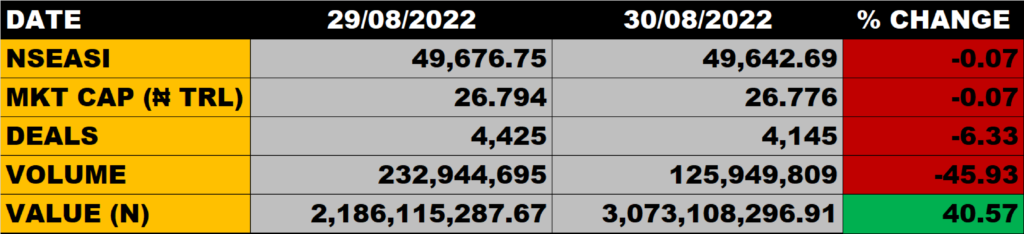

The Nigerian stock market on Tuesday extends the bearish trend as the All Share Index dropped by 0.07% to close at 49,642.69 points from the previous close of 49,676.75 points.

The Market Capitalisation declined by 0.07% to close at N26.776 trillion from the previous close of N26.794 trillion, thereby sheddingN18 billion.

An aggregate of 125.95 million units of shares were traded in 4,145 deals, valued at N3 billion.

The Market Breadth closed balanced as 13 equities emerged as gainers against 13 that declined in their share prices.

Percentage Gainers

ETRAZANCT led other gainers with 9.65% growth to close at N2.50 from the previous close of N2.28

Sovereign Trust Insurance, VITAFOAM and JAPAULGOLD among other gainers also grew their share prices by 7.69%, 7.27% and 6.45% respectively.

Percentage Losers

COURTVILLE, led other price decliners as it shed 7.69% of its share price to close at N0.48 from the previous close of N0.52.

FCMB and UPDC among other price decliners also shed their share prices by 4.06% and 3.77% respectively.

Volume Drivers

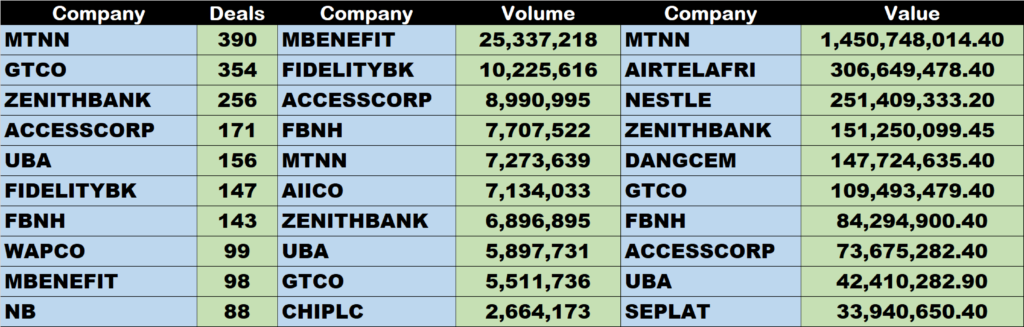

Mutual Benefits traded about 25 million units of its shares in just 98 deals, valued at N8.24 million.

Fidelity Bank traded about 10 million units of its shares in 147 deals, valued at N31 million.

Source: Stock market extends bearish trend, down by 0.07% – StocksWatch (stocksng.com)