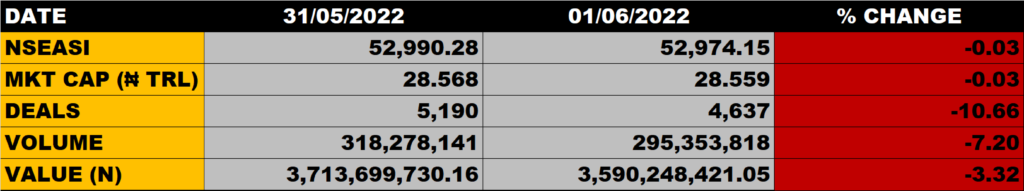

The equity market on Wednesday closed the first trading day of the month bearish as the All Share Index dipped by 0.03% to settle at 52,974.15 points from the previous close of 52,990.28 points.

The Market Capitalisation declined by 0.03% to close at N28.559 trillion from the previous close of N28.568 trillion, thereby shedding N9 billion.

An aggregate of 295 million units of shares were traded in 4,637 deals, valued at N3.59 billion.

The Market Breadth closed negative as 14 equities appreciated in their share prices against 20 equities that declined in their share prices.

Percentage Gainers

Eterna Oil led other gainers with 9.90% growth to close at N7.44 from the previous close of N6.77.

FTN Cocoa, NAHCO and Ikeja Hotel among other gainers also grew their share prices by 9.37%, 8.57% and 7.83% respectively.

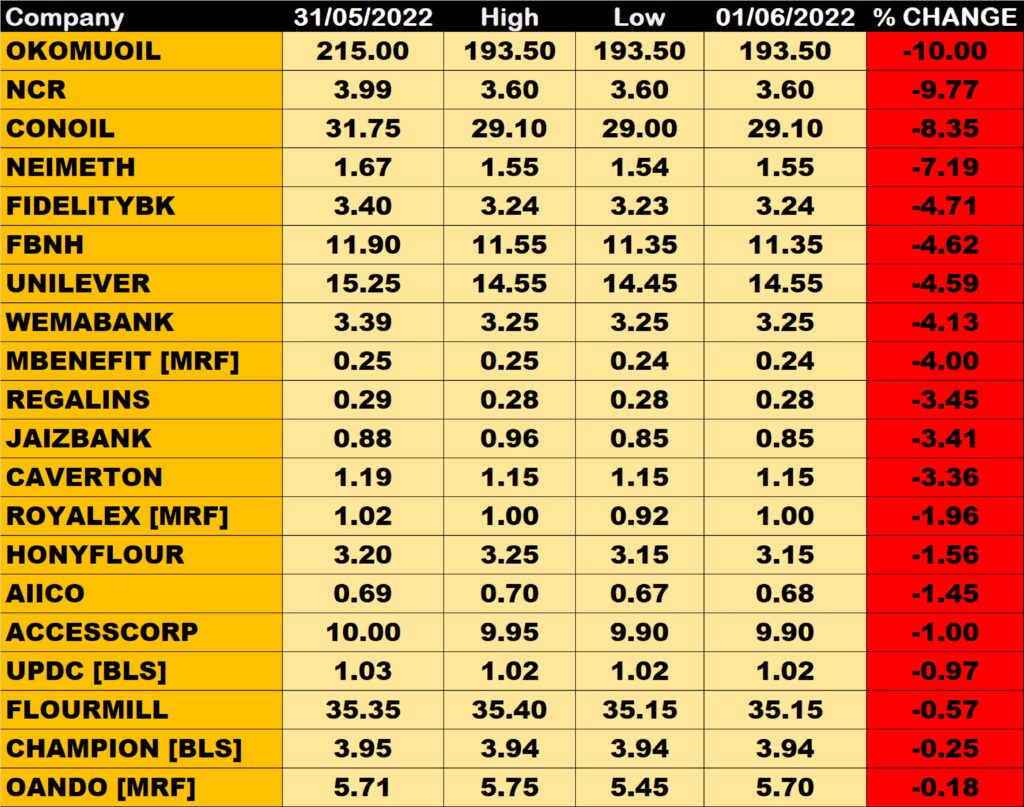

Percentage Losers

Okomu Oil led other price decliners, as it shed 10.00% of its share price to close at N193.50 from the previous close of N215.00.

NCR Nigeria Plc, Conoil and NEIMETH among other price decliners also shed their share prices by 9.77%, 8.35% and 7.19% respectively.

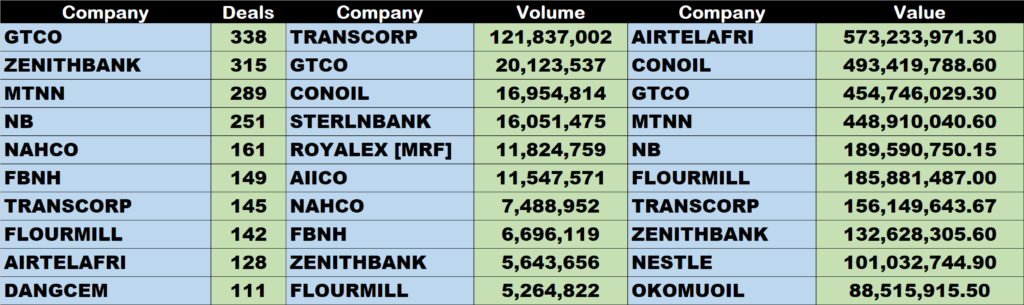

Volume Drivers

TRANSCORP traded about 122 million units of its shares in 145 deals, valued at about N119 million.

GTCO traded about 20 million units of its shares in 338 deals, valued at N454.7 million.

CONOIL traded about 17 million units of its shares in 48 deals, valued at N493 million.

Source: Market sheds N9bn as NGXASI closes marginally lower by 0.03% – StocksWatch (stocksng.com)