The Nigerian stock market last week closed on a bearish note, occasioned by profit taking in Airtel Africa and 35 other stocks.

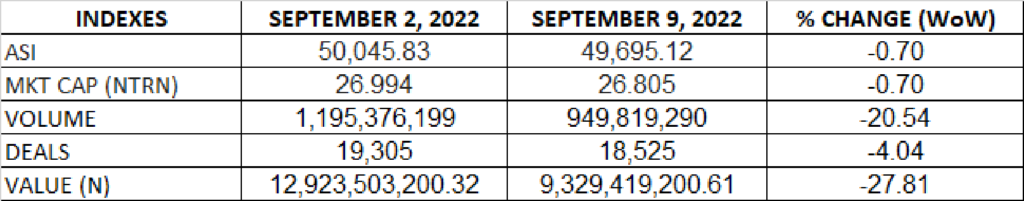

The All Share Index and Market capitalization dipped by 0.70% to settle at 49,695.12 and N26.805 trillion respectively.

An aggregate of 949.8 million units of shares were traded in 18,525 deals, valued at N9.33 billion.

The market breadth closed negative as 22 stocks gained against 36 stocks that declined in their share prices week on week.

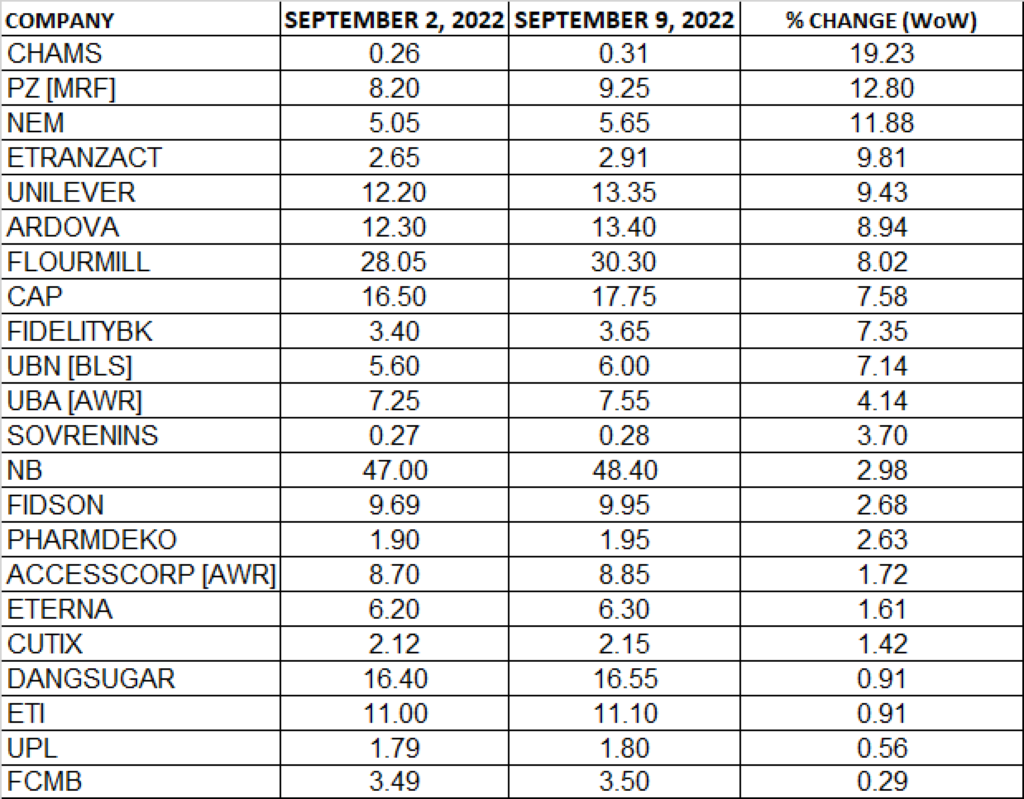

TOP 10 GAINERS

CHAMS Plc led other gainers in the course of last week with 19.23% growth, closing at N0.31 from the previous close of N0.26

PZ also gained 12.80% of its share price to stand at N9.25 from the previous gained of N8.20, Nem Insurance, ETRANZACT and UNILEVER grew their share prices also by 11.88%, 9.81% and 9.43% respectively.

Others among the top 10 gainers include: ARDOVA (8.94%), Flour Mills (8.02%), CAP Plc (7.58%), Fidelity Bank (7.35%) and Union Bank of Nigeria (7.14%) respectively.

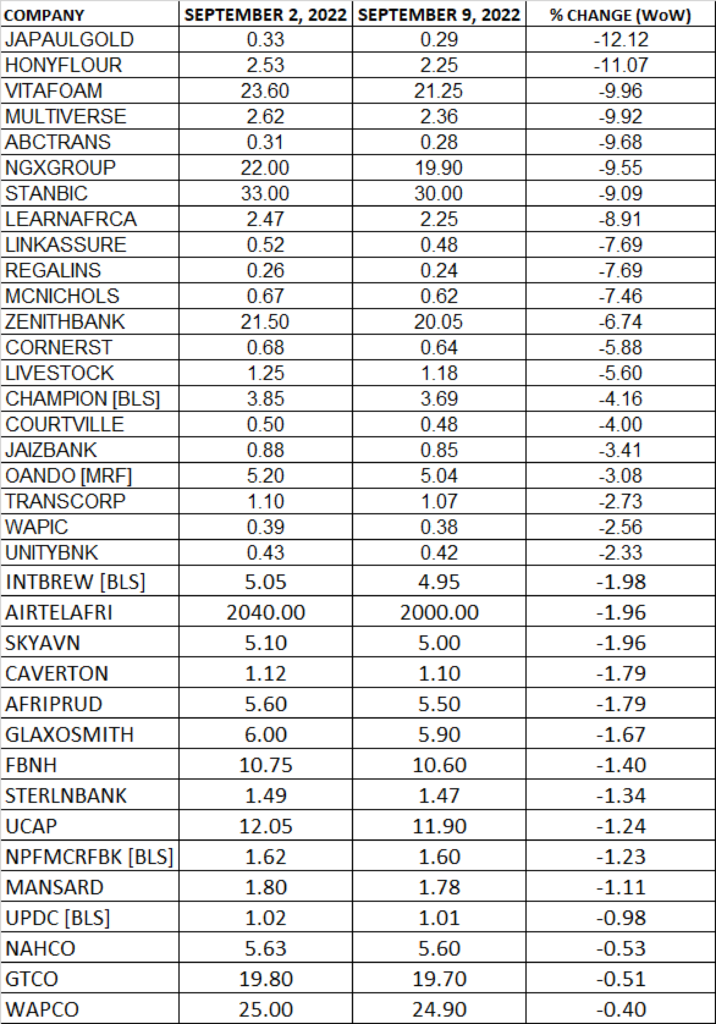

TOP 10 LOSERS

JAPAULGOLD led other price decliners, shedding 12.12% of its share price to close at N0.29 from the previous close of N0.33.

HONEYWELL, VITAFOAM, MULTIVERSR and ABC Transport shed 11.07%, 9.96%, 9.92% and 9.68% respectively.

Other price decliners include: NGXGROUP (-9.55%) STANBIC IBTC (-9.09%), LEARN AFRICA (-8.91%), Linkage Assurance (-7.69%), and Regency Alliance (-7.69%) respectively.

Source: Stock market returns -0.70% WtD amidst profit taking – StocksWatch (stocksng.com)