- Comparative Analysis of insurance stocks

The Nigerian stock market has been on the uptrend for the past few weeks, triggered by impressive results with dividend pay-out in 2021 year end, and good Q1 2022 results recently released. The positive vibration has pushed the All Share Index to 50,935.03 points, up by 19.24% year to date. The Market Capitalisation has also grown by 23.16% YtD to N27.460 trillion.

Performance of Insurance firms in the First Quarter of 2022 was quite impressive, compared to the figures released in the corresponding period of 2021. Just like we did comparative analysis for banking stocks in the previous article, this edition is dedicated to insurance firms as we compare their Q1 2022 earnings in terms turnover size, turnover growth, profit after tax, earnings per share, P/E ratio and earnings yield.

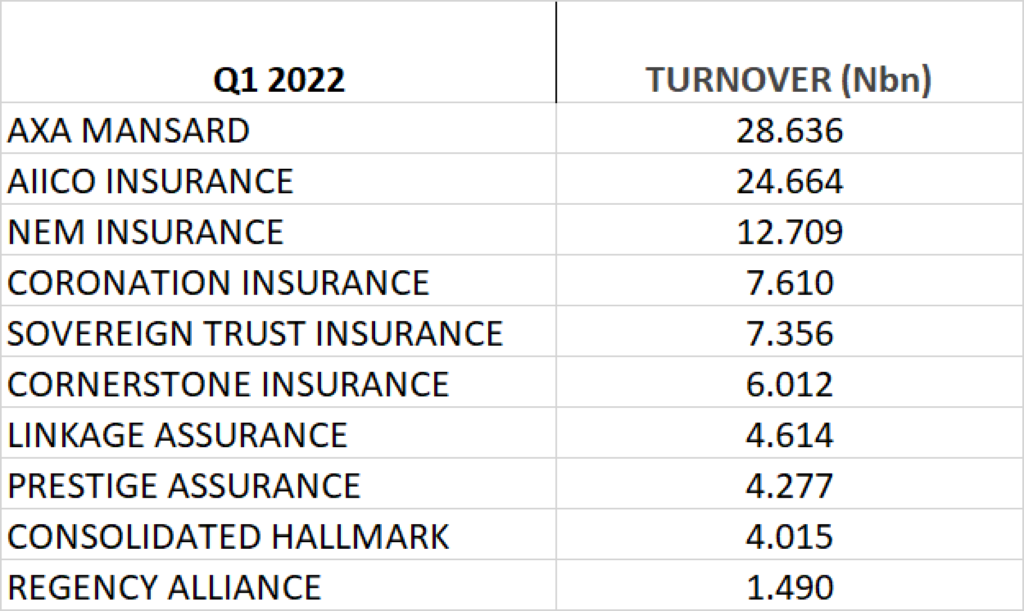

TURNOVER SIZE

- AXA Mansard has the highest turnover among others in the industry. The underwriting firm reported Gross Premium Written of 28.636 billion in Q1 2022.

- AIICO Insurance is second in the ranking with a turnover size of N24.664 billion.

- NEM Insurance emerged third in terms of turnover size with Gross Premium Written of N12.709 billion.

- Coronation Insurance is fourth on the list in terms of market share as with Gross Premium Written of N7.61 billion.

- Sovereign Trust Insurance is fifth in this ranking with a turnover of N7.356 billion

- Others in the rank include: Cornerstone Insurance (N6.012 billion), Linkage Assurance (N4.614 billion), Prestige Assurance (N4.277 billion), Consolidated Hallmark Insurance (N4.015 billion) and Regency Alliance (N1.49 billion) respectively.

