The stock market on Tuesday closed on a bearish note, occasioned by profit taking in Airtel Africa and 15 other stocks.

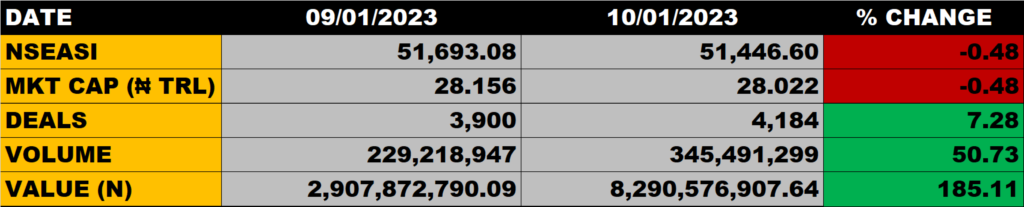

The All Share Index dipped by 0.48% to close at 51,446.60 points from the previous close of 51,693.08 points.

The Market Capitalisation closed at N28.022 trillion, down by 0.48% from the previous close of N28.156 trillion, thereby shedding N134 billion.

An aggregate of 345 million units of shares were traded in 4,184 deals, valued at N8.29 billion.

The Market Breadth closed positive as 18 equities emerged as gainers against 16 equities that declined in their share prices.

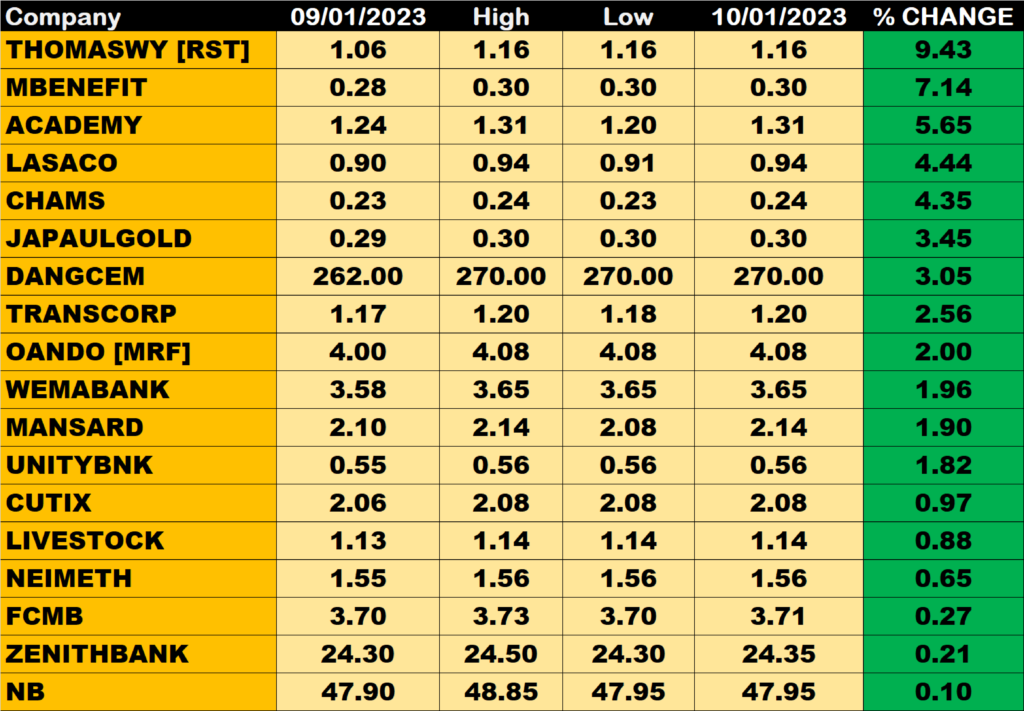

Percentage Gainers

THOMAS WYYAT led other gainers with 9.43% growth, closing at N1.16 from N1.06 it closed last session.

Mutual Benefits and Academy Press among other gainers also grew their share prices by 7.14% and 5.65% respectively.

Percentage Losers

Nem Insurance led other price decliners, shedding 10.00% of its share price to close at N4.05 from the previous close of N4.50.

CHALLARAM and Champion Breweries dropped their share prices by 9.90%, and 9.58% respectively.

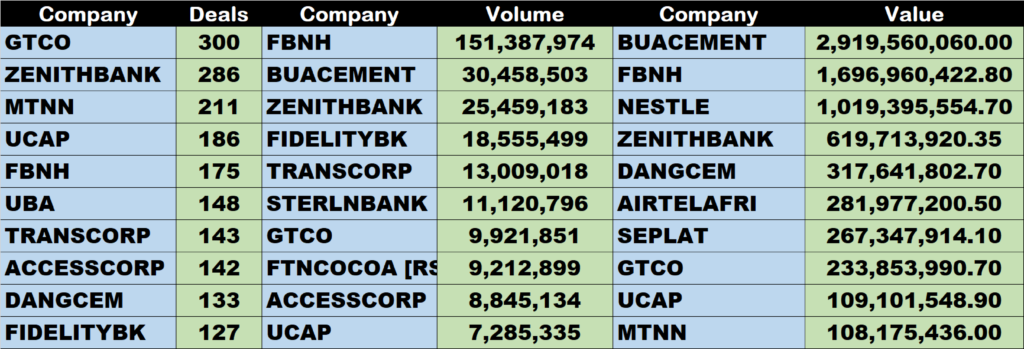

Volume Drivers

FBNH traded about 151 million units of its shares in 92 deals, valued at N2.7 billion.

BUACEMENT traded about 30 million units of its shares in 129 deals, valued at N2.9 billion.

Zenith Bank traded about 25 million units of its shares in 286 deals, valued at N619.7 million.

Source: Stock market dips by 0.48% as Airtel Africa, others shed weight – StocksWatch (stocksng.com)