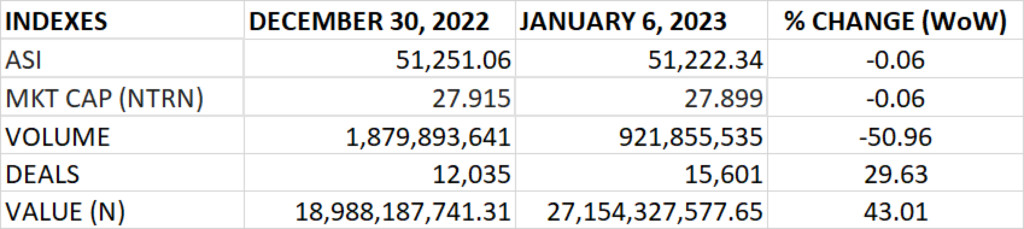

The Nigerian stock market closed lower in the first week of the year as Airtel Africa, NESTLE and 15 other stocks shed weight. The All Share Index and Market capitalization dropped by 0.06% to settle at 51,222.34 points and N27.899 trillion respectively.

An aggregate of 921.9 million units of shares were traded in 15,601 deals, valued at N27 billion.

The market breadth closed positive as 38 stocks gained against 17 stocks that declined in their share prices.

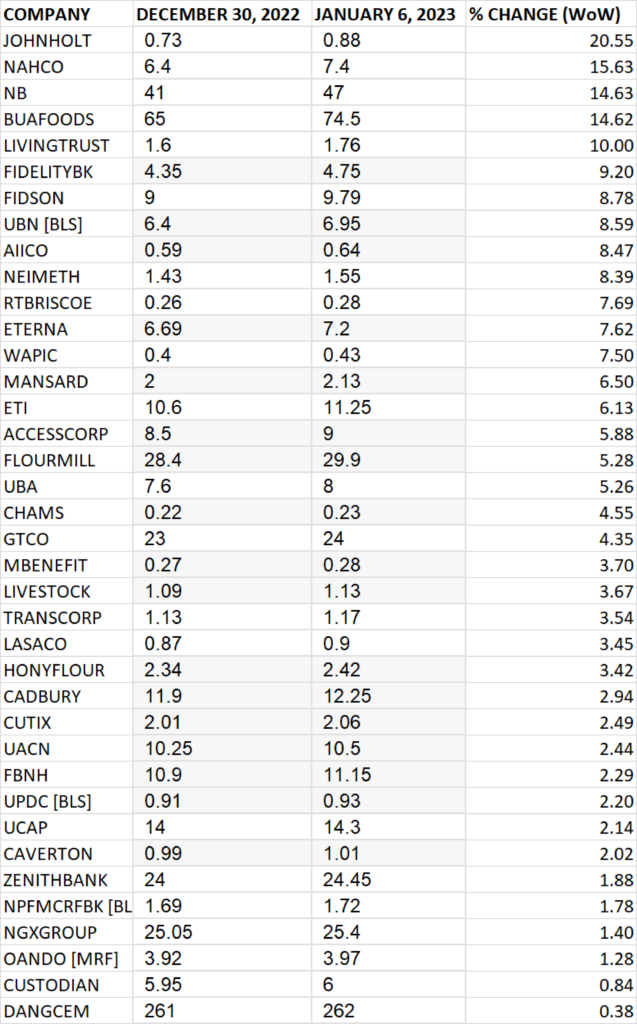

TOP 10 GAINERS

JOHNHOLT led other gainers in the course of last week with 20.55% growth, closing at N0.88 from the previous close of N0.73.

NAHCO, Nigerian Breweries, BUA FOODS and Living Trust Insurance grew their share prices by 15.63%, 14.63%, 14.62% and 10.00% respectively.

Other among the top 10 gainers include: Fidelity Bank (9.20%), FIDSON (8.78%), Union Bank (8.59%), AIICO Insurance (8.47%) and NEIMETH (8.39%) respectively.

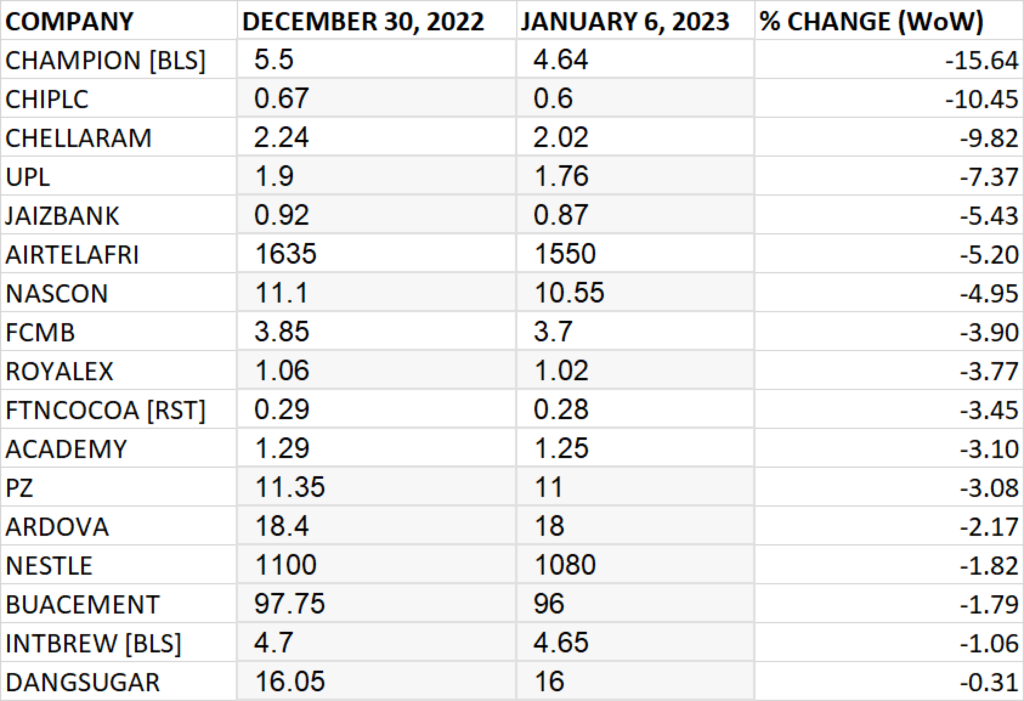

TOP 10 LOSERS

Champion Breweries led other price decliners, shedding 15.64% of its share price to close at N4.64 from the previous close of N5.50.

Consolidated Hallmark Insurance, CHELLARAM, University Press and Jaiz Bank shed 10.45%, 9.82%, 7.37% and 5.43% respectively.

Other price decliners include: Airtel Africa (-5.20%), NASCON (-4.95%), FCMB (-3.90%), Royal Exchange (-3.77%) and FTNCOCOA (-3.45%) respectively.

GAINERS

LOSERS

Source: Nigerian Bourse returns -0.06% WtD, sheds N16bn – StocksWatch (stocksng.com)