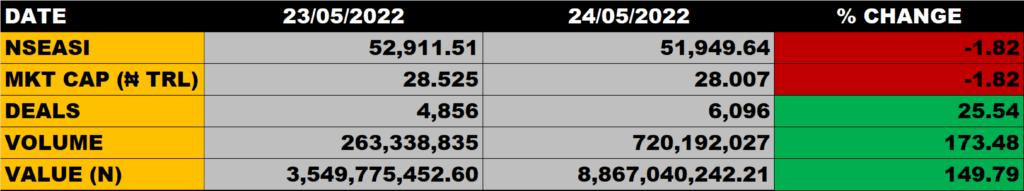

The Nigerian Stock Market on Tuesday declined further as the All Share Index dropped by 1.82% to close at 51,949.64 points from the previous close of 52.911.51 points on Monday.

Market Capitalisation was down by 1.82% to close at N28.007 trillion against Monday’s close of N28.525 trillion, shedding N518 billion.

The aggregate volume and value of traded stocks closed at 720 million units and N8.867 billion in 6,096 deals.

Market Breadth

Market Breadth closed negative as 17 stocks gained while 39 stocks lost.

Percentage Gainers

Japaul Gold led gainers’ chart with 10.00% growth to close at N0.33 from the previous close of N0.30

Industrial & Medical Gases Nigeria Plc grew by 9.89% while MRS and Abbey Building gained 9.70% and 9.09% respectively.

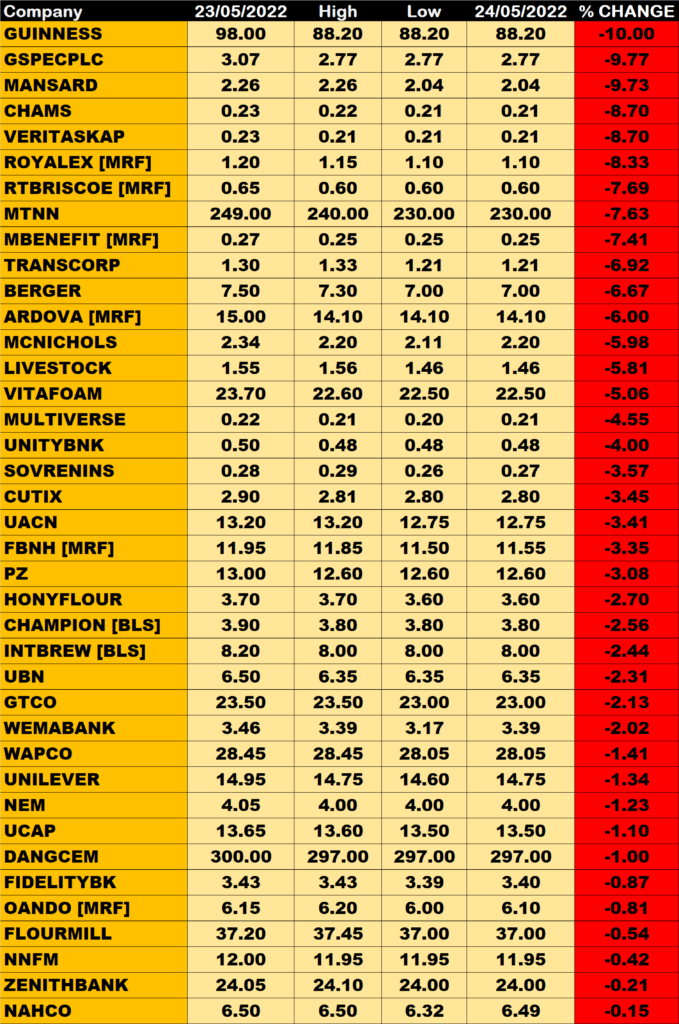

Percentage Losers

GUINNESS tops the losers’ list, shedding 10.10% of its share price to settle at 88.20 from N98.00 it closed on Monday

Still on the red chart are Global Spectrum Energy Services PLC, MANSARD and CHAMS shedding 9.77%, 9.73% and 8.70% of their share prices ahead of other stocks that declined.

Volume Driver

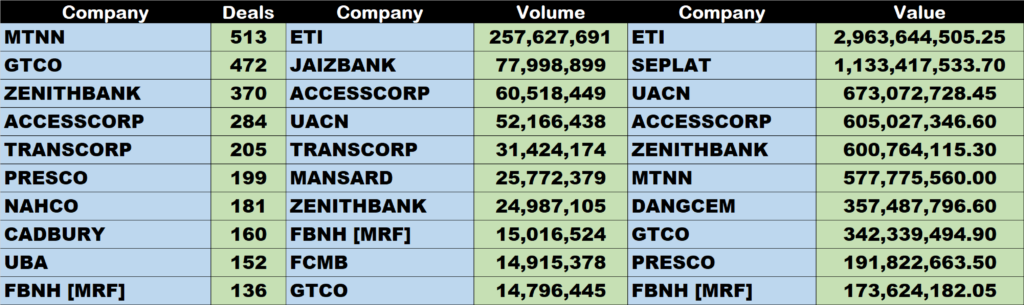

Eco Bank traded about 258 million units of its shares in 77 deals, valued at about N2.96 billion.

ACCESSCORP traded about 60.5 million units of its shares in 284 deals, valued at about N605 million.

Source: Market extends decline by 1.82%, sheds N518bn – StocksWatch (stocksng.com)