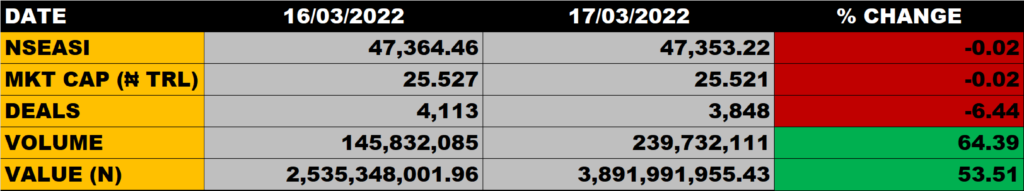

It was a bearish session on the floor of the Nigerian Exchange as the All Share Index dipped by 0.02% to close at 47,353.22 points against the previous close of 47,364.46 points on Wednesday.

The Market Capitalisation closed at N25.521 trillion, shedding N6 billion from N25.527 trillion recorded in the last session.

Aggregate volume at end of today’s session grew by 64.39% to 239.7 million units while the traded stocks is valued at N3.89 billion in 3,848 deals.

Market Breadth

The market breadth closed positive as 18 stocks gained against 17 stocks that declined in their share prices.

Percentage Gainers

UACN with 10.00% growth, led the gainers table to close at N12.10 from the previous close of N11.00.

Royal Exchange and WAPIC among other gainers also grew their share prices by 9.80% and 8.16% respectively.

Percentage Losers

Niger Insurance, Cornerstone Insurance and Veritas Kapital among other 14 stocks shed their share prices by 9.09%, 6.45%, and 4.55% respectively.

Volume Drivers

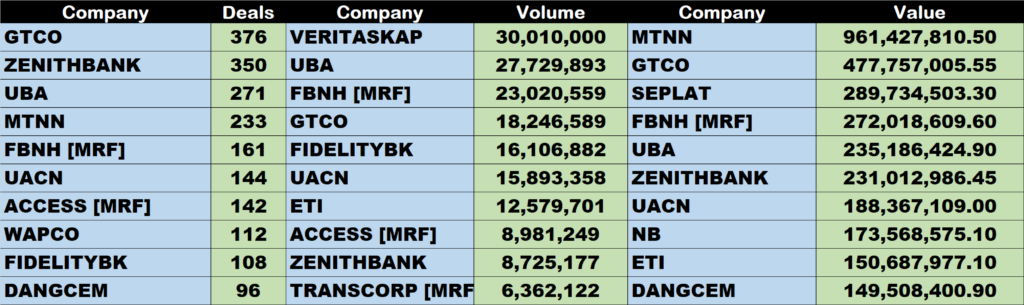

UBA traded about 27.7 million units of its shares in 271 deals, valued at about N235 million.

FBNH traded about 23 million units of its shares in 161 deals, valued at about N272 million.

GTCO traded about 18 million units of its shares in 376 deals, valued at N477.8 million.

Source: Nigerian Bourse closes lower by 0.02%, sheds N6bn – StocksWatch (stocksng.com)