The Nigerian Exchange last week closed lower by 0.13%, occasioned by profit taking in Airtel Africa, Dangote Cement and 36 other equities.

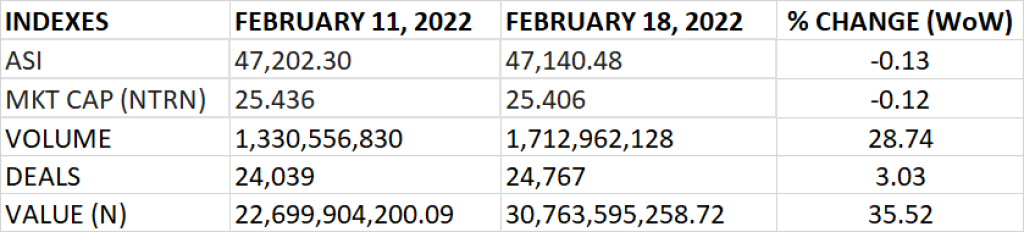

The All Share Index declined by 0.13% week on week to close at 47,140.48 points from the previous close of 47,202.30 points.

The Market Capitalisation declined by 0.12% week on week to close at N25.406 trillion from the previous close of N25.436 trillion, thereby shedding N30 billion in the course of last week.

An aggregate of 1.71 billion units of shares were traded in 24,767 deals, valued at N30.76 billion.

The Market Breadth closed positive as 43 equities emerged as gainers against 38 equities that declined in their share prices.

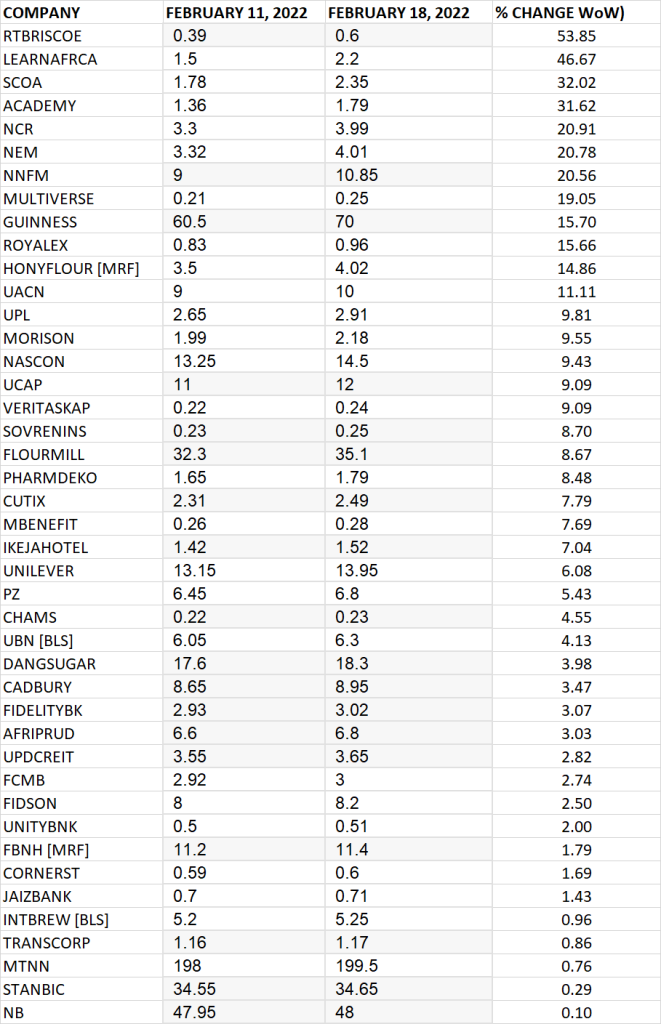

TOP 10 GAINERS

RT Briscoe led other gainers in the course of last week with 53.85% growth, closing at N0.60 from the previous close of N0.39.

Learn Africa, SCOA, Academy Press and NCR Nigeria grew their share prices by 46.67%, 32.02%, 31.62% and 20.91% respectively

Others among top 10 gainers include: NEM Insurance (20.78%), Northern Nigerian Flour Mills (20.56%), Multiverse (19.05%), Guinness (15.70%) and Royal Exchange (15.66%) respectively.

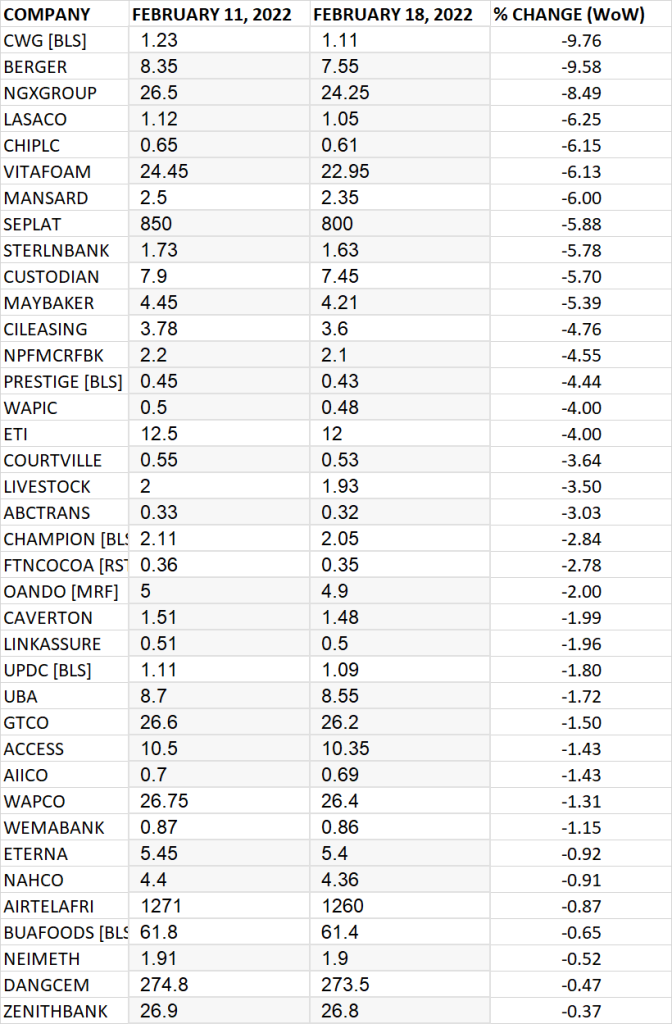

TOP 10 LOSERS

CWG led other price decliners, shedding 9.76% week on week to close at N1.11 from the previous close of N1.23

Berger Paints, NGX Group, LASACO and Consolidated Hallmark Insurance shed their share prices by 9.58%, 8.49%, 6.21% and 6.15% respectively.

Others among top ten price decliners include: Vitafoam (-6.13%), AXA Mansard (-6%), Seplat (-5.88%), Sterling Bank (-5.78%) and Custodian Investment (-5.70%) respectively.

GAINERS

LOSERS

Source: Market returns -0.13% WtD amidst sell-offs and buy interests – StocksWatch (stocksng.com)