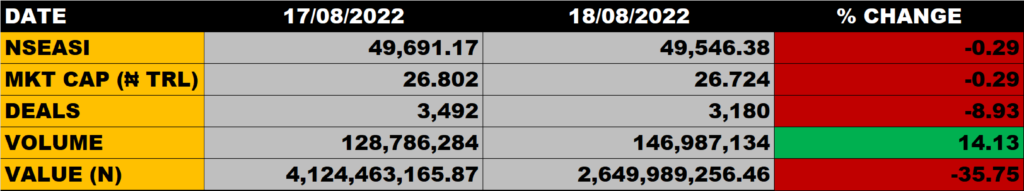

Thursday’s trading activities on the floor of the Nigerian stock market closed bearish again as the All Share Index declined by 0.29% to close at 49,546.38 points from the previous close of 49,691.17 points.

The Market Capitalisation declined by 0.29% to close at N26.724 trillion from the previous close of N26.802 trillion, thereby shedding N78 billion.

An aggregate of 147 million units of shares were traded in 3,180 deals, valued at about N2.6 billion.

The Market Breadth closed negative as 12 equities emerged as gainers against 24 equities that declined in their share prices.

Percentage Gainers

FTN Cocoa led other gainers with 10.00% growth to close at N0.33 from the previous close of 0.30.

Regency Alliance, Prestige Assurance and Redstar Express among other gainers also grew their share prices by 8.7%0, 8.33% and 5.88% respectively.

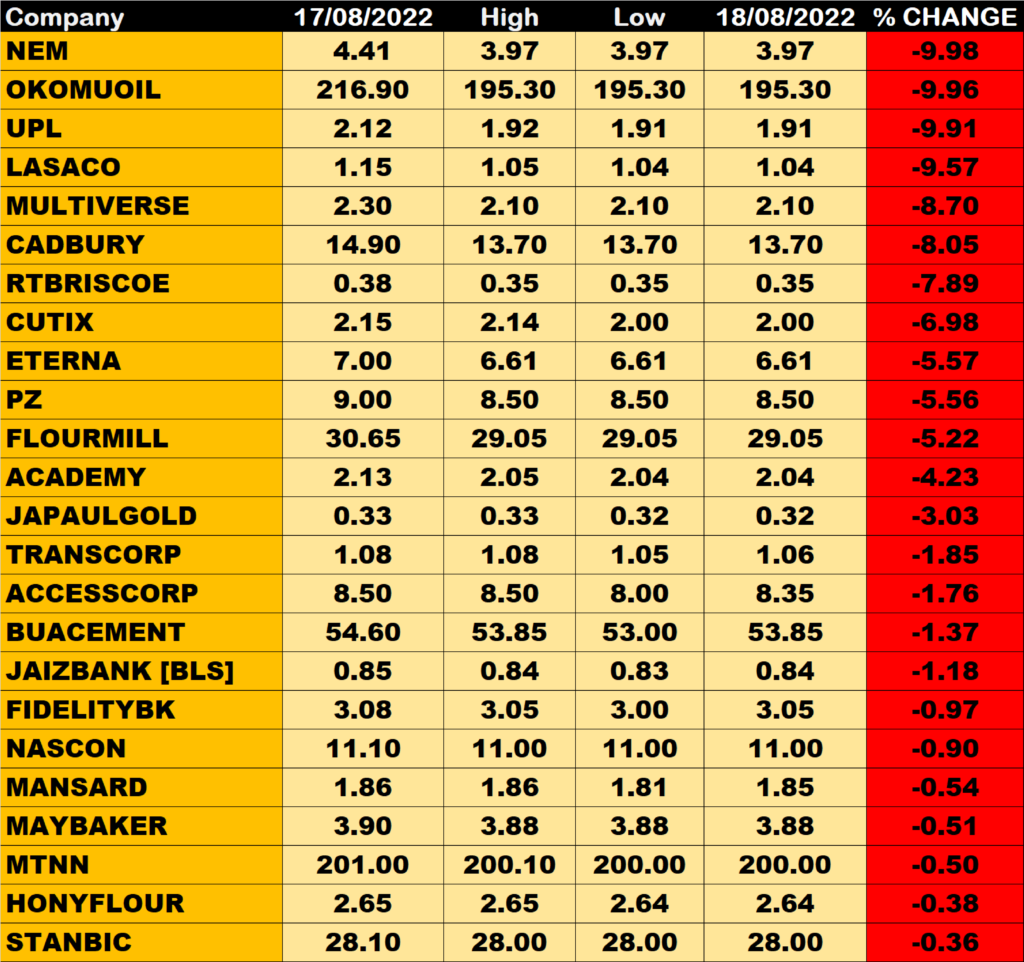

Percentage Losers

Nem Insurance led other price decliners as it shed 9.98% of its share price to close at N3.97 from the previous close of N4.41.

Okomu Oil and University Press among other price decliners also shed their share prices by 9.96% and 9.91% respectively.

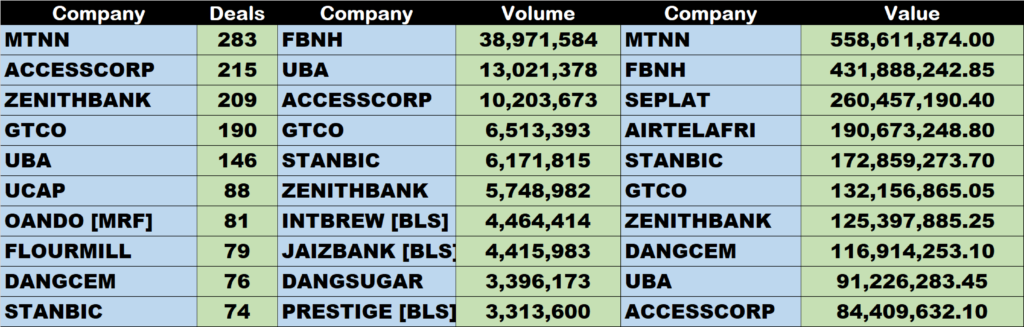

Volume Drivers

FBNH traded about 38.97 million units of its shares in 73 deals, valued at N431.9 million.

UBA traded about 13 million units of its shares in 146 deals, valued at N91 million.

ACCESSCORP traded about 10 million units of its shares in 215 deals, valued at N84 million.

Source: Stock market declines further by 0.29% – StocksWatch (stocksng.com)