The equity market on Monday closed on a bearish note as the All Share Index depreciated by 0.58% to settle at 53,772.14 points from the previous close of 54,085.30 points.

The Market Capitalisation declined by 0.58% to close at N28.989 trillion from the previous close of N29.158 trillion, thereby shedding N169 billion.

An aggregate of 27.56 billion units of shares were traded in 4,586 deals, valued at N194 billion.

The Market Breadth closed positive as 25 equities appreciated in their share prices against 17 equities that declined in their share prices.

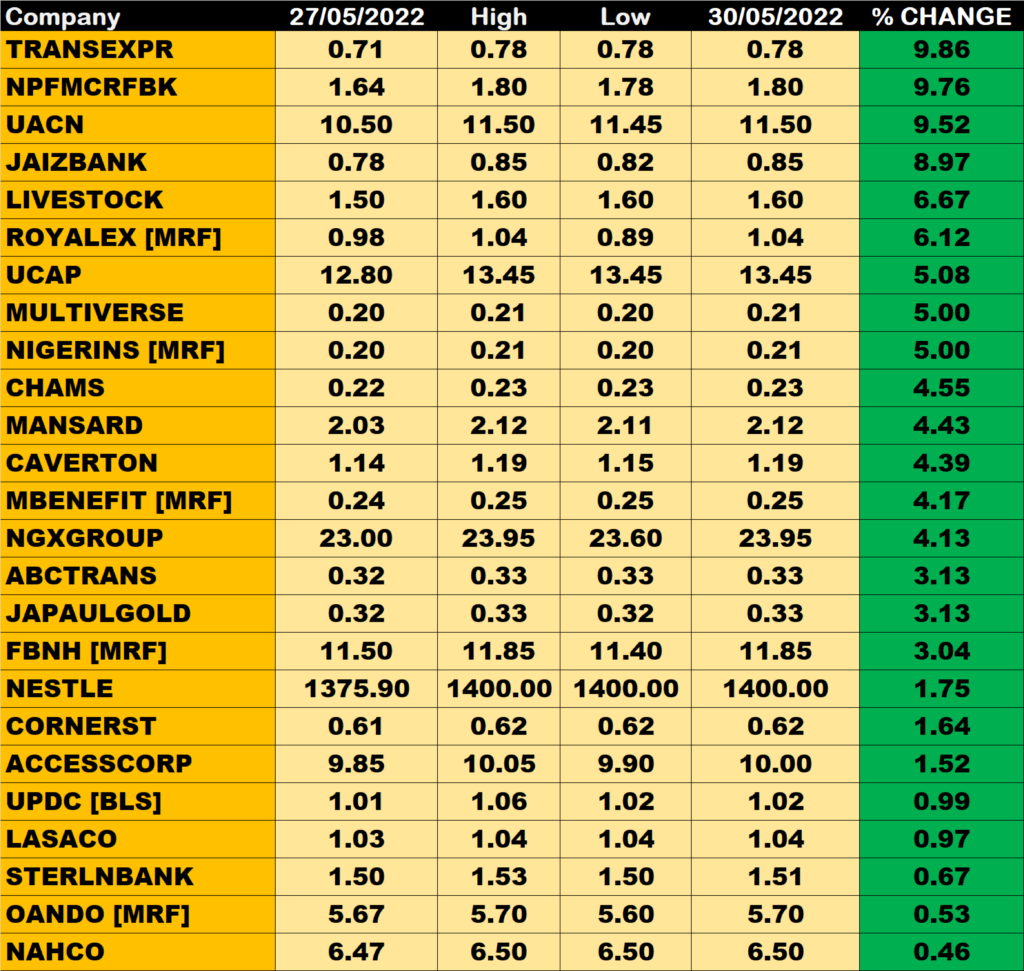

Percentage Gainers

Trans-nationwide Express led other gainers with 9.86% growth to close at N0.78 from the previous close of N0.71.

NPF Microfinance, UACN and Jaiz Bank among other gainers also grew their share prices by 9.76%, 9.52% and 8.97% respectively.

