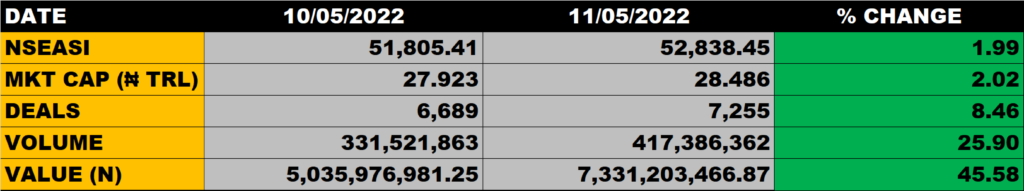

The Nigerian stock market on Wednesday bounced back after a marginal declined on Tuesday to close higher, buoyed by gains in Dangote Cement, MTN Nigeria and other 41stocks as the All Share Index grew by 1.99% to stand at 52,838.45 points against the previous close of 51,805.41 points.

The market capitalisation grew by N563 billion or 2.02% from the previous close of N27.923 trillion to N28.486 trillion.

Aggregate volume closed at 417.4 million units, valued at N7.3 billion in 7,255 deals.

Market Breadth

The market breadth closed positive as 43 stocks gained against 27 stocks that declined in their share prices.

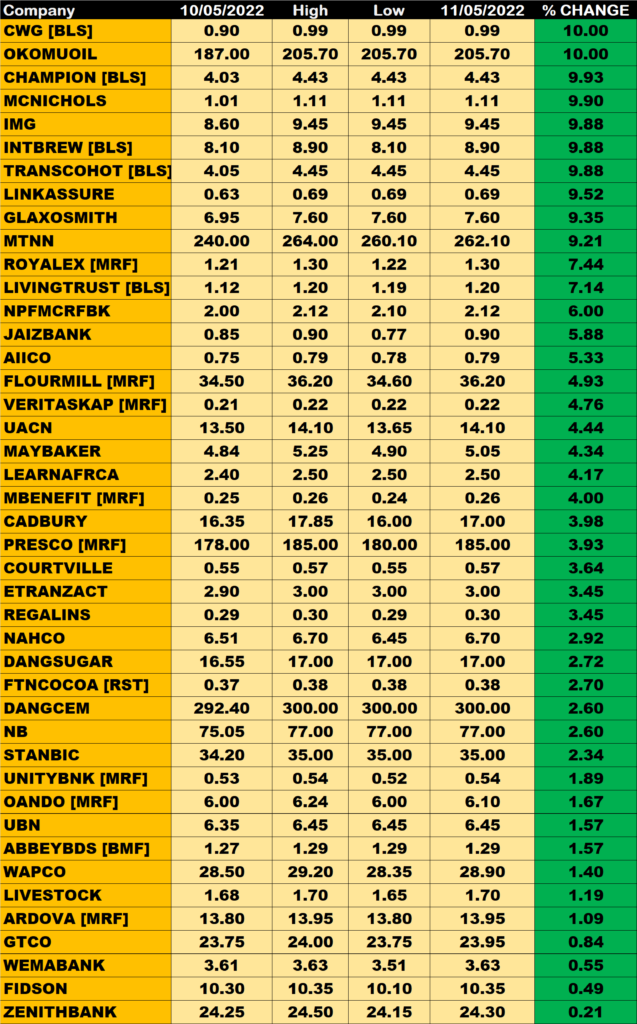

Percentage Gainers

CWG and Okomu Oil with 10.00% growth each led other gainers to close at N0.99 and N205.70 from the previous close of N0.90 and N187.00

Champion Breweries, MCNICHOLS and Industrial & Medical Gases Nigeria Plc among other gainers also grew their share prices by 9.93%, 9.90% and 9.88% respectively.

