Trading activities on the floor of the Nigerian Stock Market closed lower with 32 stocks appreciating in their share value.

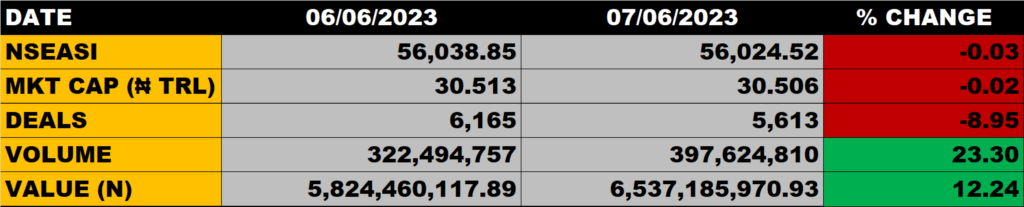

The All Share Index dropped by 0.03% to close at 56,024.52 points as against the previous close of 56,038.85 points.

Market capitalisation also nosedived by 0.02% closing at N30.506 trillion as against N30.513 trillion of the previous trading session, implying a loss of N7 billion

An aggregate of 397.6 million units of shares were traded in 5,613 deals, valued at 6.5 billion.

The Market Breadth closed positive as 32 equities emerged as gainers against 12 equities that declined in their share prices.

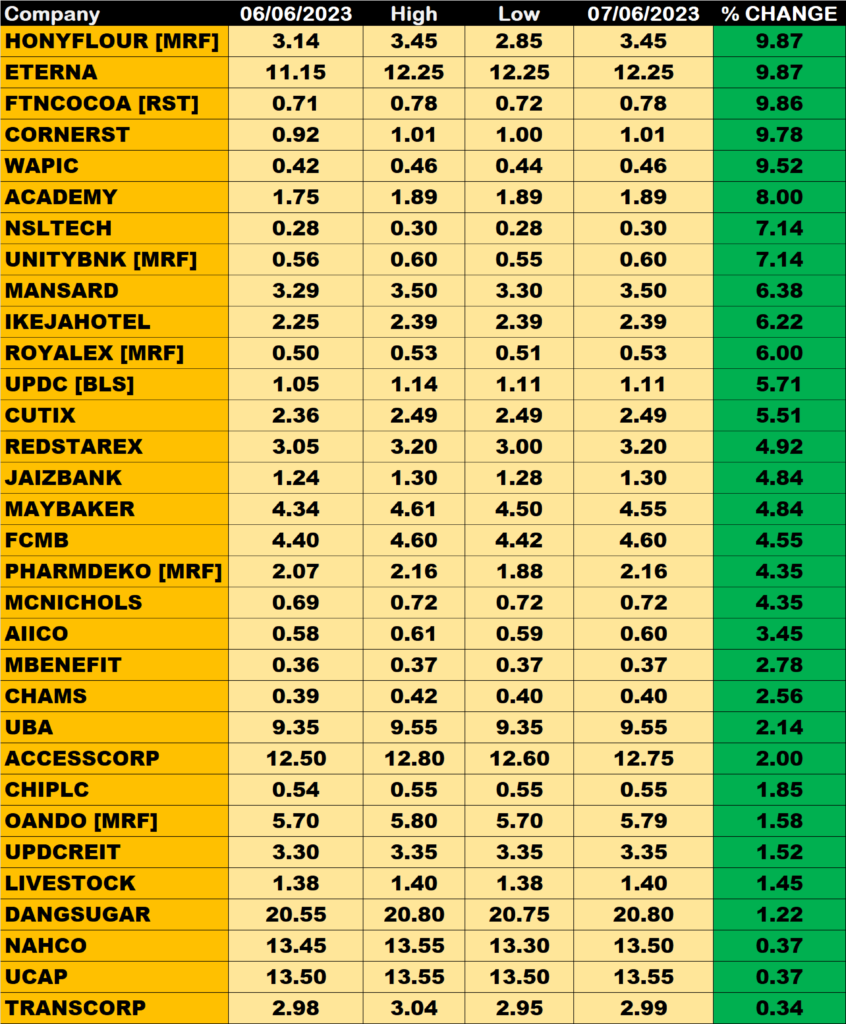

Percentage Gainers

Honeywell Flour led the gainers chart with 9.87% growth, closing at N3.45 from the previous close of N3.14.

Eterna Oil, FTN Cocoa and Cornerstone Insurance also grew their share prices by 9.87%, 9.86% and 9.78% respectively.

Percentage Losers

Union Bank of Nigeria led other price decliners as it shed 8.86% of its share price to close at N7.20 from the previous close of N7.90.

Flourmills of Nigeria and NGXGROUP among other price decliners also shed their share prices by 4.20% and 3.11% respectively.

Volume Drivers

NPF Microfinance traded about 100.8 million units of its shares in 36 deals, valued at N181.4 million.

ACCESSCORP traded about 23 million units of its shares in 347 deals, valued at N293 million.

GTCO traded about 43 million units of its shares in 315 deals, valued at N1.197 billion.

Source: NGXASI drops 0.03% with positive breadth – StocksWatch (stocksng.com)