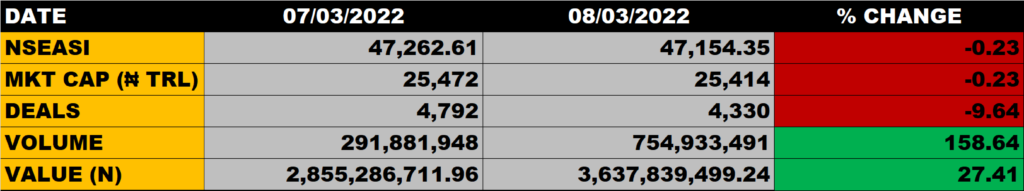

Transactions on the floor of the Nigerian Exchange on Tuesday closed lower as the All Share Index declined further by 0.23% to close at 47,154.35 points from the previous close of 47,262.61 points.

The Market Capitalisation declined by 0.23% to close at N25.414 trillion from the previous close of N25.472 trillion, thereby shedding N58 billion.

An aggregate of 754.9 million units of shares were traded in 4,330 deals, valued at N3.64 billion.

The Market Breadth closed negative as 16 equities emerged gainers against 28 equities that declined in their share prices.

Percentage Gainers

Niger Insurance led others on gainers chart with 9.52% growth, closing at N0.23 from the previous close of N0.21.

Consolidated Hallmark and CUTIX among other gainers also grew their share prices by 8.47% and 8.30% respectively.

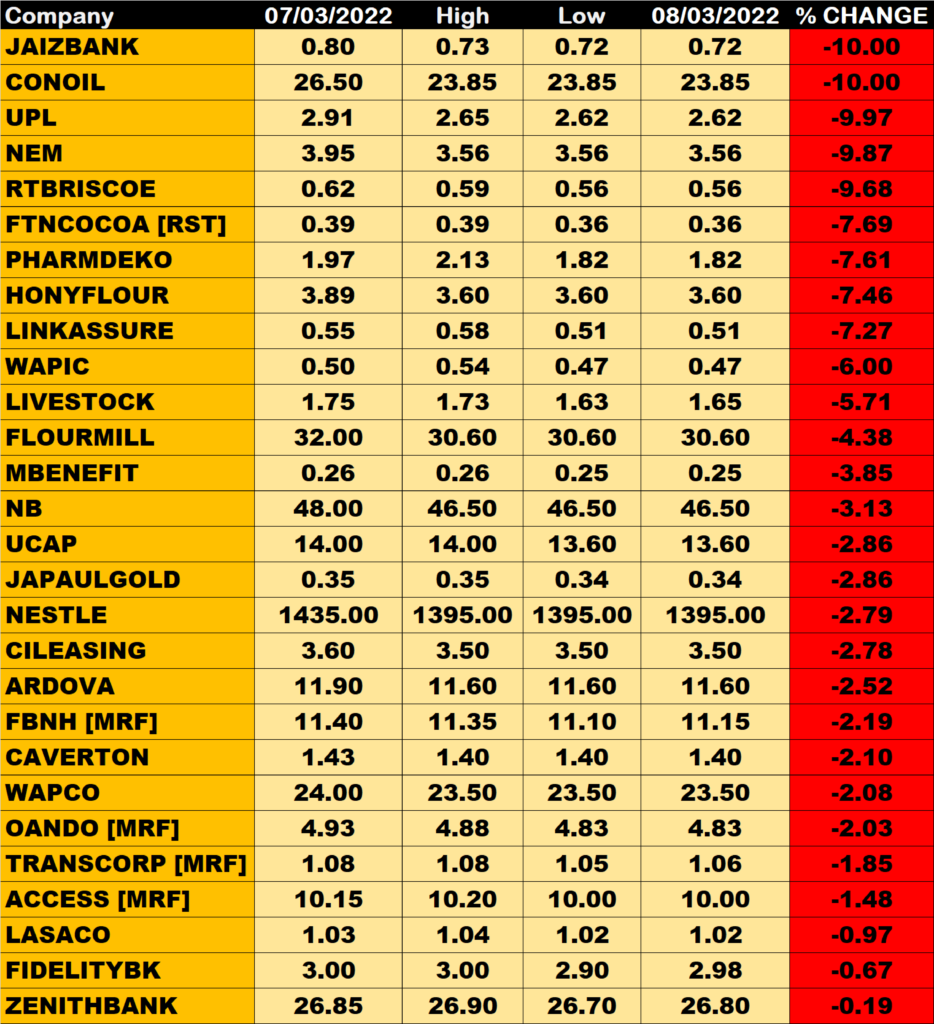

Percentage Losers

Jaiz Bank and Conoil led other price decliners as they both sheds 10.00% each of their share prices to close at N0.72 and N23.85 from the previous close of N0.80 and N26.50

University Press and Nem Insurance among other price decliners also shed their share prices by 9.97% and 9.87% respectively.

Volume Drivers

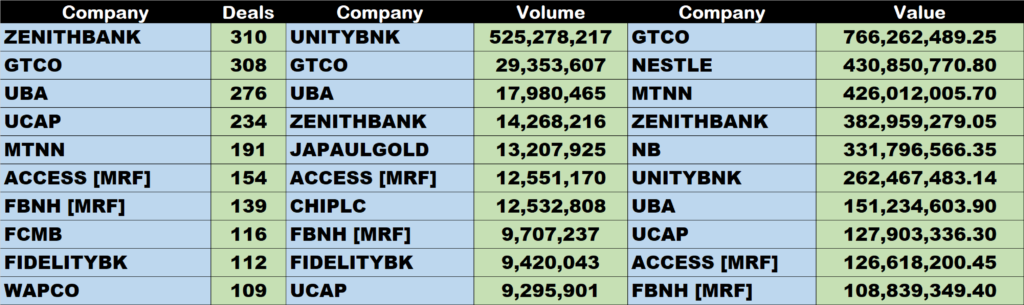

GTCO traded about 29 million units of its shares in 308 deals, valued at N766 million.

UBA traded about 18 million units of its shares in 276 deals, valued at N151 million.

Zenith Bank traded about 14 million units of its shares in 310 deals, valued at around N383 million.

Source: Market closes lower by 0.23%, sheds N58bn – StocksWatch (stocksng.com)