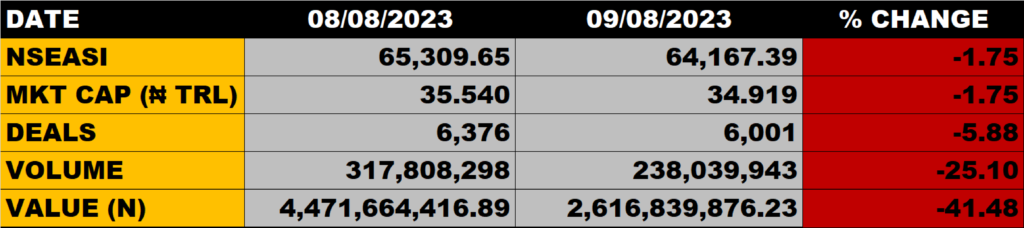

The equity market on Wednesday closed on a bearish note as the All Share Index dropped by 1.75% to settle at 64,167.39 points from the previous close of 65,309.65 points.

The Market Capitalisation declined by 1.75% to close at N34.919 trillion from the previous close of N35.540 trillion, thereby shedding N621 billion.

An aggregate of 238 million units of shares were traded in 6,001 deals, valued at N2.6 billion.

The Market Breadth closed negative as 24 equities appreciated in their share prices against 27 equities that declined in their share prices.

Percentage Gainers

Guinea Insurance and OMATEK led other gainers with 10.00% growth each to close at N0.33 each from the previous close of N0.30 each.

TANTALIZER, Abbey Building, and THE INITIATES ahead other gainers also grew their share prices by over 8.00%.

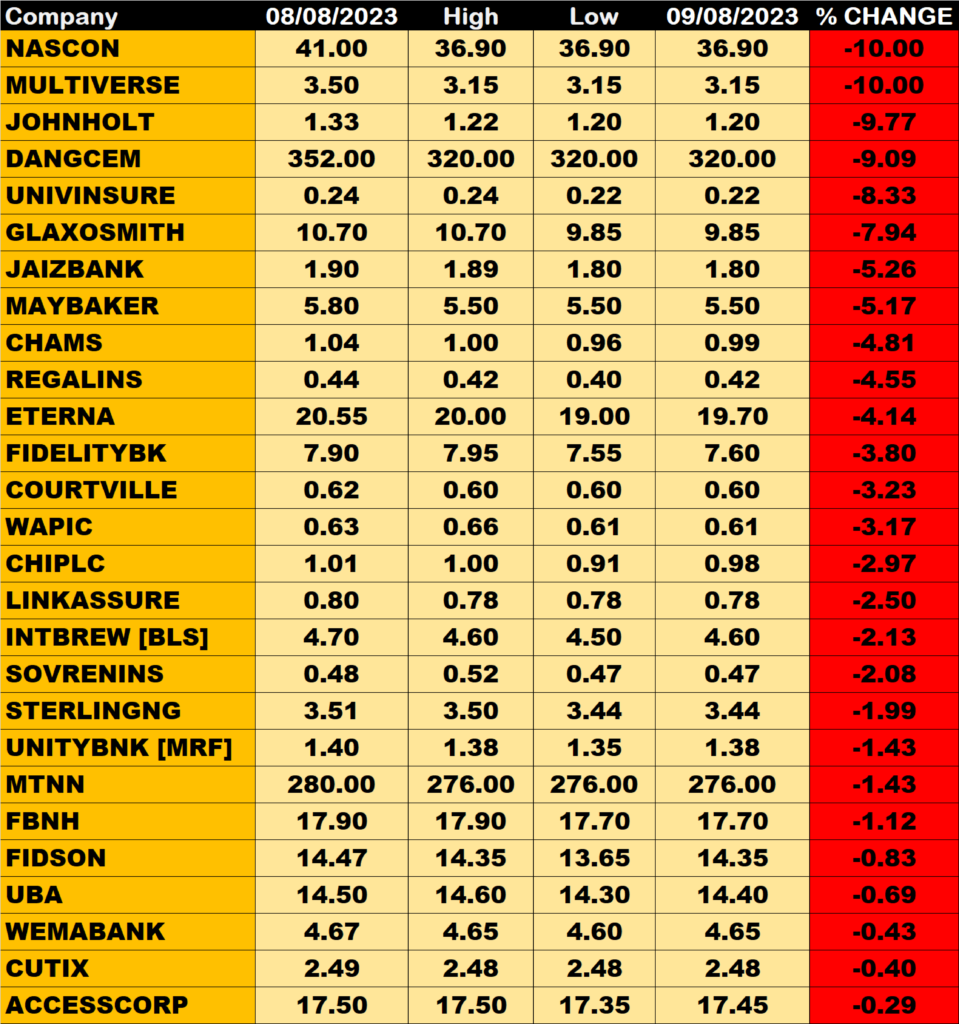

Percentage Losers

NASCON and MULTIVERSE led other price decliners as they shed 10.00% each of their share prices to close at N36.90 and N3.15 from the previous close of N41.00 and N3.50

JOHNHOLT, Dangote Cement and Universal Insurance among other price decliners also shed their share prices by 9.77%, 9.09% and 8.33% respectively.

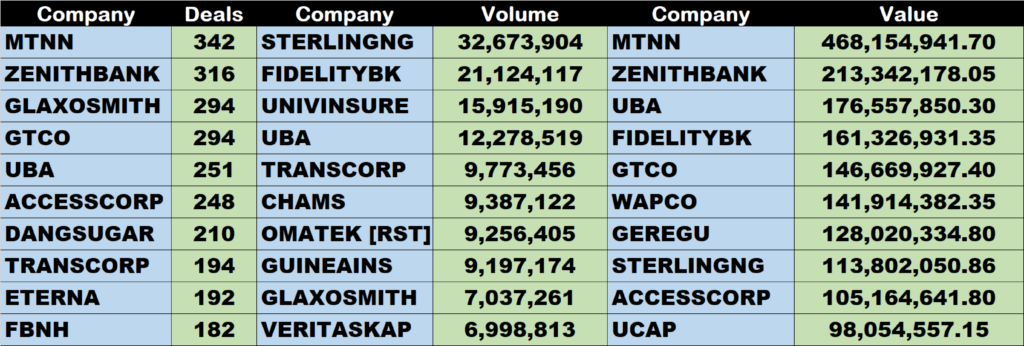

Volume Drivers

Sterling Bank traded about 32.7 million units of its shares in 91 deals, valued at about N113.8 billion.

Fidelity Bank traded about 21 million units of its shares in just 168 deals, valued at N161 million.

UBA traded about 12.3 million units of its shares in 251 deals, valued at N176.6 million.

Source: Market sheds N621bn as NGXASI drops by 1.75% – StocksWatch (stocksng.com)