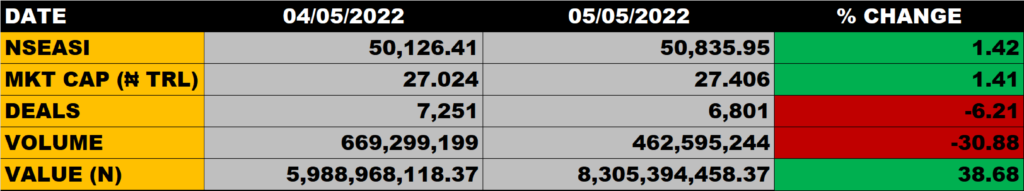

The Nigerian equity market on Thursday closed higher buoyed by gains in MTN Nigeria, Airtel Africa and 30 other stocks. The All Share Index grew by 1.42% to close at 50,835.95 points against the previous close of 50,126.41 points on Wednesday day.

The market capitalisation closed at N27.406 trillion, grew by N382 billion or 1.41% from the previous close of N27.024 trillion.

Aggregate volume closed at 462.6 million units in 6,801 deals valued at N8.3 billion

Market Breadth

The market breadth closed positive as 32 stocks gained against 22 stocks that declined in their share prices.

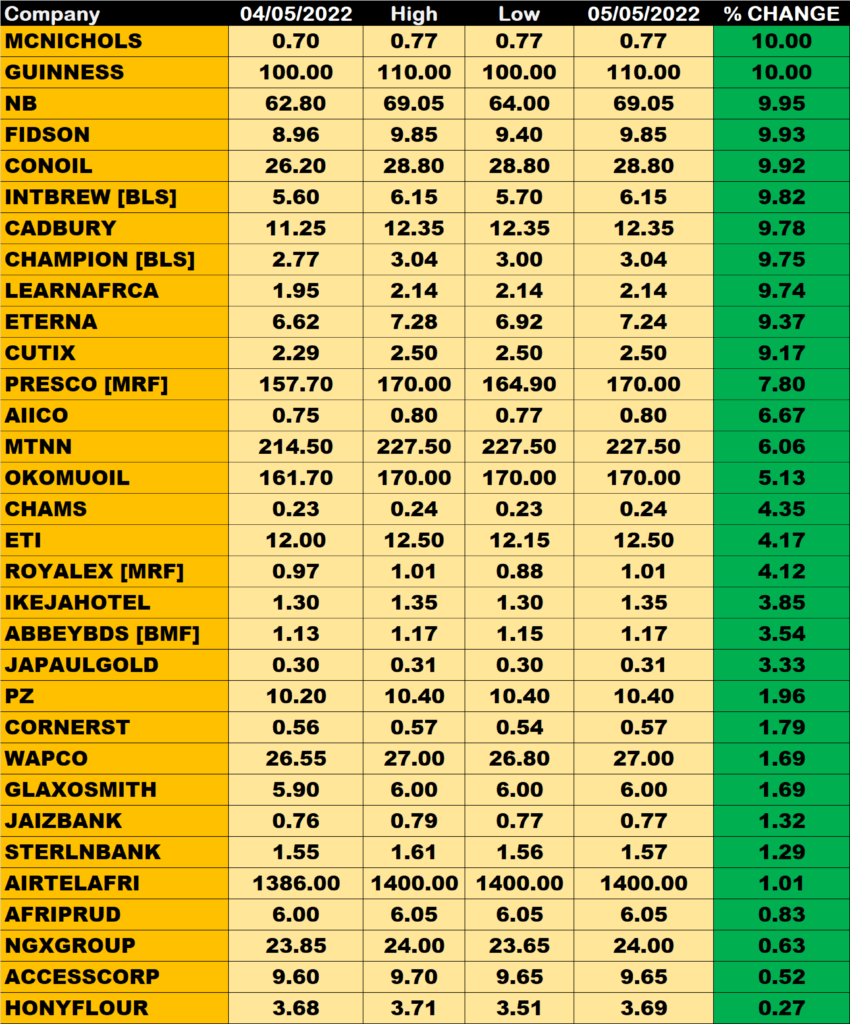

Percentage Gainers

MCNICHOLS and GUINNESS with 10.00% growth each led other gainers to close at N0.77 and N110.00 from the previous close of N0.70 and N100.00 respectively.

Nigerian Breweries and FIDSON among other gainers also grew their share prices by 9.95% and 9.93% respectively.

