Nigerian stock market on Wednesday declined as 12 stocks shed weight amidst profit taking.

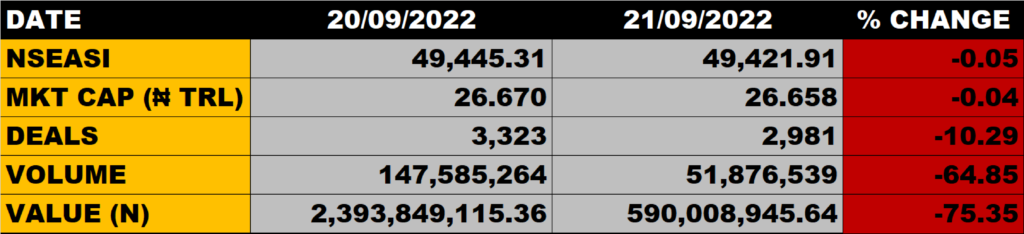

The All Share Index dropped by 0.05% to close at 49,421.91 points from the previous close of 49,445.31 points.

The Market Capitalisation declined by 0.04% to close at N26.658 trillion from the previous close of N26.670 trillion, thereby shedding N12 billion.

An aggregate of 51.9 million units of shares were traded in 2,981deals, valued at N590 million.

The Market Breadth closed negative as 10 equities emerged as gainers against 12 equities that declined in their share prices.

Percentage Gainers

Unity Bank led other gainers with 10.00% growth to close at N0.44 from the previous close of 0.40.

MULTIVERSE, Fidelity Bank and Honeywell Flour among other gainers also grew their share prices by 9.82%, 5.46% and 3.98% respectively.

Percentage Losers

Academy Press led other price decliners as it shed 9.78% of its share price to close at N1.66 from the previous close of N1.84.

Nem Insurance and CADBURY among other price decliners also shed their share prices by 6.08% and 5.45% respectively.

Volume Drivers

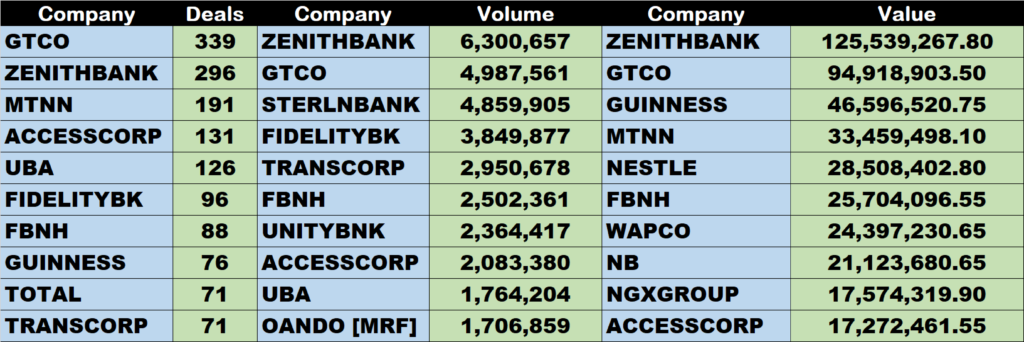

Zenith Bank traded about 6 million units of its shares in 296 deals, valued at N125.5 million.

GTCO traded about 4.99 million units of its shares in 339 deals, valued at N94.9 million.

Fidelity Bank traded about 3.8 million units of its shares in 96 deals, valued at N13.6 million.

Source: Stock market declines by 0.05% as 12 stocks shed weight – StocksWatch (stocksng.com)