It was yet another bullish session on the floor of the Nigerian stock market on Thursday as bullish trend extended to second straight session.

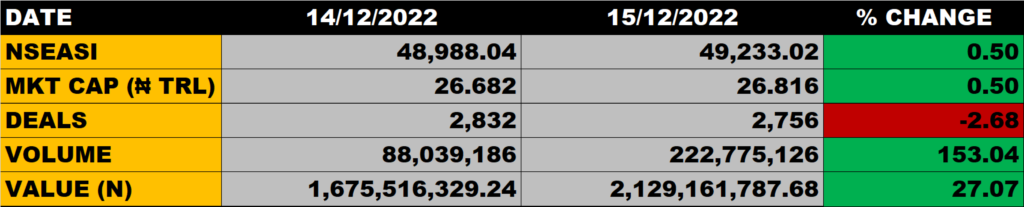

The All Share Index grew by 0.50% to close at 49,233.02 points from the previous close of 48,988.04 points.

The Market Capitalisation was up by 0.50% to close at N26.816 trillion from the previous close of N26.682 trillion, thereby adding N134 billion.

An aggregate of 222.8 million units of shares were traded in 2,758 deals, valued at N2 billion.

The Market Breadth closed positive as 20 equities emerged as gainers against 8 equities that declined in their share prices.

Percentage Gainers

CAP Plc led other gainers with 9.88% growth to close at N17.80 from the previous close of 16.20.

ARDOVA, Cornerstone and THOMAS WYATT among other gainers also grew their share prices by 9.51%, 8.33% and 8.33% respectively.

Percentage Losers

MC NICHOLS led other price decliners as it shed 10.00% of its share price to close at N0.54 from the previous close of N0.60.

GEREGU and GTCO among other price decliners also shed their share prices by 8.11% and 4.35% respectively.

Volume Drivers

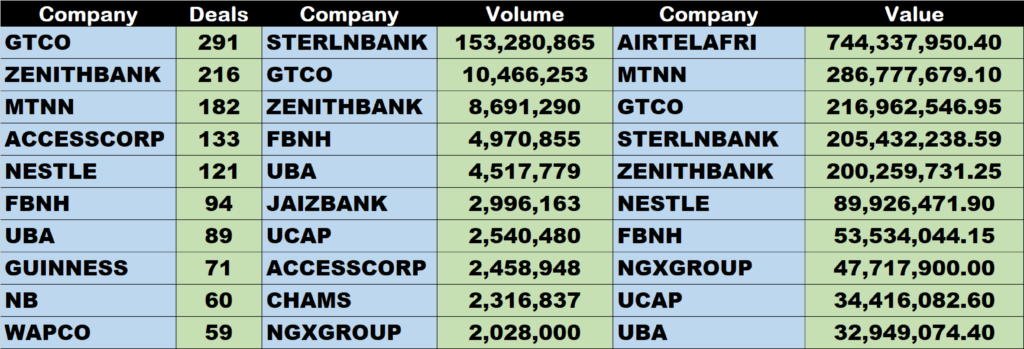

Sterling Bank traded about 153.3 million units of its shares in 33 deals, valued at N205 million.

GTCO traded about 10 million units of its shares in 291 deals, valued at N216.9 million.

Zenith Bank traded about 8.7 million units of its shares in 216 deals, valued at N200 million.

Source: Stock market extends bullish trend by 0.50% – StocksWatch (stocksng.com)