Tuesday’s trading activities on the floor of the Nigerian stock market closed bearish on profit taking in 51 stocks.

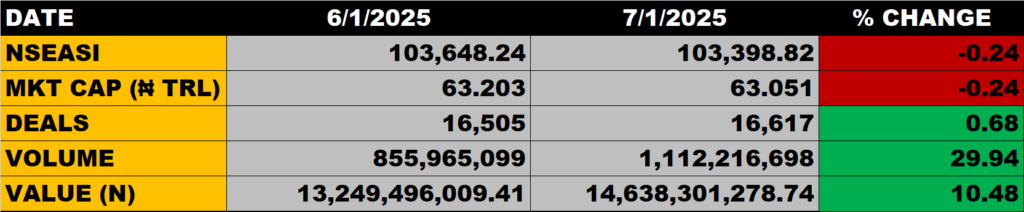

The All Share Index declined by 0.24% to close at 103,398.82 points from the previous close of 103,648.24 points.

The Market Capitalisation declined by 0.24% to close at N63.051 trillion from the previous close of N63.203 trillion, thereby shedding N 152 billion.

An aggregate of 1.112 billion units of shares were traded in 16,617 deals, valued at about N14.6 billion.

The Market Breadth closed negative as 19 equities emerged as gainers against 51 equities that declined in their share prices.

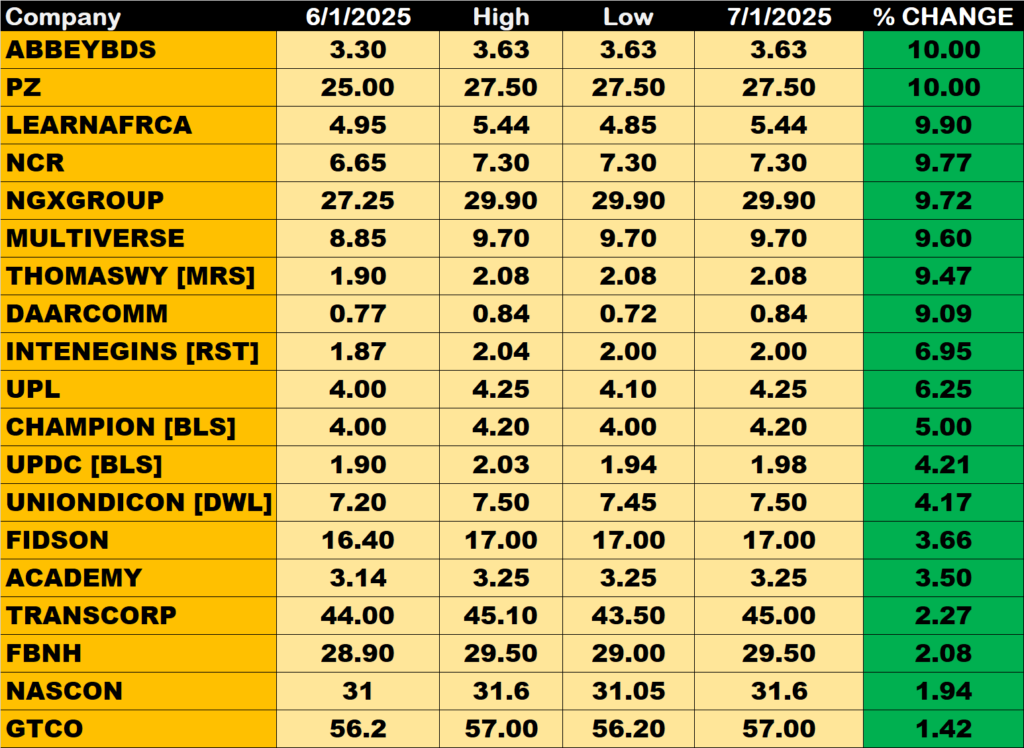

Percentage Gainers

ABBEY Building and PZ led other gainers with 10.00% growth each to close at N3.63 and N27.50 from the previous close of 3.30 and N25.00 respectively.