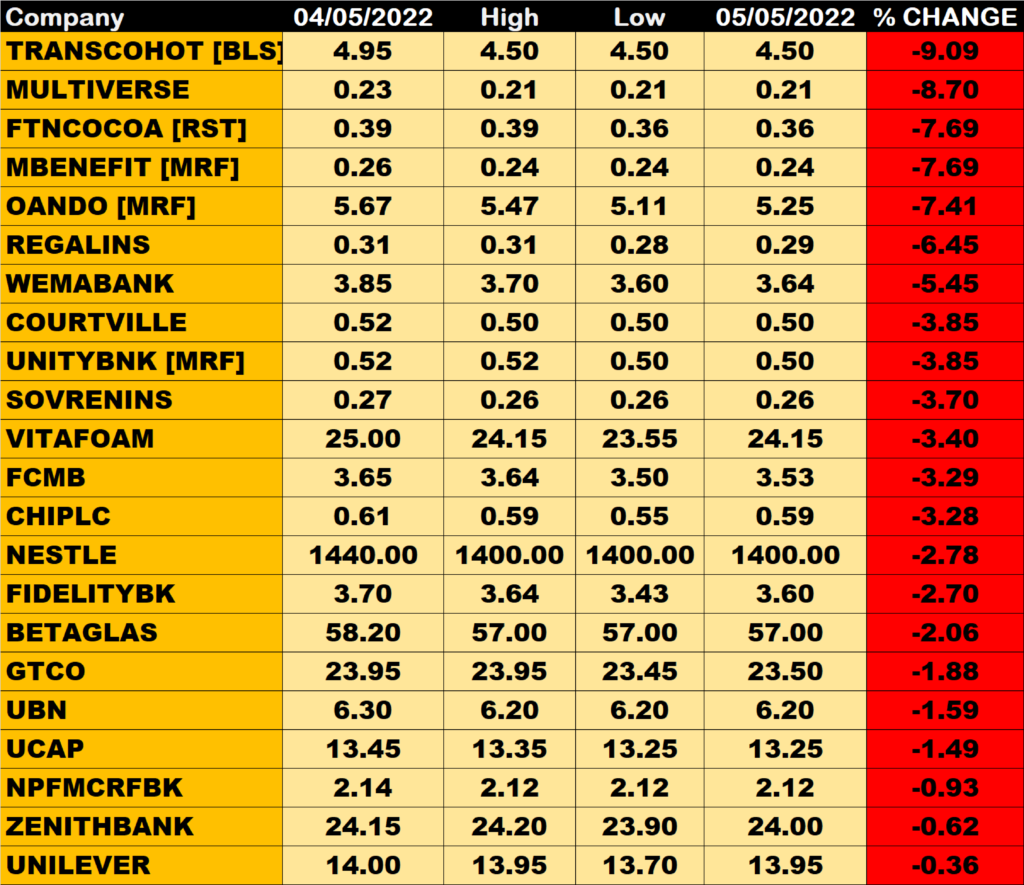

Percentage Losers

Transcorp Hotel, MULTIVERSE and FTNCOCOA among others 19 stocks shed their share prices by 9.09%, 8.70% and 7.69% respectively.

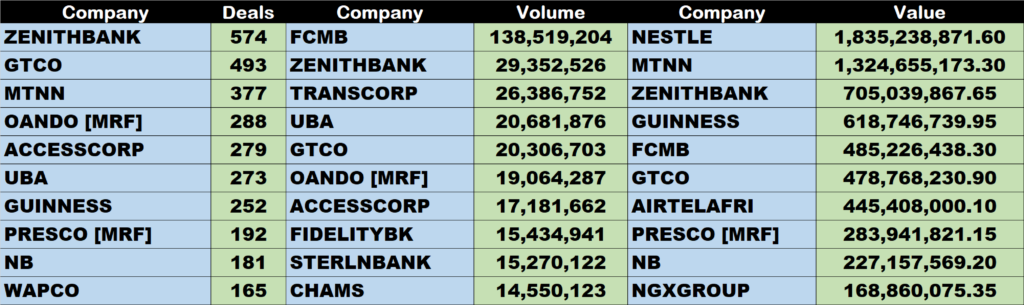

Volume Drivers

FCMB traded about 138 million units of its shares in 78 deals, valued at N485 million.

Zenith Bank traded about 29 million units of its shares in 574 deals, valued at N705 million.

GTCO traded about 20 million units of its shares in 493 deals, valued at N478.8 million.

Source: Nigerian Bourse closes 1.42% higher as MTN, Airtel add weight – StocksWatch (stocksng.com)