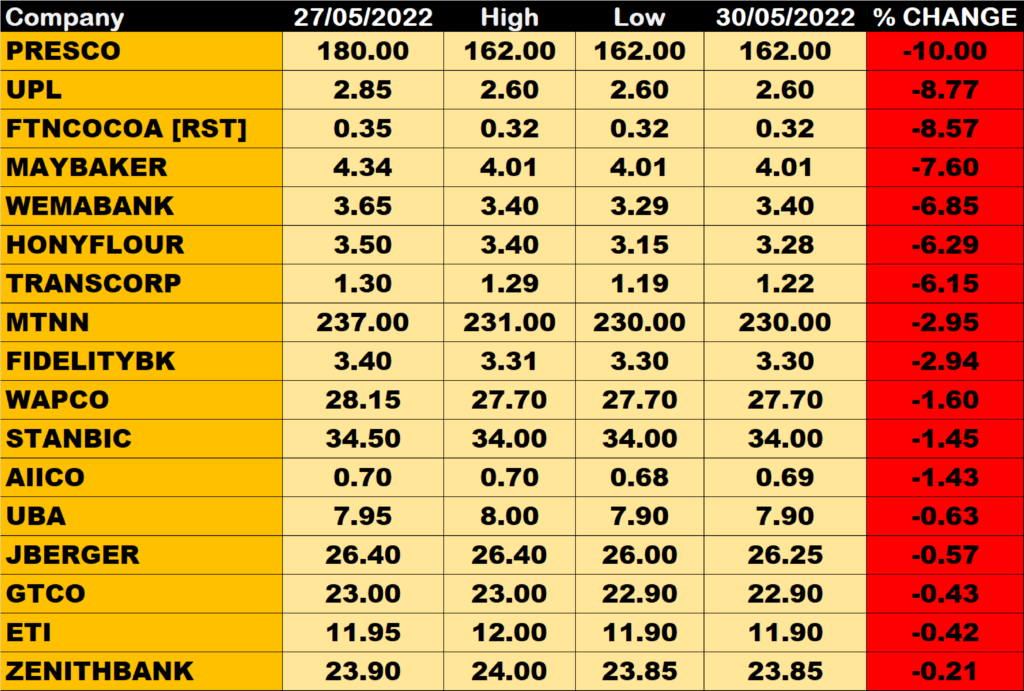

Percentage Losers

PRESCO led other price decliners as it shed 10.00% of its share price to close at N162.00 from the previous close of N180.00.

UPL, FTNCOCOA and May & Baker among other price decliners also shed their share prices by 8.77% and 8.57% and 7.60% respectively.

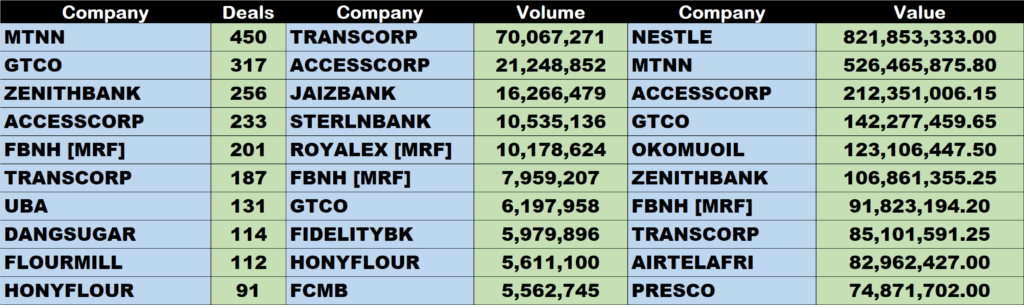

Volume Drivers

TRANCORP traded about 70 million units of its shares in 187 deals, valued at about N85 million.

ACCESSCORP traded about 21 million units of its shares in 233 deal, valued at N212 million.

Jaiz Bank traded about 16 million units of its shares in 58 deals, valued at N13.6 million.

Source: Market sheds N169bn as NGXASI closes lower by 0.58% – StocksWatch (stocksng.com)