LEARNAFRICA, NCR and NGXGROUP among other gainers also grew their share prices by 9.90%, 9.77% and 9.72% respectively.

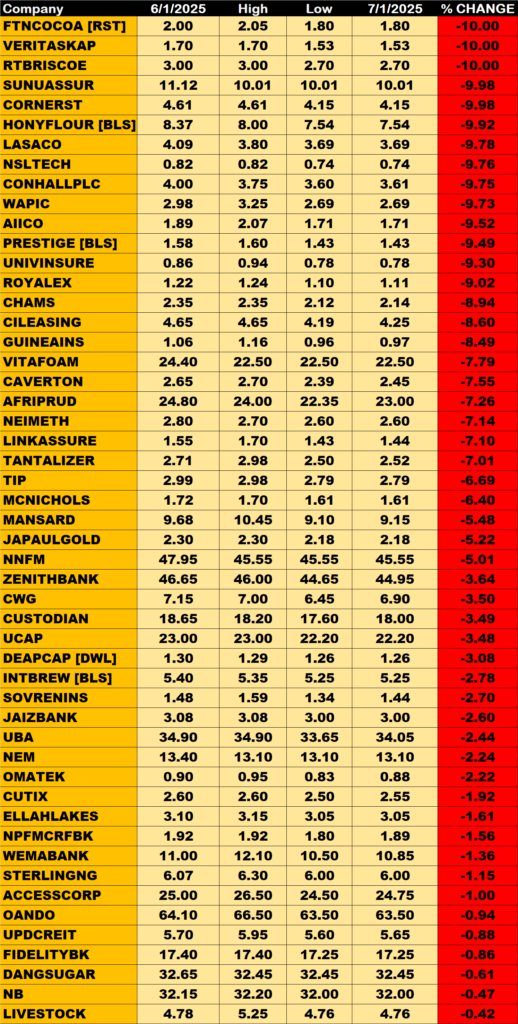

Percentage Losers

FTN COCOA, VERITAS KAPITAL and RTBRISCOE led other price decliners as they shed 10.00% each of their share prices to close at N1.80, N1.53 and N2.70 respectively.

Sunu Assurance and Cornerstone Insurance among other price decliners also shed their share prices by 9.98% and 9.98% respectively.

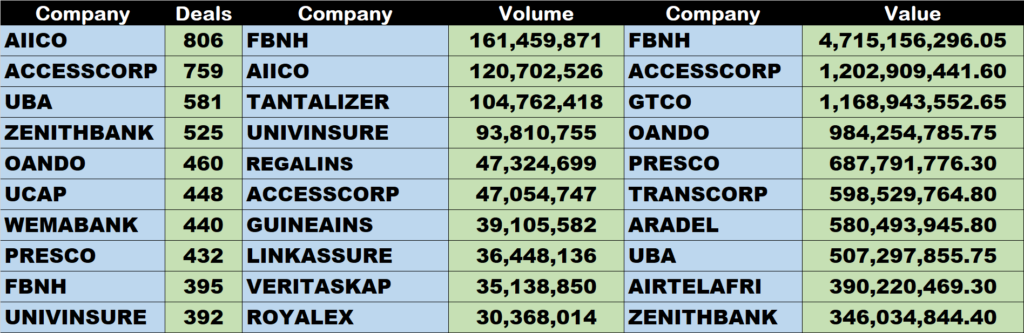

Volume Drivers

FBNH traded about 161 million units of its shares in 395 deals, valued at N4.7 billion.

AIICO Insurance traded about 806 million units of its shares in 267 deals, valued at N225 million.

TANATALIZER traded about 105 million units of its shares in 293 deals, valued at N267 million.

Source: Stock market declines by 0.24% on profit taking – StocksWatch