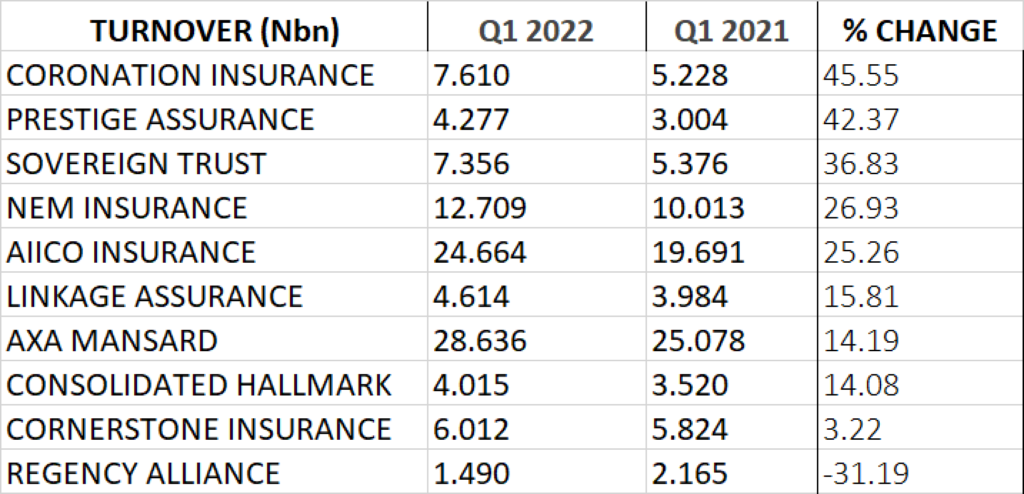

TURNOVER GROWTH

- Coronation Insurance emerged top among others with 45.55% growth in turnover from N5.228 billion to N7.61 billion.

- Prestige Assurance is second on the list in terms of turnover growth. It grew by 42.37% to N4.277 billion from N3 billion reported the previous year.

- Sovereign Trust Insurance grew its turnover by 36.83% to N7.356 billion from N5.376 billion reported the previous year

- NEM Insurance grew its turnover by 26.93% to N12.709 billion from N10.013 billion reported in Q1 2021.

- AIICO Insurance is the fifth in ranking in terms of growth in turnover as it grew by 25.26% from N19.691 billion to N24.664 billion.

- Others in the ranking in terms of turnover growth include: Linkage Assurance (15.81%), AXA Mansard (14.19%), Consolidated Hallmark Insurance (14.08%) and Cornerstone Insurance (3.22%) respectively.

