Transactions on the floor of the Nigerian Exchange on Tuesday closed on a negative note, occasioned by profit taking in MTN and 18 other stocks.

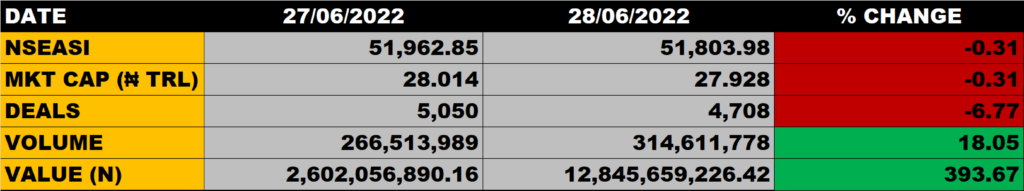

The All Share Index declined by 0.31% to close at 51,803.98 points from the previous close of 51,962.85 points.

The Market Capitalisation declined by 0.31% to close at N27.928 trillion from the previous close of N28.014 trillion, thereby shedding N86 billion.

An aggregate of 314.6 million units of shares were traded in 4,708 deals, valued at N12.846 billion.

The Market Breadth closed negaitive as 10 equities emerged as gainers against 19 equities that declined in their share prices.

Percentage Gainers

Sovereign Trust Insurance led other gainers with 8% growth to close at N0.27 from the previous close of N0.25.

Chams Plc and Regency Assurance among other gainers also grew their share prices by 4.17% and 3.85% respectively.

Percentage Losers

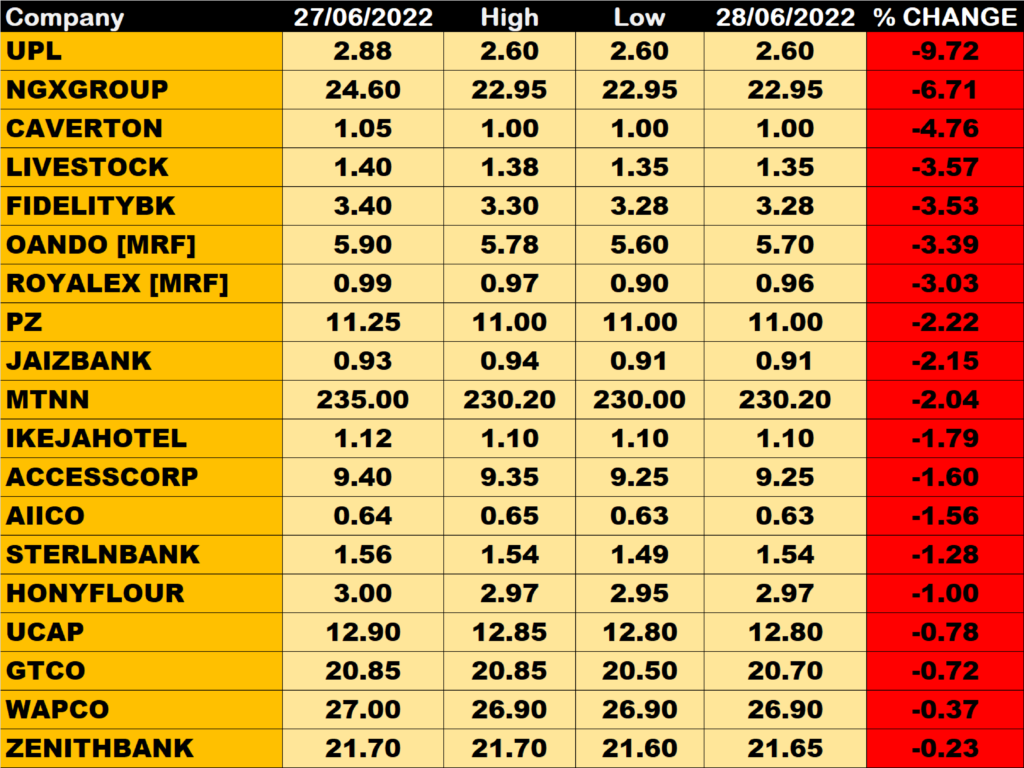

University Press led other price decliners as it shed 9.72% of its share price to close at N2.60 from the previous close of N2.88.

NGX Group Plc and Caverton among other price decliners also shed their share prices by 6.71% and 4.76% respectively.

Volume Drivers

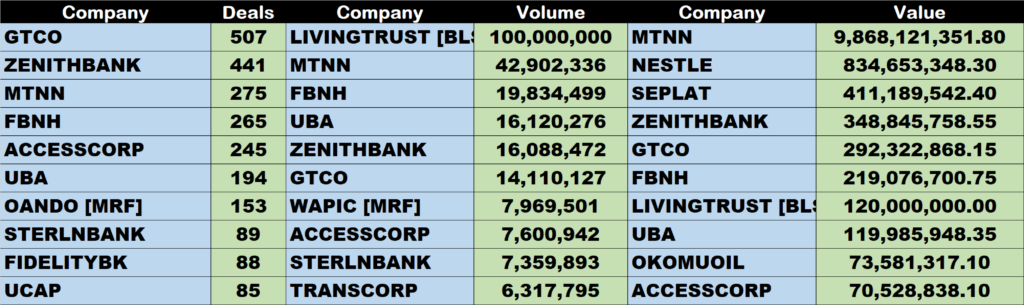

Living Trust Mortgage Bank traded 100 million units of its shares in 1 deal, valued at N120 million.

MTN traded about 42.9 million units of its shares in 275 deals, valued at N9.87 billion.

FBNH traded about 19.83 million units of its shares in 265 deals, valued at N219 million.

Source: Market sheds N86bn as NGXASI declines by 0.31% – StocksWatch (stocksng.com)