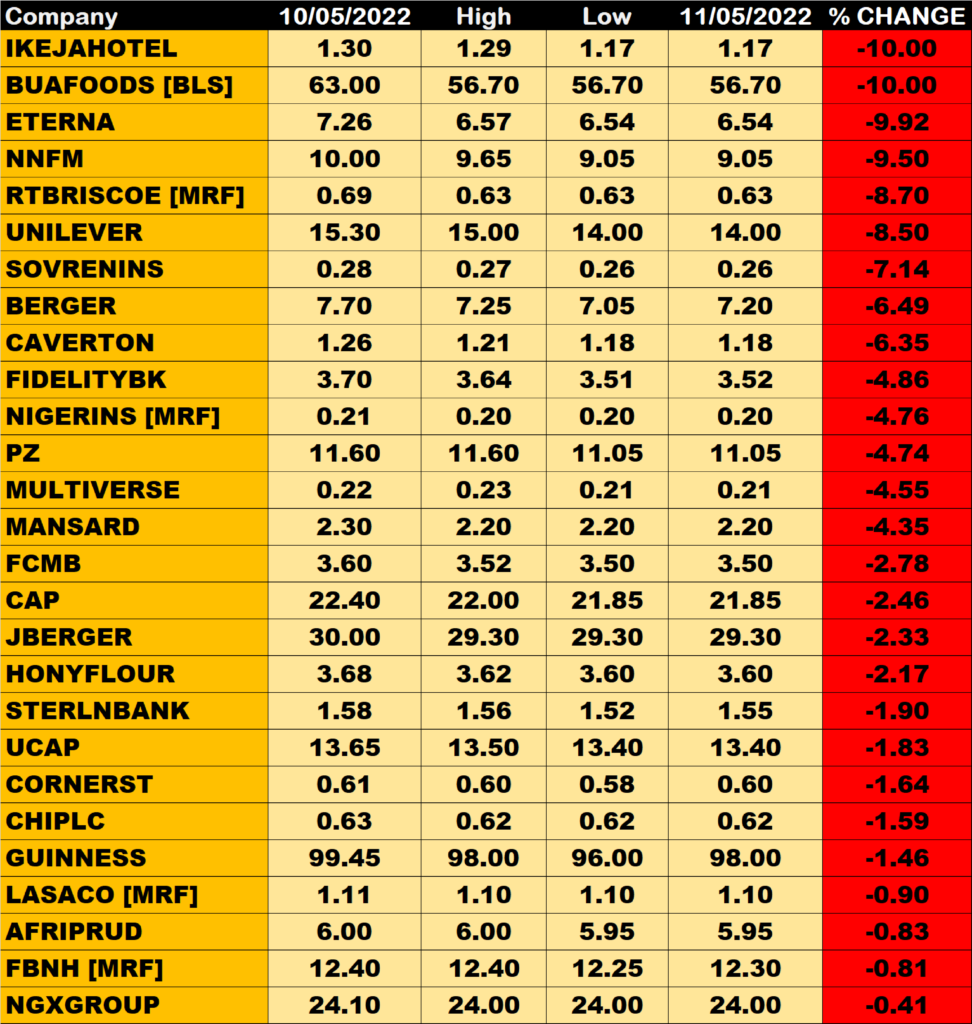

Percentage Losers

Ikeja Hotel and BUAFOODS top the losers’ chart shedding 10.00% each of their share prices to close at N1.17 and N56.70 below the previous close of N1.30 and N63.00 respectively

Eterna Oil and Northern Nigeria Flourmills among others also shed their share prices by 9.92% and 9.50% respectively.

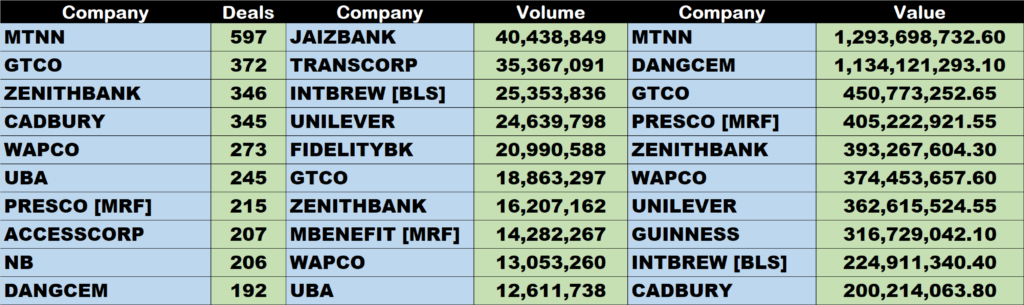

Volume Drivers

Jaiz Bank traded about 40 million units of its shares in 81 deals, valued at N34.9 million.

TRANSCORP traded about 35 million units of its shares in 159 deals, valued at N42.6 million.

International Breweries traded about 25 million units of its shares in 184 deals, valued at N224.9 million.