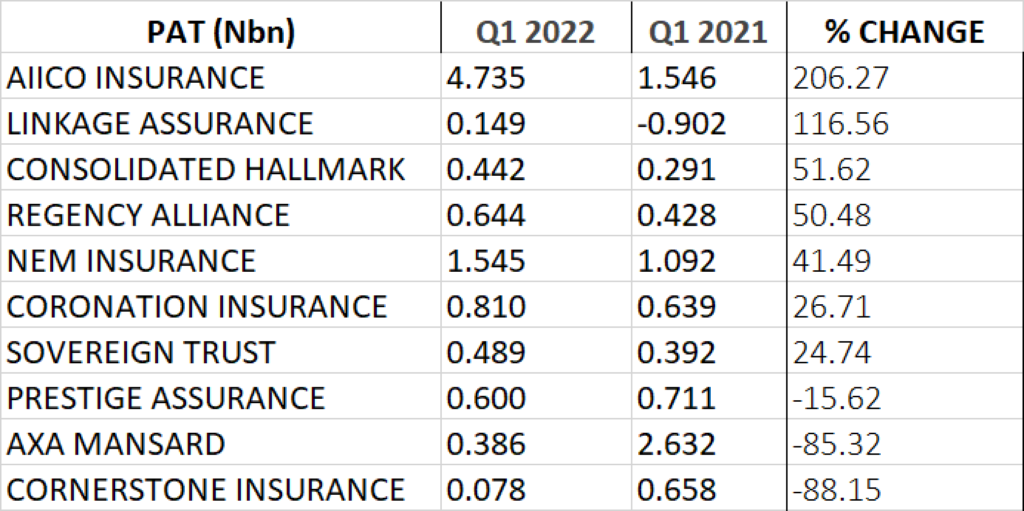

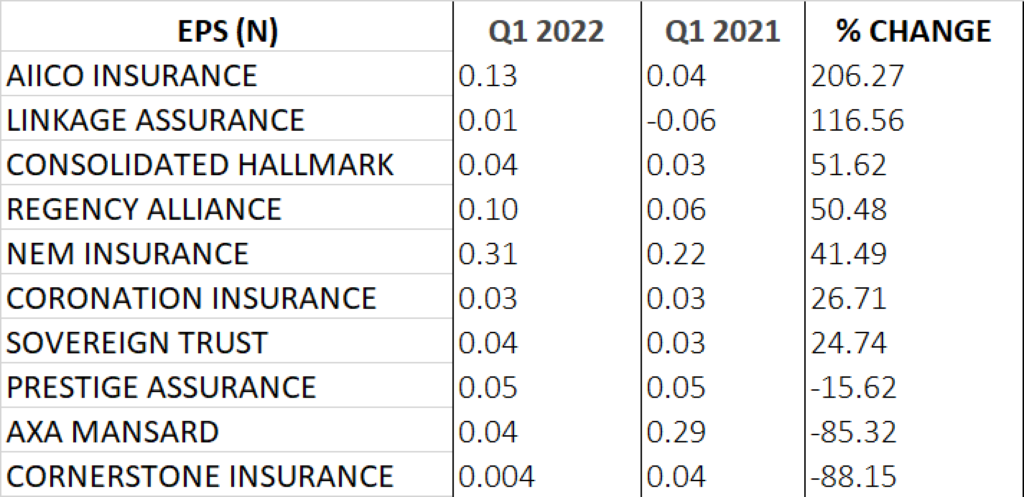

PROFIT AFTER TAX GROWTH

- AIICO Insurance emerged top among others with 206.27% growth in profit after tax from N1.546 billion to N4.735 billion.

- Linkage Assurance is second on the list in terms of growth in profit after tax. It grew by 116.56% to N149 million from a loss after tax of N902 million reported the previous year.

- Consolidated Hallmark Insurance grew its profit after tax by 51.62% to N442 million from N291 million reported the previous year

- Regency Alliance Insurance grew its profit after tax by 50.48% to N644 million from N428 million reported in Q1 2021.

- NEM Insurance grew its profit after tax by 41.49% to N1.545 billion from N1.092 billion reported the previous year.

- Others in the ranking as regards growth in profit after tax in Q1 2022 include: Coronation Insurance (26.71%) and Sovereign Trust Insurance (24.74%) respectively.

- Prestige Assurance, AXA Mansard and Cornerstone Insurance recorded decline in their profit after tax by 15.62%, 85.32% and 88.15% respectively.

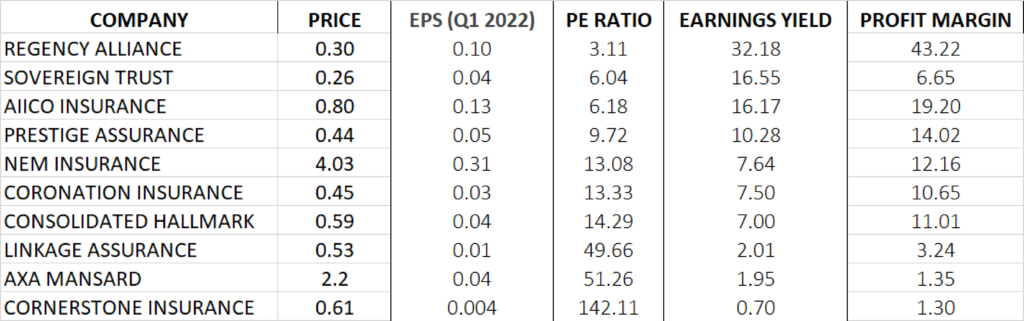

PERFOMANCE IN EARNINGS PER SHARE, P/E RATIO AND EARNINGS YIELD

- REGENCY ALLIANCE

The Earnings per share of Regency Alliance increased year on year by 50.48% to 10 kobo from the EPS of 6 kobo reported in Q1 2021.

At the share price of 30 kobo, the P/E ratio of Regency Alliance stands at 3.11x with earnings yield of 32.18%.

- SOVEREIGN TRUST INSURANCE

The earnings per share of Sovereign Trust Insurance stands at 4 kobo, up by 24.74% from the EPS of 3 kobo achieved the previous year.

At the share price of 26 kobo, the P/E ratio of Sovereign Trust Insurance stands at 6.04x with earnings yield of 16.55%.

- AIICO INSURANCE

The Earnings per share of AICCO Insurance increased by 206.27% to 13 kobo from the EPS of 4 kobo achieved the previous year.

At the share price of 80 kobo, the P/E ratio of AIICO Insurance stands at 6.18x with earnings yield of 16.17%.

Source: AIICO Insurance leads industry in PAT growth in Q1 2022 – StocksWatch (stocksng.com)