The Nigerian Exchange last week closed on a bearish note, occasioned by mark downs and profit taking by investors.

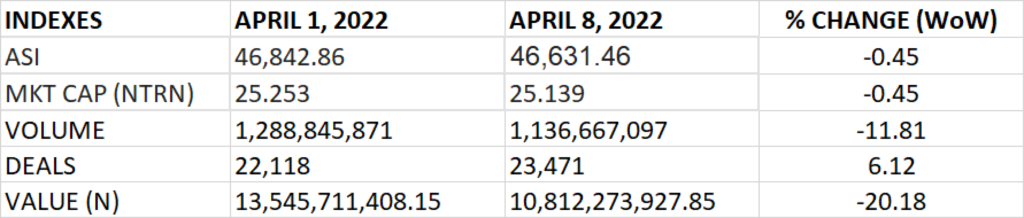

The All Share Index and the Market Capitalisation declined week on week by 0.45% to close at 46,631.46 points and N25.139 trillion respectively. Year to date, the market has returned 9.17%.

An aggregate of 1.14 billion units of shares were traded in 23, 471 deals, valued at N10.81 billion.

The Market Breadth closed positive as 33 equities emerged as gainers against 31 equities that declined in their share prices.

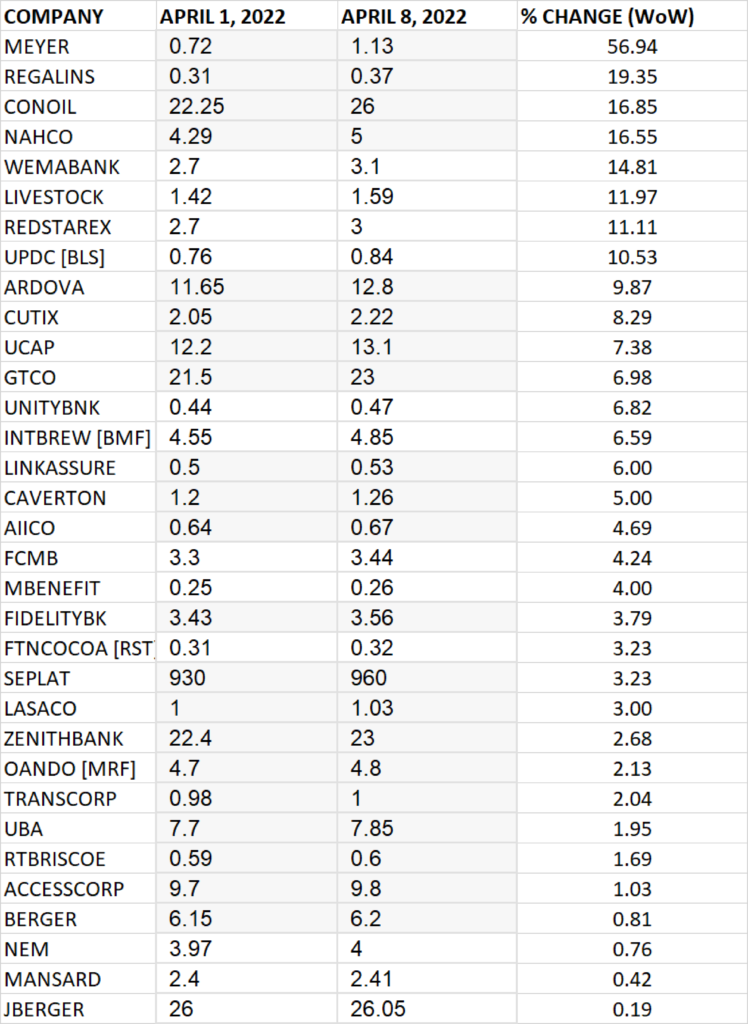

TOP 10 GAINERS

Meyer Plc led other gainers with 56.94% growth, closing at N1.13 from the previous close of N0.72.

Regency Alliance, Conoil, NAHCO and Wema Bank grew their share prices by 19.35%, 16.85%, 16.55% and 14.81% respectively.

Others among top 10 gainers include: Livestock Feeds (11.97%), Red Star Express (11.11%), UPDC (10.53%), Ardova (9.87%) and Cutix (8.29%) respectively.

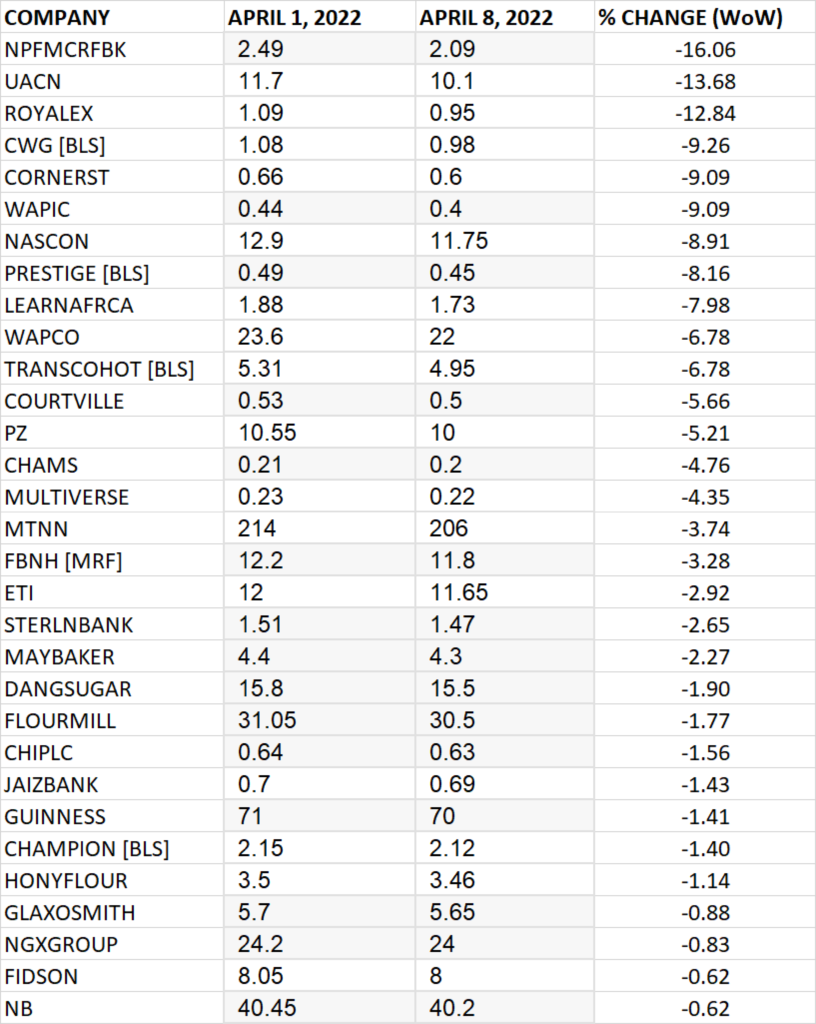

TOP 10 LOSERS

NPF Microfinance Bank led other price decliners in the course of last week, shedding 16.06% of its share price to close at N2.09 from the previous close of N2.49.

UACN, Royal Exchange and CWG shed their share prices by 13.68%, 12.64% and 9.26% respectively.

Others among top 10 price decliners include: Cornerstone Insurance (-9.09%), Coronation Insurance (-9.09%), NASCON Allied Industries (-8.91%), Prestige Assurance (-8.16%), Learn Africa (-7.98%) and Lafarge Africa (-6.78%) respectively.

GAINERS

LOSERS

Source: Stock market returns -0.45% WtD as profit taking persists by investors – StocksWatch (stocksng.com)