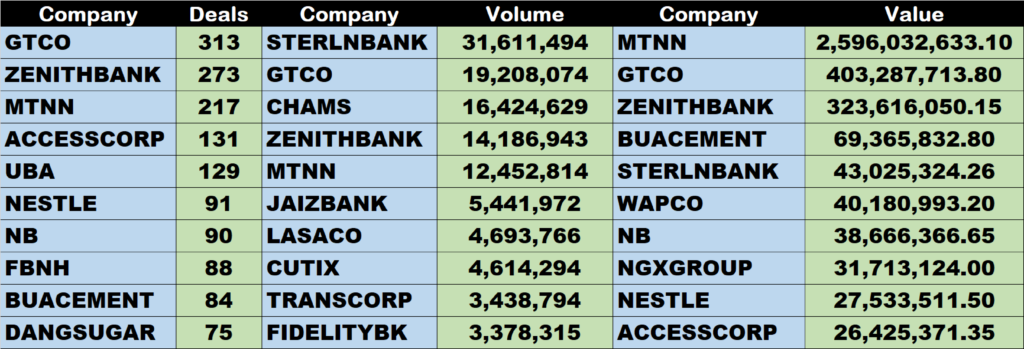

Sterlig Bank traded about 31.6 million units of its shares in 35 deals, valued at N43 billion.

GTCO traded about 19 million units of its shares in 313 deals, valued at N403 million.

Zenith Bank traded about 14 million units of its shares in 273 deals, valued at N323 million.

Source: Stock market declines by 0.09% on profit taking in MTN, others – StocksWatch (stocksng.com)